EXPLORING

THE

COMMERCIAL

EVOLUTION IN THE QD MARKET: A

CONSTANT INTERPLAY BETWEEN

ENTREPRENEURIAL AGENCY AND

INVESTOR’S LOGICS

Aantal woorden / Word count: 16.585

Bernard Huyghe

Studentennummer / Student number: 0140 8878

Promotor / Supervisor: Prof. Dr. Bart Clarysse

Masterproef voorgedragen tot het bekomen van de graad van:

Master’s Dissertation submitted to obtain the degree of:

Master of Science in Business Engineering

Main subject: Finance

PERMISSION

I declare that the content of this Master’s Dissertation may be consulted and/or reproduced, provided that the source is referenced.

FOREWORD

This master’s dissertation could not be realized without the contribution of certain individuals. In line with the subject of this work, its realization is the result of the interaction with specialists in the entrepreneurial and quantum dot field. Therefore, I would like to take a moment to express my gratitude towards them.

In this, special mention goes to Prof. Dr. Bart Clarysse. As my supervisor he not only guided me through my research process, more importantly, he fueled my interest in the QD field and – what’s in the name – did a great job as “promotor” of the technological entrepreneurship and innovation research fields. Additionally, I am thankful for the opportunity to be part of his research team and attend the weekly videocall meetings. The discussed topics and personal feedback have been very helpful for the structure and focus of my work. Thanks to the frequent feedback moments, the Corona measurements have had no impact on the realization of my thesis.

I sincerely hope that my master’s dissertation proves to be helpful for other team members, especially for those who already did a lot of research within the QD sector like Maria Anakina or Laurens Vandeweghe. Hopefully, my work compensates in a way for the fact that I could build on their gathered data for my own case study.

Last but definitely not least, I would like to thank my parents Frank Huyghe and Catherine Supré for the continuous support during the unusual lockdown period as well as during my whole university career. I will always be grateful for their dedicated time and effort encouraging me to reach my full potential.

TABLE OF CONTENT

1. ABSTRACT……….1

2. INTRODUCTION………2

3. WHAT’S IT ALL ABOUT: THE TECHNOLOGY ITSELF………..6

4. RESEARCH METHOD………...……7

4.1 Case composition & data collection 4.2 Method & data analysis 5. THE COMMERCIALIZATION PATH: THREE WAVES………..10

5.1 First wave (1998 - 2006): “techie tech” ventures with no application focus 5.2 Second wave (2009 - 2015): focus on specific applications 5.3 Third wave (2014 - …): specific products and end-user needs 6. VENTURE FUNDING: CHANGING INVESTMENT LANDSCAPE………....13

6.1 First wave (1998 - 2006): VC dominance 6.2 Second wave (2009 - 2015): boom in CVC investments, VC partners follow 6.3 Third wave (2014 - …): public funding and a new type of VC 7. EVOLVING INSTITUTIONAL CONTEXT: STEP-BY-STEP APPROACH……….19

7.1.1 Early years: research labs disguised as companies

7.1.2 Herding behavior exhibited by both academics and investors 7.1.3 New research goals for academic teams

7.2.1 Signs of dampening expectations

7.2.2 Entrepreneurs look for alternative forms of funding 7.2.3 Investment partners intervene

7.3.1 Strategic investments

7.3.2 A corporate guide towards commercialization

7.4.2 Varying entrepreneurial backgrounds 7.4.3 Small-scale investments

8. DISCUSSION……….41 8.1 Investor’s logic intertwines with venture’s institutional context

8.2 Impact of investor’s logic on venture’s innovation 8.3 Interaction with consequences on both sides

LIST OF USED ABBREVIATIONS

QD quantum dot

VC venture capital

CVC corporate venture capital

LP Limited Partner

QDC Quantum Dot Corporation

LIST OF TABLES

Table 1: Case overview……….7 Table 2: Abstract review of the three waves………40 Table 3: Impact VC Logics……….44

LIST OF FIGURES

Figure 1: Investments in QD ventures……….14 Figure 2: Patent applications………...23 Figure 2’: Patent applications supplemented with vital events………. .33

