A

BLOCKCHAIN-BASED

APPROACH

TO

REGISTER

CAR

OWNERSHIP

AND

INSURANCE

IN BELGIUM

Word count: 24.775

Arne Aers

student number: 01506614

Jef de Bundel

student number: 01509427

Promotor / supervisor: Prof. Dr. Michaël Verdonck

Master’s Dissertation submitted to obtain the degree of:

Master of Science in Business Economics: Corporate Finance

II

Permission

I declare that the content of this Master’s Dissertation may be consulted and/or reproduced, provided that the source is referenced.

III

Foreword

This master’s thesis is written as a finale to our studies in business economics: corporate finance. Although our main course of study entails finance and finance-related topics, we chose to step out of our comfort zone and explore the (until then) rather unknown domain of blockchain technology. We both already had some experience with cryptocurrencies before, but never really investigated the technology behind it in depth. Therefore, this topic piqued our interest. What initially started as an exploration of the characteristics, quickly evolved in an extensive and in-depth research on the functioning and possibilities of the technology. It is safe to say that we experienced a steep learning curve throughout the process of writing this dissertation. This was challenging at some times, but as we both dare to embrace challenges, this did not demotivate us. We are convinced this master’s thesis was an enriching course, both to learning to know ourselves and each other better as well as with regard to our knowledge of blockchain technology, which will definitely pay off in the future.

Thanks to the qualitative education of Ghent University we received the past five years, we were able to understand, treat, and research the subject in a critical and self-reflecting way.

In addition, our sincere and honest thanks go to our supervisor Michaël Verdonck, who persistently provided us with constructive and correct feedback. When requested, he always took the time to elaborate on our findings and helped with some input. Thank you for assisting us throughout this process.

Although we were faced with challenging times during the writing of this master’s thesis, we were not bothered by the impact of Covid-19 throughout the process of bringing this paper to a good end.

IV

Table of contents

Permission II Foreword III Table of contents IV List of abbreviations VIList of figures and tables VII

1. Introduction 1

2. Blockchain technology 3

2.1 What is blockchain technology 3

2.1.1 Blockchain technology definition 3

2.1.2 BCT building blocks 4

2.1.3 Implications of the building blocks 6

2.1.4 BCT architecture 8

2.2 Blockchain technology in practice 10

2.2.1 New technology 10

2.2.2 Blockchain technology so far 10

3. Methodology 15

3.1 Gap and relevance 15

3.2 Research question 16

3.3 Research method 16

4. Current situation 19

4.1 Car ownership and insurance today in Belgium 19

4.1.1 Car registration 19

4.1.2 Car insurance 20

4.1.3 Additional parties and elements 21

4.2 Shortcomings of the current situation 23

4.2.1 For an individual 23

4.2.2 For the government and insurers 24

4.3 Desired solutions and how blockchain technology can address them 27

5. E³value models 31

5.1 The e³value ontology 31

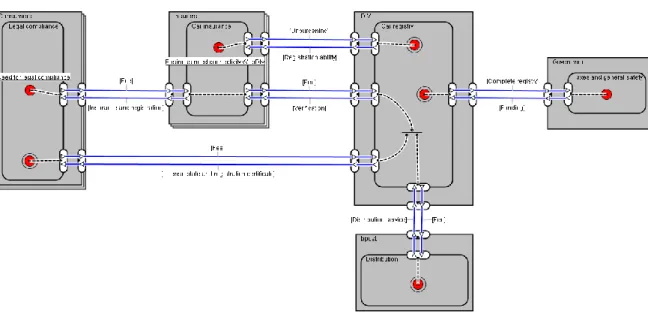

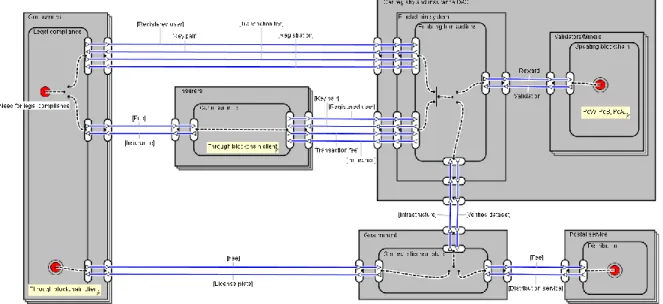

5.2 As-is value model 32

V

5.5 Discussion e³value models 38

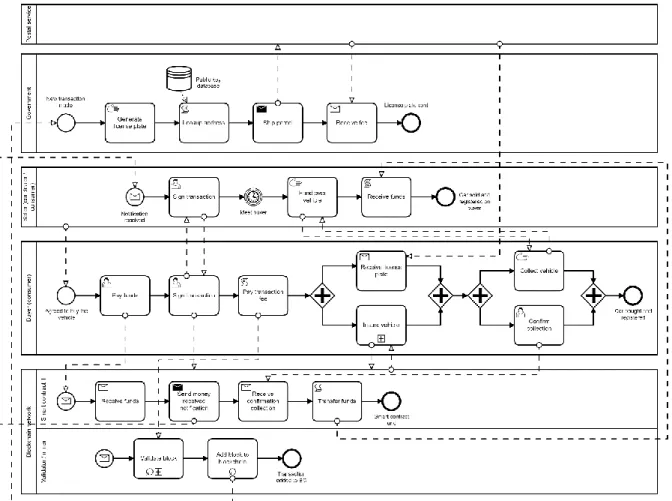

6. Business process models 41

6.1 From value models to business process models 41

6.2 As-is business process models 42

6.2.1 Registry 42

6.2.2 Insurance 45

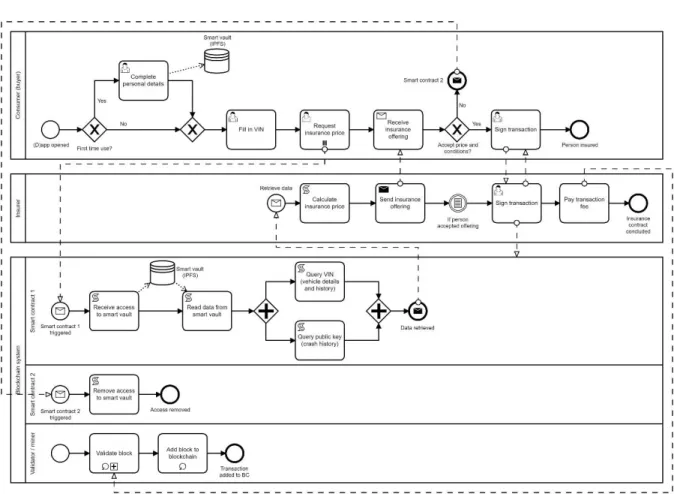

6.3 To-be business process models 45

6.3.1 Registry 46

6.3.2 Insurance 48

6.4 Discussion of the business process models 50

7. General discussion 52

7.1 Advantages inhere to BCT specific for our use case 52

7.2 Constraints inhere to BCT specific for our use case 61

7.3 Limitations of this research and topics for further research 67

8. Conclusion 69

9. References 71

VI

List of abbreviations

AI Artificial Intelligence BCT Blockchain technology BPM Business Process Model

BPMN Business Process Model and Notation COC Certificate of Conformity

DAO Decentralized Autonomous Organisation DIV Dienst voor Inschrijvingen van Voertuigen DLT Distributed Ledger Technology

GDPR General Data Protection Regulation IPFS InterPlanetary File System

IoT Internet of Things

KYC Know Your Customer

P2P Peer-to-Peer

PoA Proof of Authority

PoS Proof of Stake

PoW Proof of Work

RQ Research Question

SQ Sub-question

VAT Value Added Tax

VIN Vehicle Identification Number e-ID Electronic Identification

VII

List of figures and tables

Figure 1: How blockchain technology works 3

Figure 2: Legend of an e³value model 31

Figure 3: As-is value model of car registry and insurance 32

Figure 4: To-be value model of car registry and insurance 35

Figure 5: As-is car registry BPM 43

Figure 6: As-is car insurance BPM 45

Figure 7: To-be car registry BPM 46

Figure 8: To-be car insurance BPM 48

Table 1: Key characteristics of different blockchain categories 9

VIII

“In the future, it might seem just as strange to say that I am

trusting a third-party institution with my interests as to say

that I'm using an abacus today.”

Gavin Wood Ethereum Co-Founder

1

1. Introduction

Blockchain technology was for the first time conceptualized by Satoshi Nakamoto in 2008 as a core component of the digital cryptocurrency Bitcoin. At that moment, Nakamoto, which is a pseudonym, will probably not have known what consequences his invention would evoke. The invention of Bitcoin has led to a real hype regarding blockchain technology. New application scenarios were identified which went far beyond just cryptocurrencies. As such, three different blockchain evolutions can be identified: Blockchain 1.0 for digital currencies, Blockchain 2.0 for smart contracts, digital finance and ownership and Blockchain 3.0 for digital society (Zhao, Fan, & Yan, 2016).

The identification and analysis of successful blockchain ecosystems and application scenarios however imposes a prevailing issue for practitioners and researchers. An often cited phrase in this regard states that “blockchain is an innovative technology in search of use cases” (Glaser, 2017, p. 1543). However, many are starting to realize the innovative features blockchain technology offers and declare that it is preparing to revolutionize a multitude of economic activities. These applications include entire value and supply chains, market structures and business models (Notheisen, Cholewa, & Shanmugam, 2017). Various authors such as Ølnes, Ubacht and Janssen (2017) and Gatteschi, Lamberti, Demartini, Pranteda and Santamaría (2018) mention car registry and the insurance industry as two domains that might benefit from this innovative technology. Also practitioners such as Deloitte make notion of the fact that some European countries are already analyzing what blockchain could mean for digitizing car registration and the attendant document management (Pfeifle, Ley, Tacke, & Ferrari, 2017). Glaser (2017) states that the truly innovative character of blockchain technology lies in its openness and technologically driven capability to pervade multiple vertical layers of a digital ecosystem infrastructure. However, an in-depth perspective on the potential blockchain technology has to invade the multiple layers of the car registry and insurance ecosystem is seldom taken in academic literature. Moreover, authors such as Gordijn, Wieringa, Ionita and Kaya (2019) and Poels, Kaya, Verdonck and Gordijn (2019) posit that for a successful and sustainable implementation of blockchain technology, it has to be sufficiently disruptive in terms of changing the business ecosystem in the first place. Also Ølnes et al. (2017) state that an implementation of blockchain technology without extensive changes might not result in all desired benefits.

In this paper we will address the potential blockchain technology has for the car registry and insurance ecosystem in Belgium, and adopt a technology-driven and model-based approach in doing so. More

2 specifically, we take a business ecosystem and business process viewpoint in order to see what impact a blockchain-based system would have, allowing us to analyze the requirements and challenges that would result from this. We hereby adopted the concept of a decentralized peer-to-peer (P2P) car registry and insurance network, in order to fully explore the innovativeness and disruptiveness a blockchain-based approach could have on the ecosystem and its business processes, whilst possibly revealing challenges and constraints full decentralization evokes. This has led to the following research questions:

RQ: “How could blockchain technology change the way registration of car ownership and car insurance are handled in Belgium today?”

SQ1: “What benefits would arise from a blockchain-based system to register and insure vehicles, given blockchain's key characteristics?”

SQ2: “What are the challenges and limitations a blockchain-based system to register and insure vehicles would induce?”

The first section of this master’s thesis provides a brief background on blockchain technology and its key characteristics and gives an overview of the technology in practice by means of a literature review. The section thereafter concerns the methodology used in this work and points out the gap, relevance, research questions and resulting research method. The third section entails our conceptual models we created, and is split up in two parts. We first made an analysis from a business ecosystem viewpoint, and consequently made one from a business process viewpoint. Both parts have an accompanying discussion with insights for that viewpoint in particular. Hereafter, we provide a general discussion about blockchain technology and its potential for car registry and insurance in Belgium, hereby focussing on both benefits as constraints or specific design decisions that have arisen throughout our work. Moreover, we also give some first insights on how a practical implementation could look like. We hereafter give a brief overview of the research its limitations and suggest topics for further research to finally, in the eighth section, provide the conclusion of this research.

3

2. Blockchain technology

2.1 What is blockchain technology

2.1.1 Blockchain technology definition

What is blockchain technology (BCT)? Unfortunately, there is no such thing as a generally accepted definition of the concept (Seebacher & Schüritz, 2017). There are however some key concepts of blockchain technology most research and applications build on.

Firstly, if we would try to explain the concept of blockchain technology in a few words, we would describe it as follows: a blockchain is a chain of blocks of encrypted information that registers transactions (Zhao et al., 2016). The basic idea behind BCT is that it allows actors in a system (called nodes) to transact digital assets or currencies using a P2P network that stores these transactions in a distributed and immutable way across the network (Ølnes et al., 2017). The owners of the assets, and the transactions involving change of ownership, are registered on the ledger by the use of public key cryptography and digital signatures (Warburg, 2016). The transactions are then validated by the other nodes in the network by employing a ‘consensus mechanism’ or ‘consensus protocol’. This consensus mechanism enables to shift away power and decision-making from centralized authorities. Consensus is achieved in an emergent manner, through the asynchronous interaction between multiple nodes all following mathematical rules (i.e. the consensus mechanism) (Antonopoulos, 2014).

.

Figure 1: How blockchain technology works. Adapted from PwC (n.d.)

In fact, multiple verified transactions are then grouped together in a block. This block then gets added to the existing chain of blocks, the blockchain, of which all the participating (full) nodes own an identical copy. Once a block, consisting of transactions, is added to the blockchain, newer blocks will

4 be ‘stacked’ on top of it. The blocks on top of the particular block make that block permanent and immutable, which means it becomes impossible to ‘undo’ or ‘delete’ transactions in that block (Antonopoulos, 2014).

2.1.2 BCT building blocks

We will now briefly introduce the key building blocks of BCT, which we used in our definition.

1. Transactions

A transaction is a signed data structure expressing a transfer of value which arises from an interaction between parties. Transactions are transmitted over the blockchain network and are included in blocks, which make them permanent (Antonopoulos, 2014). A transaction can either represent a transfer of a monetary amount or record a transfer of digital or physical assets (Yaga, Mell, Roby, & Scarfone, 2018).