1. ABSTRACT

The aim of this research is to understand and explain the interactions that take place between technology entrepreneurs and their investors. Our research field concerns the industry incubation period of the nascent QD technology. This generic technology provides an eligible sector to analyze the investor-entrepreneur relationship as its commercialization period can be subdivided in three waves. All three periods are characterized by a distinct strategic focus of the ventures and a corresponding dominant investor’s type. Using longitudinal case data on 31 QD ventures, we try to reason the (in)effectiveness of the investment relations displayed in each wave. More specifically, we look through an institutional lens in an attempt to understand the impact technology ventures have on their investors on the one side, and, on the other side, how investor’s logic intertwines with the ventures’ institutional context and the impact thereof. We show that not only the investors’ institutional context limits entrepreneurial agency, but that technology entrepreneurs also have agency in changing the dominant institutional realm. Additionally, we provide insights on how funding partners’ logics, embedded in the agency of technology entrepreneurs, influence the strategic decisions (e.g. application focus) taken by QD startups. However, our main contribution concerns the effect of partners’ resources on the development of a platform technology. Our research uncovers discrepancies in both commercial and technological commercialization between first-, second- and third-wave ventures. Therefore, we argue that the maturity of the technology and the corresponding institutional context determines the efficiency of the relation with different types of investors. Whereas for the later-stage (product-oriented) ventures our findings are in line with previous literature concerning the impact of investors on young technology firms, we observe contrasting behavior looking at the first- and second-wave ventures.

2. INTRODUCTION

Although discovered a couple of years before, the term “quantum dot” is first mentioned back in 1986 (Reed et al.). Building upon previous work of Ekimov, & Onushchenko (1982) and Rossetti, Nakahara, & Brus (1983), Reed was the first to name these semiconductor particles of only a few nanometers in size. These series of events symbolize the birth of a very promising nanotechnology with numerous potential applications. Unfortunately, throughout its life course, many obstacles came along, resulting in the fact that upon today – a couple of decades later – the technology's disruptive potential is far from met. At the end of this dissertation, we hope to provide answers to why this is the case or why some applications have received more attention than others.

One of these first hurdles to overcome lies in the fact that quantum dots can be categorized as a general-purpose technology (Breshanan & Trajtenberg, 1995). Stated as having the potential to revolutionize a wide variety of industries, QD entrepreneurs – within their startup – face the tough decision which market opportunity to pursue with their technology. While the most difficult, the decision poses itself as a defining choice, given the path dependencies over the venture’s life cycle (Gruber, MacMillan, & Thompson, 2008). Combined with the fact that emerging technologies deal with high uncertainty about the potential of the technology (Rosenberg, 1994), technology entrepreneurs face considerable market ambiguity since it is unclear whether their technology can count on the future interest of the particular end customer (Molner, Prabhu, & Yadav, 2019).

Extant literature has shown that this technological uncertainty and ambiguity lead to long periods of industry incubation, defined as the period between the introduction of a discontinuous technological change and the first instance of product commercialization (Agarwal & Bayus, 2002; Golder, Shacham & Mitra, 2009;Moeen & Agarwal, 2017). The average duration of this industry incubation period across multiple industries is reported to be between 26 and 28 years (Agarwal & Bayus, 2002; Golder, Shacham, & Mitra, 2009). When we take the introduction to the mainstream customer as the endpoint, the duration of such an incubation period is on average ten years longer (Golder et al., 2009).

While extensive research on industry evolution describes long periods between breakthroughs of emerging technologies such as biotechnology or nanotechnology and their first commercialization, we lack a systematic investigation on the role investors play during this incubation period. Financing partners can differ significantly in terms of their background (education, institutional experience, etc.) as compared to the founders of the ventures we will investigate and therefore, they approach the uncertainty and ambiguity that these pioneers face in a completely different way. How they influence technology entrepreneurs and their decisions, both deliberately and unintentionally, and consequently, how they steer the industry during the incubation period forms the core of our research.