2. Blocks

A block is a grouping of transactions, marked with a timestamp and a fingerprint (hash) of the previous block. Blocks are being validated through a consensual agreement, and valid blocks are added to the main blockchain by network consensus (Antonopoulos, 2014; Yaga et al., 2018).

3. Distributed ledger

BCT works with a distributed ledger, which is often simply referred to as ‘the blockchain’. Blockchain technology can be seen as a mechanism for recording transactions (Sharples & Domingue, 2016), while the blockchain itself is the linked sequence of these transactions represented by a chain of blocks (Böhme, Christin, Edelman, & Moore, 2015). The ledger documents all the transactions and activities that took place within the construct, making use of decentralized timestamping (Gipp, Meuschke, & Gernandt, 2015). As a result, a blockchain is a complete and immutable history of network activities, which are shared among all nodes of a distributed network (Abeyratne & Monfared, 2016). In fact, it can be seen as a shared ‘database’ (Kakavand, Kost De Sevres, & Chilton, 2017). The difference however is that there is no central server or central point of control (Antonopoulos, 2014).

4. Consensus mechanism

The consensus mechanism enables the creation of new blocks and allows agents to autonomously agree on the correct order of transactions and a shared system state at any given point in time (Buterin, 2014). Because of the consensus mechanism and its pre-agreed rules about what new data can be added, the distributed ledgers are kept in synchronization. The invention of BCT and its

5 corresponding consensus mechanism therefore represents a breakthrough in distributed computing science that copes with a well-known problem, known as the ‘Byzantine generals problem’ (Antonopoulos, 2014; Ølnes et al., 2017).

Different consensus mechanisms do exist, each having a different impact on the security, performance and the scalability of the blockchain (Xu et al., 2017). The most commonly implemented consensus protocols are proof-of-work (PoW) and proof-of-stake (PoS), but various other protocols do exist (Cachin & Vukolić, 2017; Xu et al., 2017). Blockchain’s leading networks, Bitcoin and Ethereum, employ a PoW consensus protocol. This implies miners to participate in a process of solving a computationally heavy puzzle (Watanabe & Kishigami, 2016). It creates trust by making sure that transactions are only confirmed if enough computational power was devoted to the block that contains them. The competition to solve the PoW algorithm in order to earn the reward and the right to record transactions on the blockchain is the basis for blockchain’s security model (Antonopoulos, 2014).

5. Cryptography

Various encryption methods are used within BCT, including the ‘asymmetric public-key cryptography’ (Perucchini, 2017; Yaga et al., 2018). Blockchain adopts an asymmetric encryption mechanism, which enables users to sign transactions with their private key and encrypt data with their public key. This public key is generated from the user’s private key. More specifically, the public key is a hash value calculated from the private key and performs as the identicator of the user. This hash value has no relation with the real identity of the user and the process of calculating the hash value is irreversible (Antonopoulos, 2014). As a result, the public key is made public without reducing the security of the process, but the private key must remain secret at all times if the data is to retain its cryptographic protection (Yaga et al., 2018). The private key is ideally backed up and protected from accidental loss, because if lost it cannot be recovered (Antonopoulos, 2014).

Another important component of BCT is the use of cryptographic hash functions for many operations (Yaga et al., 2018). A hash function is immutable and can be seen as a digital fingerprint of some binary input (Antonopoulos, 2014). Within a blockchain network, the cryptographic hash functions are used for many tasks, such as address derivations (from a public key, often a QR-code), the creation of unique identifiers, and the security of block data and block headers (Yaga et al., 2018).

6 Cryptography is also deployed in the cryptographic puzzle which needs to be solved within a PoW consensus protocol (Sousa, Bessani, & Vukolić, 2017). Bitcoin for example uses the SHA-256 algorithm which has to be solved in order to add a new block to the chain (Antonopoulos, 2014).

6. Business rules

BCT offers the attractive feature of coding algorithms - representing business rules - that are stored on the blockchain and get automatically executed whenever a certain predefined condition is met or satisfied, called smart contracts (Kudwa, 2018). Because of the limitless possibilities the smart contracts offer for business transactions, numerous enterprise-based blockchains were and are being developed such as Enterprise Ethereum1, Hyperledger2 and R3’s Corda3. These platforms offer the possibility, through the implementation of arbitrary smart contracts, to transfer and store information about business objects.

Smart contracts

Smart contracts are defined in the Ethereum whitepaper as “systems which automatically move digital assets according to arbitrary pre-specified rules” (Buterin, 2014). These are computer programs (lines of code) whose correct execution is initiated by a certain external trigger and which are automatically enforced without relying on a trusted authority (Bartoletti & Pompianu, 2017; Lauslahti, Mattila, Hukkinen, & Seppäla, 2018). They typically include the terms of an agreement (e.g. between a buyer and a seller). A smart contract can thus execute a transaction of currencies or digital assets when triggered, and automatically redistribute these among the parties involved (Ølnes et al., 2017). It goes without saying that if one codes business processes and business transactions into smart contracts, automation will be performed on a higher level. The applications of smart contracts are endless and can be executed on a lot of public and private blockchains.

2.1.3 Implications of the building blocks

1. Decentralized network

Blockchain is what is called a decentralized network. Due to its distributed nature and its integrated consensus mechanism, it provides a novel way of governing transactions between multiple parties without the need for a central party that controls all this (Notheisen et al., 2017). It is thus based on a P2P network, where the key innovation is in its decentralized core technologies (Böhme et al, 2015).

1 https://ethereum.org/enterprise/, consulted on 26/04/2020 2 https://www.hyperledger.org/, consulted on 26/04/2020 3 https://www.r3.com/corda-platform/, consulted on 26/04/2020

7 The blockchain offers every single user an opportunity to become one of the network’s many transaction processors4, the nodes. Because all these nodes own the same set of transactions and follow the same mechanism to make decisions, there is no central point of failure in the system (Böhme et al., 2015).

As Vitalik Buterin (2017), a co-founder of Ethereum, more thoroughly explains: a blockchain is a politically decentralized (no single authority controls the blockchain), architecturally decentralized (no single infrastructure or computer owns the blockchain), but logically centralized system. The logical centralization implies that there is one commonly agreed state and that the system behaves like a single computer. If one would cut the chain in half, it would become inoperative.

2. Security and privacy

Through the use of advanced cryptographic tools, transactional privacy is guaranteed, meaning anonymity or pseudonymity on the blockchain (Cachin et al., 2017). As stated above, the identity behind a public key is – by definition – untraceable. The security of the data relies on the decentralized control over keys and on the independent transaction validations (Antonopoulos, 2014).

3. Trust-shift

Costly trust-building mechanisms, such as trusted intermediaries or governing institutions, are replaced by cryptographic protocols, decentralized consensus algorithms, and smart contracts (Notheisen et al., 2017). In other words, BCT encompasses a shift from trusting people to trusting math (Antonopoulos, 2014).

Various authors refer to BCT as a ‘trust-free system’ (Beck, Czepluch, Lollike, & Malone, 2016; Notheisen et al., 2017) because no third parties, meaning no human interferences, should be trusted anymore. In fact, these authors rely on the fact that algorithms and maths are 100% trustworthy.