Past literature tends to start from a cognitive approach towards entrepreneurship, which assumes too much that entrepreneurs make decisions as isolated agents. More recently, Pontikes and Barnett (2017) have argued that in practice, they act in social systems (Aldrich, 2007), emphasizing in particular the relationship of social structure outside of the organization to the internal processes of the venture (Ruef, 2010). Institutional theory plays an essential role in this. Previous research has shown that the transformation of organizational fields is often grounded in a shift from one institutional logic to another (Perkmann, Salter, & Tartari, 2011; Scott, Ruef, Mendel, & Caronna, 2000; Reay & Hinings, 2005). As described by Dalpiaz, Rindova and Ravasi (2015), institutional logics are socially constructed, and integrated sets of assumptions, values, beliefs, and rules (Thornton and Ocasio, 1999) that give actors guiding principles prescribing legitimate ends and how those ends are achieved (Friedland and Alford, 1991). Logics can be regarded as the underpinning of an organization’s entity and determine the underlying guiding principles which conduct the actions taken by entrepreneurs (Von Halle, & Goldberg, 2010; Lounsbury, 2002). Because this set of norms and beliefs can vary significantly among different types of partners, firms have to cope with divergent logics within their social system. While the institutional recombination can lead to an efficient hybrid, competing logics can also provide the impetus for institutional change and transformation (Tracey, Phillips, & Jarvis, 2011; Rao & Giorgi, 2006; Seo & Creed, 2002). How young firms handle the diverse set of logics and how the individuals within the firm embed these logics into their agency, determines entrepreneurs’ future interpretation of incoming events and their actions in response (Yu, 2009).

Therefore, it is interesting to analyze the influence of outside investors such as venture capitalists and the particular set of logics that they bring into the ventures in which they invest. Research by Pahnke, Katila, and Eisenhardt (2015) indicates that differences between strategic actions of young technological ventures can be traced back to the influence of the institutional logics surrounding the investors.

Although diverse types of funding partners all provide valuable resources, the reasoning behind their investment might lie entirely apart. Corporate, public, or institutional venture capitalists significantly differ in logic concerning what is perceived as proper, rational, and necessary (Tolbert, David, & Sine, 2011). As this heterogeneity shapes their actions, it leads to different behavior towards the following-up of their investments. For example, as opposed to VCs, their corporate counterparts are less likely to pay attention to helping ventures grow. A significant goal for them is to ensure that ventures’ innovations fit with the products of the corporation. Hence, unlike the rapid, time-paced liquidation of VC funds, CVCs position themselves as ‘‘patient capital’’ (Pahnke et al., 2015). Looking through a sociological lens, these differences between partners’ institutional logics are interesting to include when analyzing the behavior of the technology venture.

In this regard, the quantum dot sector proves to be ideal for analyzing the interactions that take place between entrepreneurs and their partners in social systems. The reasons why this is the case are twofold. Firstly – as this paper will show – the incubation period of the QD technology is characterized by a noticeable evolution in funding types prevalent in the nascent industry. As the technology entrepreneurs take small steps towards commercialization over the years, apparent shifts in the interest of various types of investors can be observed.

Secondly, quantum dots – characterized as a general-purpose technology – were seen as having the inherent potential to drastically innovate multiple distinct industries (Breshanan & Trajtenberg, 1995). Therefore, technology entrepreneurs that started the first QD-ventures around the turn of the century had multiple market options as the technology itself was still in its infancy. Roughly said, nobody knew how to commercialize quantum dots, and for that reason, it was entirely up to the founders to decide which path to go down. Therefore, it is exciting to analyze how outside institutional logics embed the

agency of the entrepreneurs over time and how this influences the strategic directions (sector focus) taken by these platform technology entrepreneurs.

This combination – different types of capital and the luxury of the entrepreneurs to choose from a wide variety of applications – makes an ideal setting to form a broader image of the interactions that take place between these two actors and how this cooperation influences strategic decisions. We make a case for both the technology entrepreneurs’ point of view as well for the investor’s point of view. Taking into account the interests of partners, we try to reason the strategic decisions young QD ventures make. Just like many other technology-based ventures, their founders lack relevant market knowledge (Wright, Clarysse, Mustar, & Lockett, 2007). Therefore, standing at the cradle of this nascent industry, it is most interesting to see to which degree these pioneering QD entrepreneurs let them guide in their strategic actions by their investment partners.

By being part of larger social systems, technology ventures and their actions are influenced by vital events that take place in the market like IPO’s, investments, acquisitions or bankruptcies (Pontikes et al., 2017). Venture capitalists play a leading role in such movements because their investments can be considered as measures of the attractiveness of – and the belief in – a specific market. Facing considerable uncertainty in evaluating the promise of a potential investment, other investors tend to enter more quickly in a market perceived as invest-worthy by other VC firms (Sorenson & Stuart, 2008). By following others, VC firms can alter prevailing beliefs in the market, which ultimately can lead to the perception of a “hot” market (Valliere & Peterson, 2004).