Regardless if one calls it a trust-shift (Antonopoulos, 2014), a trust-free system (Notheisen et al., 2017), or a trust-machine (The Economist, 2015), everyone agrees that BCT reduces trust frictions (Böhme et al., 2015), thus enhancing trust. We will sum up the main trust drivers:

- Immutability: the foundation for data immutability in BCT is built by the cryptographic

interconnection (timestamp and hashes) of data blocks, that capture the timely order of past

8 transactions in a blockchain (Notheisen et al., 2017). Once data is stored on the blockchain, it also becomes practically immutable as it is impossible to change the data in a block without reaching consensus amongst the validators. (Abeyratne & Monfared, 2016). This allows participants to operate with the highest degree of confidence that the chain of data is unaltered and accurate (Abeyratne & Monfared, 2016; Notheisen et al., 2017).

- Transparency: Because of its distributed nature, every node holds or has access to an identical

copy of the blockchain, thereby allowing auditing and inspecting of the data sets in real time. All the network activities and operations are highly visible, reducing the need for trust (Abeyratne & Monfared, 2016).

- Data integrity: meaning the maintenance and assurance of the accuracy and consistency of

the data over its entire life-cycle (Ølnes et al., 2017). The data integrity is, next to the immutability and transparency, derived from the process integrity. The blockchain protocols are executed exactly as written in the code. Therefore, users can be certain that actions described on the protocol are executed correctly and timely without the need for any human intervention (Abeyratne & Monfared, 2016).

4. Automation

Due to the self-executing nature of a smart contract, it can transfer digital assets according to arbitrary pre-specified rules (Buterin, 2014). Smart contracts can automate businesses and transactions in a very scalable way, resulting in a more efficient and cost-effective way of working (Giancaspro, 2017).

2.1.4 BCT architecture

Current blockchain systems are generally categorized in three types: public blockchains, private blockchains and consortium blockchains (Buterin, 2015). We will elaborate on these three applications through the following table based on Buterin (2015), Carson et al. (2018) and Zheng, Xie, Dai, Chen and Wang (2017).

9

Table 1: Key characteristics of different blockchain categories

Public blockchain Consortium blockchain Private blockchain

Centralized No Partially Yes

Consensus process Permissionless Permissioned Permissioned

Efficiency Low High High

Scalability Low Medium High

Public blockchain: In a public blockchain, all records are visible to the public and everyone can take

part in the consensus process (Zheng et al., 2017). Permissionless public blockchains are completely open: new users can join the network at any time and read, write, and commit transactions. This means the public blockchains are at the most decentralized end of the spectrum (Carson et al., 2018; Xu et al., 2017). So we can state that one of blockchain its most disruptive and innovative features, the decentralized and distributed structure, will be reflected the most in public blockchains. But on the other hand, as there are a large number of nodes on a public blockchain network, it takes plenty of time to propagate transactions and blocks over the network (Zheng et al., 2017). As a result, transaction throughput is limited and latencies are high (Christidis & Devetsikiotis, 2016), which makes a public blockchain less scalable (Carson et al., 2018). Some established and well-known public blockchains are Bitcoin, Ethereum and Litecoin5.

Consortium blockchain: In a consortium blockchain, only a group of pre-selected nodes participate in

the consensus protocol (Buterin, 2015; Zheng et al., 2018). These could for example be a dozen of financial institutions, each of which operates a node and of which 8 of them must validate every block in order for the block to be accepted. The right to read the blocks might still be public (Buterin, 2015). We can consider these blockchains as partially centralized, as the ledger is distributed over a certain number of participants. The consortium blockchain is thus a permissioned consensus process with fewer validators which does result in a higher efficiency and an intermediate level of scalability. Well known (enterprise) consortium blockchain networks are Hyperledger, Corda6 and Enterprise Ethereum.

5 https://litecoin.org/, consulted on 01/05/2020

10

Private blockchain: A fully private blockchain is a blockchain where write permissions are kept

centralized to one organization. Read permissions may be public or restricted to an arbitrary extent (Buterin, 2015). We mostly see these private blockchains as an application within a single company for e.g. database management, auditing, tracking assets,... A private blockchain can thus be described as fully centralized (within one organisation), defusing one of blockchain’s most disruptive features. On the other hand, as only one party is in control, there will be almost no transaction latency thus resulting in a very efficient and scalable way of working.

2.2 Blockchain technology in practice

In this part we will have a look on how BCT is developed today. On the one hand, we aim to discover how much of the promising blockchain applications are already used in practice (in different sectors). On the other hand, we want to see how ready a government or insurance sector would be to switch to a blockchain-based system today.

2.2.1 New technology

Blockchain technology, invented in 2008 by Satoshi Nakamoto, was originally developed with the purpose of a P2P electronic cash system, using Bitcoin as a cryptocurrency (Nakamoto, 2008). Researchers and IT-technologists quickly realised that the potential application scenarios of this disruptive technology were limitless (Nofer, Gomber, & Hinz, 2017). While the financial industry is still seen as the primary user of the blockchain concept, adoption and customization in various other potential fields is in progress (Glaser, 2017) because it has the potential to revolutionize a variety of commercial applications (Notheisen et al., 2017).

2.2.2 Blockchain technology so far

2.2.2.1 Blockchain as a payment system

Whilst Bitcoin’s payment method is the most widely accepted one amongst other cryptocurrencies (e

.

g. one can pay with Bitcoin at AT&T, Norwegian Air, Microsoft store7), runners-up like Ethereum, Ripple8 and Litecoin are also making their way into becoming established cryptocurrencies. We can state that, Bitcoin and consequently BCT its initial purpose - a P2P electronic cash system to prevent double-spending - became a developed technology but which is only to a minor extent used for day-to-day activities.7 https://usethebitcoin.com/list-of-online-stores-accepting-bitcoin/, consulted on 27/04/2020 8 https://ripple.com/, consulted on 27/04/2020

11

2.2.2.2 The non-financial sector

On the other hand, smart contracts have only been developed more recently and emerged as a new usage for blockchains to digitize and automate the execution of business workflows (Hamida, Brousmiche, Levard, & Thea, 2017). This feature makes BCT particularly suitable for the management of e.g. medical records, notary services, user identities and traceability (Gatteschi et al., 2018; Hamida et al., 2017). Because of these smart contracts, that allow the automation of multi-step processes, BCT becomes increasingly interesting for businesses. Especially with the rise of the internet of things (IoT), the combination of both technologies could be pretty powerful (Christidis & Devetsikiotis, 2016; Rimol & Goasduff, 2019). The latter authors believe that we are facing new possible business models and that we should reconsider how existing systems and processes are implemented.

Many authors agree upon this statement and researched possible implication fields, sectors and industries where BCT could, and is already, making a contribution. BCT has enormous potential in the healthcare industry in both the patient record and the drug anti-counterfeits field, the retail industry to trace goods, and other non-financial sectors such as entertainment, tourism and charity (Cole, Stevenson, & Aitken, 2019). We believe that, as of today, in nearly every industry some businesses are exploring the potential of BCT.

2.2.2.3 The financial sector

Melanie Swan (2018), an economic theorist and blockchain-expert, argues that blockchain its distributed ledgers are the most profound form of fintech. They are an enterprise technology that fits into existing IT infrastructures fairly seamlessly, with one of the main advantages being simultaneously private and transparent (Swan, 2018). This way, businesses and IT systems can securely transfer monetary assets, property assets, business contracts and identity credentials. Summarized, asset logging and transfer could be done - in and across - organisations in an automatic, secure, fast and reliable way due to the features of BCT. BCT thus offers the financial sector (banks, insurance companies, real estate,...) much more than just a new payment method and currency.

In the banking sector, the development of BCT comes at the right time, according to Collomb, Sok and Léger (2017). These authors argue that the emergence of the distributed ledger technology (DLT) comes in the wake of a rising trend of disintermediation, of which one symptom is the growing market share of shadow banking. This trend has accelerated over the past years with the steady development of new forms of digital finance, such as P2P lending or crowdfunding, whereby lenders and borrowers can directly transact with each other without having to resort to banking intermediation (Collomb et

12 al., 2017). Therefore, we believe blockchain will even make a bigger contribution to this trend, concerning it has the potential to completely remove the middleman. On top of that, as a blockchain permits tracking all information concerning a physical or digital asset in a secure and reliable network, it has the potential to reduce information asymmetry between two parties.

There is plenty of practical evidence confirming that the financial sector is really encouraging BCT and vice versa. Following B-Hive (2019), a European fintech platform, InsurTech is evolving the insurance industry through four major trends: automation, hyper-personalisation, cyber-security and peer-to-peer. Considering all the above literature, BCT would perfectly match those insurance trends. Ryskex9 for example, a German InsurTech company founded in 2018, uses BCT for transferring risk from one party to another without the use of a middleman. This innovative business concept also brings a new investment method to life, where risk takers get an interest on their stake if no claims have been made. Another example is Kasko2Go10, which provides a ‘pay-as-you-drive’ car insurance model. On-demand insurances, a charming concept, but requiring a lot of underwriting, policy documents, buyer records and other paperwork so that it is almost impossible for traditional insurance companies to accomplish this concept in an (cost)-effective way (Gatteschi et al., 2018).

Fintech companies their business model is based on providing specific customer solutions based on innovative technologies such as blockchain (FSMA, n.d.). They might form a threat to large and established financial institutions which therefore also began to explore the use of BCT. What we see today is that most of the worldwide financial institutions set up some kind of blockchain platform or side-business, in collaboration or as joint-venture with a big tech company. For example, Microsoft and Bank of America Merrill Lynch set up the Azure Blockchain11, while Barclays, HSBC, KBC and others work together with fintech company R3 on its Corda blockchain platform. In Japan, three of the four biggest domestic banks are working together with IT provider Fujitsu on a P2P blockchain platform (Peyton, 2017).

2.2.2.4 Governmental public services

The public sector also has several services and transactions that could benefit from the use of BCT, or of which its potential should at least be investigated (Ølnes et al., 2017). BCT creates multiple opportunities when used in government services such as an (operational) cost reduction, reducing fraud and payments errors and transparency of transactions between government agencies and

9 https://ryskex.com/, consulted on 28/04/2020

10 https://kasko2go.com/en/about/, consulted on 27/05/2020

13 citizens (Alketbi, Nasir, & Talib, 2018). As an example, Ølnes et al. (2017) describe the potential value BCT could offer to the car registration service. The distributed ledger would contain all of a car its transactions, wherefrom an owner can be identified. When a car is sold, a transaction needs to be created on the blockchain from the seller to the buyer. Deloitte mentions that some European countries are already analyzing whether the introduction of blockchain could help to digitize car registrations (Pfeifle et al., 2017).

If BCT were to be implemented in a public service like this one, governance of the system would play a critical role (Ølnes et al., 2017). Blockchain governance entails that the development, execution, maintenance and adaptation of blockchain architectures and applications need to be guided and should fit the needs of the service requirements. Policy-makers should thus play a prominent role to ensure that public values and societal needs are fulfilled and taken into account in the design of blockchain architectures and applications (Ølnes et al., 2017). If public blockchains enable basic services like car or citizenship registry, the government would be responsible for provision and maintenance of the fabric layer (Glaser, 2017).

Alketbi et al. (2018) explored different use cases of governments using BCT and DLT in their public services. The services went from record keeping (e.g. Estonian public notary services), to voting systems (in a Danish political party), to healthcare, to smart cities (Alketbi et al., 2018). The last example is being implemented in Dubai, which is providing a smart city with blockchain and IoT to enable the tracking of assets throughout the supply chain12 (Cherrayil, 2020). Dubai had 24 blockchain use cases in the last three years, with an objective to become a paperless government by 2021 (Alketbi et al., 2018). Therefore, we believe the Dubai government has the most advanced blockchain-based public services of the moment.

As of 2020, there are no blockchain-based governmental initiatives in Belgium. However Belgium does take part in the European Blockchain Partnership (EBP) along with 21 other countries (European Commission, 2018). This partnership is however focussed on establishing an intra-country system, which has little to no value for Belgium’s domestic public services.

2.2.2.5 Conclusion

For blockchain as a P2P payment electronic cash-system, we can conclude that the technology and its cryptocurrencies have found some applications, but that it is still far away from being considered an

14 established payment method. As far as we know, we are not able to pay at the local bakery with Bitcoin and it does not seem like this will happen any time soon.

As for business applications, we can clearly conclude that in almost every industry or sector, blockchain technology has drawn the attention of enterprises. Whilst some businesses are only starting to investigate the technology, others have already conducted pilot projects. There are even businesses developed with the specific purpose to provide P2P blockchain-based services. Notwithstanding, we do not see the very large and established organisations completely switching to a blockchain-based business model, nor do we see governments provide their public services through BCT (maybe with Dubai as an exception). Following Gartner (Rimol & Goasduff, 2019), BCT is in the ‘trough of disillusionment’, meaning that interest wanes and experiments and implementations fail to deliver. We do support the waning interest issue because most research and articles we read, were from the years 2016 to 2018. We think, along with Gartner, that BCT is a little bit stuck in the middle for now. A lot of research is done, but BCT has not yet lived up to the hype and most enterprise blockchain projects are stuck in experimentation mode. The reason for this is that the technology and accompanying infrastructure is not (yet) mature enough. Gartner however forecasts that, as technology advances and pragmatic use cases continue to roll out, blockchain platforms will be scalable, interoperable, and support cross-chain functionality by 2023. But for blockchain to really enable a digital revolution across business ecosystems, we will have to wait until at least 2028. BCT will reach its full potential when combined with other technologies such as IoT (Christidis & Devetskiotis, 2016; Rimol & Goasduff, 2019). By 2028, Gartner expects blockchain to become fully scalable, technically and operationally. But even if the technology is not quite advanced enough to launch blockchain-based initiatives now, CIOs should begin exploring the potentials and gathering support from their leadership team (Rimol & Goasduff, 2019)

.

We do support these statements by arguing that enterprises and governments should investigate what BCT could mean for their practices and what potential benefits this might have, but should also comprehend that the technology is not yet mature enough to fully disrupt their business models as it could do in theory.15

3. Methodology

3.1 Gap and relevance

Building further on the previous statements, we support the fact that researching the implications and opportunities of BCT on several business processes and business ecosystems is very valuable, although the technology might not yet be mature enough to fully implement the concepts as aspired. As for every investment, it is wise to initially research the impact it will have, in order to decide whether or not to conduct the investment. If we follow Gartner (2019) and Oliver Wyman’s (2016) estimations that the technology has a disruptive potential but needs some time to further develop, we believe that right now is the time for organizations to investigate the technology so they are able to step on board instantly when the technology reaches its full potential. BCT has so much potential yet so much to prove. It comes with no surprise that an often cited phrase related to BCT is that "blockchain is an innovative technology in search of use cases" (Glaser, 2017, p. 1543).

To this day, the Belgian government and financial institutions lack these use cases. Following Ølnes et al. (2017), this is not only the case for Belgium. They state that there is hardly any research focused on BCT and its ability to address societal needs. Neither is the potential of applications based on BCT for governments explored in a systematic way. The authors state that the public sector has several services and transactions that could benefit from BCT, or of which at least the potential has to be investigated.

As the registration of physical and digital assets is one of the many BCT applications, we believe this is a very interesting and challenging research topic to have a closer look at. This is why we have chosen to investigate the potential impact of BCT on a Belgian governmental service, namely the registration of car ownership. In practice however, car registration and car insurance go hand in hand and are subject to the same businesses. Furthermore, many authors agree that the insurance sector is a perfect fit to adopt BCT along with smart contracts for identity registration, fraud prevention, claim payouts,... (Gatteschi et al., 2018; Notheisen et al., 2017). Therefore, we have decided to address these two application scenarios in this research.

16

3.2 Research question

From the literature and already developed proof-of-concepts on BCT and its practical implications, we can adopt that it is theoretically possible to build a registration and insurance system running on BCT. Therefore, the research question of this study will emphasize on the ‘how aspect’:

RQ: “How could blockchain technology change the way registration of car ownership and car insurance are handled in Belgium today?”

Given our concept of a blockchain-based system to register and insure vehicles in Belgium, we would be interested in the implications/consequences such a system would engender. Therefore, we formulated the following sub-questions:

SQ1: “What benefits would arise from a blockchain-based system to register and insure vehicles, given blockchain's key characteristics?”

SQ2: “What are the challenges and limitations a blockchain-based system to register and insure vehicles would induce?”

3.3 Research method

As discussed above, our goal is to study what impact BCT could have on the registration of car ownership and insurance in Belgium, and to expand on the implications that might potentially arise from this. We hereby adopt a technology-driven approach as described by Ølnes et al. (2017), in which we explore the potential BCT has to change the car registry and insurance ecosystem.

The use cases we envision to research are frequently mentioned and discussed in both academic as practitioner-related literature (Glaser, 2017), as seen in the works of Pfeifle et al. (2017), Gatteschi et al. (2018) and Ølnes et al. (2017). The truly innovative character of BCT however, lies in its technologically driven capability to pervade multiple vertical layers of a digital ecosystem infrastructure (Glaser, 2017). An in-depth perspective on the potential BCT has to invade the multiple layers of the car registry and insurance ecosystem is seldom taken. Moreover, motivations for a good blockchain use case should be sought into changes into the ecosystem, and not so much into technical arguments (Gordijn et al., 2019). Therefore, we deemed a model-based design method to be appropriate in this case to analyze the requirements of such a blockchain-based approach.

17 It is needless to say that for the investigation of a new system and its potential, one has to fully understand the environment in which the system is to be developed. We therefore started off by investigating various practitioner and government sources regarding the current practices on how car ownership and insurances are managed today. We continued by elaborating on the constraints the current situation implies and had a first view on how blockchain could potentially provide an answer to these. A textual overview of the current situation and our perceived constraints is given in section 4 below.

To further analyze and elaborate on our case, conceptual modeling was chosen. Conceptual modeling is an important and helpful tool in the requirements analysis stage of system development, where abstract models of the represented system and its organizational ecosystem are created. A conceptual model thus is an abstract description of an enterprise or organizational setting, of which one part is the represented domain (the subject world) and another part is the usage environment (the real world) (Wand, Monarchi, Parsons, & Woo, 1995). Conceptual modeling is useful in that it not only helps to understand the required information systems and business processes, but also helps to develop and evaluate the service value proposition of a business ecosystem (Hotie & Gordijn, 2017).

Therefore, we made an analysis of our business case on two different domains. This provides a separation of concerns and should aid in managing the complexity (Gordijn & Akkermans, 2001). We looked at our case from a business ecosystem viewpoint and a business process viewpoint, where the business process viewpoint is a refinement of the business ecosystem viewpoint. This is a process of gradual elicitation, specification and refinement of the system requirements.

Moreover, conceptual modeling techniques that take a business ecosystem viewpoint could indicate for our business case, at an early stage, whether or not the introduction of blockchain technology would be meaningful i.e. have a disruptive impact on the composition of the business ecosystem. In practice this often comes down to eliminating or limiting the role of the middleman (Poels et al., 2019).

In reality these viewpoints result in a value model and a process model. The value model shows which economically valuable service outcomes are exchanged between the actors in our business ecosystem. It thus only focuses on ‘what’ is exchanged of value. The process model in turn shows ‘how’ these exchanges are accomplished and operationalizes them by designing corresponding business processes (Gordijn & Akkermans, 2001; Hotie & Gordijn, 2017). We chose e³value and BPMN as modeling languages for the aforementioned models, respectively. The used modeling languages will be briefly

18 discussed further on in this work. One last aspect worth mentioning is that although we will frequently mention other parties such as the vehicle inspection, mechanics, and the police in our textual breakdown of the current situation, we do not take these into account in our conceptual models for the sake of brevity and complexity in our models. We hereby aimed to focus on the core processes regarding car registry and insurance.

19

4. Current situation

In the next section, we are going to elaborate on the current situation concerning vehicle registration and insurance in Belgium. We will have a first look at shortcomings that result from this, and will try to discover whether BCT could address those.

4.1 Car ownership and insurance today in Belgium

4.1.1 Car registration

If a Belgian inhabitant wants to proceed on public roads, he or she is obligated to register his or her car in advance13. In order to register a car, one has to complete an application for registration of a vehicle and send it to the ‘Dienst voor Inschrijvingen van Voertuigen’ (DIV), which is the governmental institution charged with the responsibility for a complete register (database) containing all Belgian vehicle owners and their respective cars14. Besides that, it is also charged with the production and supply of license plates and official registration certificates. With the completion of the application form, and the approval of the DIV, the applying person his or her vehicle gets registered and receives his or her license plate.

To date, it is impossible for the applicant to deliver its form directly to the DIV. The DIV runs an application, WebDIV, which is only accessible for authorized parties. These include insurers, leasing companies and companies with a large fleet of vehicles15. Today, there are 8000 insurance companies or agents authorized to process the application form through use of the WebDIV16 application. Once the individual completed its application form, he or she has to deliver it at their insurance company. If a client does not feel capable to complete the form by him/herself, he can go to the insurance company and let an insurance agent handle the completion of the form17. Either way, the insurance company will check the application form and completes the required details about the insurance for civil liability (cf. infra). The DIV will never accept a form without the vignette of a car insurance.So in theory, one should get a car insurance before one can register its car. In practice, we see that the insurance company almost always arranges the insurance and registration the same day. The DIV receives the application form, deals with it, and sends the requested license plates and registration

13 Koninklijk Besluit van 20 juli 2001 betreffende de inschrijving van voertuigen, BS, 8 augustus 2001, 27.022. 14 https://mobilit.belgium.be/nl/wegverkeer/inschrijving_van_voertuigen, consulted on 11/02/2020 15 https://www.inmotiv.be/nl/faq-autoconnect-webdiv/, consulted on 11/02/2020

16 https://mobilit.belgium.be/nl/wegverkeer/inschrijving_van_voertuigen, consulted on 11/02/2020 17 https://www.ethias.be/part/nl/tips-weetjes/mobiliteit/diverse/inschrijving-voertuig.html, consulted on

20 certificates through bpost directly to the client. The next working day, the client receives a license plate as well as two registration certificates. He or she is obligated to keep one registration certificate in the car, while the other one should be kept at home as a backup. The DIV works with a cash-on-delivery system, meaning the amount has to be paid cash at the door to the mailman by the requesting person.

In summary, the DIV currently owns all the data of Belgian vehicle owners and their respective vehicles18. With this data, they know exactly who and how much they have to charge each year in terms of road taxes. The DIV nor the Belgian government owns the institutions which provide car insurances or vehicle inspections, but they do make these services obligatory. It comes down to the fact that the government makes the rules and owns the data, but privatises or outsources some services.

As of 2018, the Federal Public Service Mobility and Transport, who owns the DIV, holds the data of over 7.7 million vehicles and their respective owners, of which 5.8 million passenger cars19. As an illustration, in January 2020, the DIV had to handle 150.000 new car registrations20, equalling 6 688 vehicles a day. This is done by almost 300 employees of the Federal Public Service Mobility and Transport who are fully employed with road traffic registrations and monitoring21.

4.1.2 Car insurance

Belgian inhabitants who drive a car are obligated by law to take a car insurance for civil liability22. The respective insurance company that issues the insurance will cover the damage caused to third parties in case of an accident. Car insurance premiums are paid monthly or annually23. The amount that has to be paid depends on different personal factors. In most cases, there are 9 different elements that affect the premium (Selleslagh, 2019; Test-Aankoop, 2019):

- Age of the driver: Young drivers will pay a higher premium than more experienced drivers

because they statistically have a higher chance to be involved in an accident.

18 https://www.belgium.be/nl/mobiliteit/Voertuigen/inschrijving, consulted on 17/02/2020

19 https://mobilit.belgium.be/sites/default/files/kerncijfers_mobiliteit_2018.pdf, consulted on 17/02/2020 20

https://mobilit.belgium.be/sites/default/files/qx_immatriculations-inschrijvingen_nl_2020-02-01-10-21-47.pdf, consulted on 17/02/2020

21 https://mobilit.belgium.be/sites/default/files/jaarverslag2015.pdf, consulted on 17/02/2020

22 Wet van 21 november 1989 betreffende de verplichte aansprakelijkheidsverzekering inzake motorrijtuigen,

BS, 18 december 1989, 20.122.

23

21 - Crash history: Measured as the number of accidents you experienced in the past five years.

The higher that number, the higher the premium will be. The crash history can be requested at the previous insurance company or through Carattest24.

- Domicile: Depending on the hometown of the driver, the premium will be higher for people

living in urban areas than for people who live in rural areas.

- Purchase price: The more expensive a car was in the first place, the higher the costs of repair

and replacement will be.

- Engine power: The higher the engine power, the faster the car. Insurance companies assume

that faster cars will cause crashes more frequently.

- Mileage: Some insurance companies offer a discount to people who do not drive a lot, or offer

a formula where the customer pays an insurance for every kilometer driven25.

- Personal or professional usage: Company car drivers will pay a higher premium than cars used

for leisure activities.

- Eco-friendliness: Some insurance companies reward drivers of an electric or hybrid car with a

discount on the premium.

- Driver assistance systems: Vehicles who are equipped with additional security tools, like

parking assistance, are sometimes offered a discount.

In order to take a car insurance, one has to contact a preferred insurance company. In Belgium, these are often banks or financial institutions related to banks. As with the vehicle registration form, the policyholder has to complete an insurance application form. He or she again has to provide personal data, personal data of other occasional drivers and vehicle specifications in order to do so.

4.1.3 Additional parties and elements

Car manufacturer

An automobile company typically executes an order-based sales process, whereby a specific vehicle will only be manufactured once an order from one of their customers has been placed. Their primary customers are in fact the car dealers or concessionaires, while the users of a vehicle are seen as secondary customers26. Once an order is manufactured, the vehicle will be shipped to the car dealer, which will on his term sell the vehicle to the customer. The time in between the placement of the order and the receipt of the vehicle will be used by the customer to register and insure his car. So when the vehicle arrives at the car dealer, the customer already has his licence plate, registration

24 https://www.carattest.be/carattest/faces/, consulted on 06/05/2020 25 https://www.coronadirect.be/nl/autoverzekering/kilometerverzekering

22 certificate and insurance. With the new vehicle comes the certificate of conformity (COC), which leads us to the next point.

Certificate of conformity

The COC is a European document on board of the vehicle which proves that the vehicle complies to the appropriate technical specifications27. The document contains information about the vehicle and its producer, type approval number, technical specifications and other data28. Every vehicle should come with a COC, whether it is a new or used vehicle. It is obligated by law to have the COC accompanying your vehicle.

Car dealer

Car dealers or concessionaires can trade in both used and new cars. When one sells new cars, they most likely have a concession contract with a manufacturer of a specific car brand. The car dealers are in fact the salespeople of the car manufacturers. Once a car is sold, they place an order at the car manufacturer and prepare the registry application form for the customer by filling in all the car details.

Vehicle inspection

The Belgian law has some legal provisions about the state of the vehicles on the roads. There are a number of criteria the vehicle has to meet in order to be allowed on the roads. These criteria comprise some technical specifications about the brakes, lights, safety belts,... of the vehicle29. The driver of the vehicle accounts for the costs of the inspection30. After the inspection, the driver receives a green or a red card, depending on whether the vehicle is approved or has to be inspected again.

Garage or mechanic

Garages and mechanics are independent parties who perform the periodic or non-periodic maintenance as well as repairments. Whenever a car was involved in a serious accident31, it has to get repaired by a mechanic and is then obligated to get inspected at the vehicle inspection.

27 https://www.verzekeringen.be/gelijkvormigheidsattest, consulted on 18/02/2020 28 https://www.eurococ.eu/en/certificate-of-conformity, consulted on 18/02/2020

29 Koninklijk Besluit van 15 maart 1968 betreffende algemeen reglement op de technische eisen waaraan de

auto's, hun aanhangwagens, hun onderdelen en hun veiligheidstoebehoren moeten voldoen, BS, 28 maart 1968, 3.263.

30 https://www.belgium.be/nl/mobiliteit/Voertuigen/technische_vereisten/autokeuring, consulted on

14/02/2020

23

Car-Pass

Car-Pass is a document which prevents certain kinds of fraud in the trades of second-hand cars. It is initially developed to track the mileage of a car but recently added information about the CO2-emissions, the compliance with euronorms and if the vehicle had an inspection after a crash. When a private person sells a vehicle, he is obligated by law to provide the Car-Pass document to the buyer, which he gets at the vehicle inspection. This way, the buyer is - in theory - always certain that the information the seller provides matches the reality, which should address problems of information asymmetry and provides a response to Akerlof’s (1970) market for lemons.

Road tax

The road tax in Belgium is a yearly required payment to one of the three regional governments32. The road tax has to be paid by the owners of the vehicle registered with the DIV33. Consequently this is one of the major reasons why the Belgian government wants a mapping of the cars and inhabitants (i.e. a car registration).

Law enforcement institutions

When one commits a traffic offense (speeding, driving under the influence of drugs or alcohol, not wearing seat belts,...)34, the person in question can be charged with a fine or has to hand in his driving license. These decisions are invented by the law35, and executed by law enforcement institutions like the police, customs, judges,...

4.2 Shortcomings of the current situation

In the next section we will elaborate on the infrastructure and processes of car registration and insurance today. More specifically, we will elaborate on the constraints for the different parties.

4.2.1 For an individual

KYC verification

During the whole process of acquiring a driver's license, buying a car, registering a car, taking an insurance,... a customer has to register and prove his identity repetitive times. Every service requires

32https://www.belgium.be/nl/mobiliteit/Voertuigen/verkeersbelasting_en_verzekering/verkeersbelasting,

consulted on 14/02/2020

33 https://belastingen.vlaanderen.be/VKB_wie-moet-de-jaarlijkse-verkeersbelasting-betalen, consulted on

14/02/2020

34 https://www.veiligverkeer.be/onderwerpen/boetes-en-straffen/, consulted on 06/05/2020

35 Koninklijk Besluit van 30 september 2005 tot aanwijzing van de overtredingen per graad van de algemene

reglementen genomen ter uitvoering van de wet betreffende de politie over het wegverkeer, BS, 9 november 2005, 48.037.

24 a full identity check which is costly in terms of effort and time (Sullivan & Burger, 2017). On top of that, the current know-your-customer (KYC) compliance does cost a significant amount of money for e.g. financial institutions (Moyano & Ross, 2017), averaging $60 million a year for a bank (Thomson Reuters, 2016).

Non-digital pieces of evidence

As a driver, you are obligated to have your registration certificate, insurance certificate, inspection certificate and your certificate of conformity on board when driving36. For example, if you cannot present your insurance certificate at a police checkpoint, it is possible to receive a fine or your car might even get confiscated37. As you are obligated by law to have these pieces of evidence physically with you, it is possible to lose or forget them, which could unfortunately result in negative consequences for the person in question even though he is registered or is insured.

Effort and availability

As registry, insurance, inspection, license plate delivery,... all have to be done manually, these actions can only take place during office hours, which only cover 1/3rd of a day. As of today, none of those services are available 24/7 to a consumer, which means one can only carry them out during the office hours. Furthermore, a person has to find the time to do so during his working day. This industry might therefore be lacking some digitization and automation.

4.2.2 For the government and insurers

Bureaucracy

The government, being a bureaucratic entity (Gordijn et al., 2019), prescribes the rules and regulations over the other parties in this organizational ecosystem. The whole car registry and insurance process is as such already distributed over different services and institutions. The federal government in fact already gives away some of its power and control to other institutions. It for example delegates its power and responsibilities regarding car ownership and registration to a government institution like the DIV, while it outsources certain activities such as vehicle inspection and provides a legal framework to others such as insurances. Although organizations like the vehicle inspection and insurance companies require authorization by the government38, it is safe to say that

36 https://www.aginsurance.be/Retail/nl/mobiliteit/auto/Paginas/boorddocumenten.aspx, consulted on

17/02/2020

37 https://www.pv.be/dossiers/auto/auto-verzekeren/groene-kaart, consulted on 17/02/2020

38 https://www.vlaanderen.be/technische-keuring-van-voertuigen/erkende-keuringscentra, consulted on

25 as such, some government responsibilities and services are already decentralized. While this decentralization definitely brings certain benefits, we also want to highlight the fact that this might bring more organizational and bureaucratic efforts for the government to orchestrate everything. The Belgian government has to, firstly, make agreements with other companies and check if they are credible, and secondly, communicate with them and exchange data back and forth. This implies extra costs and efforts which should not be the case if information systems between the different parties were managed more efficiently. Due to the bureaucratic structure of the government, and thus their ability to prescribe rules and regulations over the other parties, insurance companies are obligated by law to take the role of the middleman in the car registration process and make use of the WebDIV application39. For the insurers, this can sure help in attracting new customers which see the insurer as a one-stop shop, but the insurance companies still have to pay a fee on every vehicle they register, ranging from €0,25 to €1,0040. This is an obligated and inevitable cost for the insurance companies, which the government is able to impose because of its hierarchical and bureaucratic structure. Next to this transaction cost, the insurance companies do put resources and working hours in the registration process, without having any return from these activities specific. Concluding, the bureaucracy unintentionally affects both the government and the insurance companies.

Data diffusion

Closely matching previous statement is the fact that vehicle and driver’s data is currently pretty diffused. There is the DIV who tracks the ownership, Carattest who tracks the crash history of a driver, Car-Pass who tracks the mileage and maintenance of vehicles. But in fact they do all relate to the same vehicle. The system lacks a single and complete file of a vehicle and its history. This is acknowledged by McKinsey stating that “public data is often siloed as well as opaque among government agencies and across businesses, citizens and watchdogs” (Carson, Romanelli, Walsh, Zhumaev, 2018).

Conflicting data

This diffusion might result in inconsistent and conflicting data. Imagine one goes to a garage to upgrade or tune the engine of his car. In theory, when a substantial modification is done to a vehicle, the owner should immediately go to the vehicle inspection to update the specifications of his car in the system. If the person in question does not do this, the reality does not match the paperwork. This is also the reason why some insurers require to see the vehicle when they receive an application, because they cannot completely rely on the data on the paperwork.

39 https://mobilit.belgium.be/nl/wegverkeer/inschrijving_van_voertuigen/webdiv, consulted on 09/05/2020 40 https://webdiv.inmotiv.be/licenseplatesNL.asp#16, consulted on 09/05/2020

26

Non-digital pieces of evidence

The certificates made out of paper entail the threat of fraud, loss or duplicates. We think this system of physical attendant document management is obsolete, especially when the effective data which proofs that a vehicle is registered or insured is sitting somewhere else in a database.

Ownership of legal compliance proof

Although one needs to comply with the legal formalities issued by the government, he or she is still the one who owns the proof. For example, when one gets pulled over by a policeman, the obligatory board documents (registration, insurance and inspection) are requested from the person in question, because the policeman does not own the proof of registration, insurance and inspection himself. This is somehow conflicting and contradictory because it is the government who issued the obligations and owns the details of them, but still puts the proof in the hands of the consumers, opening space for loss, fraud or other adverse consequences. This is due to the fact that the data is not always and for everyone accessible.

Manual labour

As mentioned above, the DIV employs 300 full-time equivalents. This results in a significant labour cost. These resources could be re-allocated and used more efficiently somewhere else. Furthermore, there is only little automation embedded today in the process of registering and insuring a vehicle.

Single point of failure

The vehicle registration data (mapping between consumer and his vehicle) is stored in a government database. Although this database might be architecturally decentralized, meaning the database is distributed over multiple nodes, it is still owned and controlled by a single entity, namely the DIV (government). This political centralization entails a database system which is more vulnerable to conflicting or false data. In case this database is also not architecturally decentralized either, then it is more vulnerable for attacks, technical breakdowns and has a limited transaction flow scalability (Buterin, 2017).