This herding behavior is not only exhibited by the VC market but also the technology ventures themselves display so-called consensus behavior (Pontikes et al., 2017). Especially under conditions of uncertainty, organizations tend to pay more attention to high-profile events that take place within their industry (Festinger, 1954; Kahneman, 2011). Therefore, facing a lot of uncertainty and ambiguity, our research tries to give a better understanding on the extent to which QD entrepreneurs let crucial events within their social system influence their behavior. Remarkable successes, such as a considerable investment deal, or agonizing failures like a missed IPO can trigger entrepreneurial waves. Extant

literature suggests that these waves result from social factors (Ruef, 2006; Sine & David, 2010; Aldrich, 2011).

3. WHAT’S IT ALL ABOUT: THE TECHNOLOGY ITSELF

Not only the commercialization of QDs can be labeled as very interesting; the quantum dot technology itself is even more intriguing. The first thing to know about Quantum Dots is that they are small. Incredibly small. At just two to ten nanometers in diameter, or ten thousand times narrower than a human hair (Shenton-Taylor, 2019), some people even say they have no dimensions. Each dot is a tiny man-made nanoparticle man-made from semiconducting materials. Since QDs confine the motion of electrons in all three spatial directions, quantum dots possess unique optical and electrical properties. When they are excited by an electric current (electroluminescence) or are being placed in front of a light source (photoluminescence), the crystals emit light with a specific wavelength. The color of that emission solely depends on its structure and, therefore, can be controlled very precisely (Yadav & Choudhary, 2014). This means that the manufacturer can play with the size of the QDs in order to vary the wavelength – hence color – of the emitted light. Whereas the smaller crystals produce energy signatures in the blue (high energy) spectrum, larger crystals tend to emit lower energy wavelengths (red hue).

Because of their unusual optical properties, these nanocrystals can be used for all sorts of applications where precise control of colored light plays an important role. Because the technology’s exploitation can yield benefits for a wide range of sectors of the economy and society, QDs can be considered a generic technology (Keenan, 2003; Maine, 2006). Examples of fields in which QDs can make valuable contributions are extensive: life sciences, lighting, photovoltaics, displays, and many others (Bagher, 2016). Its unique qualities make quantum dots advantageous compared to existing technologies in many ways: higher brightness, natural colors, easily controllable, energy-efficient, smaller, etc. On paper, the benefits are numerous. However, quantum dots pose critical challenges in order to translate nanoscience into nano-enabled products. Scaling capacity, product integration, health and environment issues or behavior outside the lab (in more challenging conditions) are only a few hurdles entrepreneurs face to

move from the laboratory to commercial products. A turbulent period of incubation reflects this complex set of commercialization challenges for the early QD startups.

4. RESEARCH METHOD

Case composition & data collection

To analyze the evolution of entrepreneurial agency alongside the changing investment landscape, we perform a micro-historical case study analysis to consider how the cognitions and actions of individual ventures are shaped by and, in turn, shape the institutional context in which a particular event takes place (Hargadon, 2016). We assembled data on a total of 31 QD startups who saw the light between a time span of 23 years, starting with the creation of Quantum Dot Corporation in 1998 and ending with the recent founding of QustomDot in 2020. We identified the ventures based upon availability of/access to company data and relevance for our research without taking into account their application focus, success or whatsoever which results in – what we believe – a representative list of companies for the entire QD industry. Table 1 gives an overview of the 31 ventures included in our research.

Table 1. Case Overview

Company Founded Country Application focus/sector Total funding

Quantum Dot Corporation 1998 USA Life sciences $ 45,5m

Evident Technologies 2000 USA Life sciences, security, displays, electronics, photovoltaics, LEDs

$ 14,3m

Zia Laser 2000 USA Laser $ 19,5m

OmniPV (UltraDots, UltraPhotonics)

2000 USA Security, photovoltaics, energy $ 33 m

Nanoco 2001 UK Displays, photovoltaics, lighting, life sciences $ 32,6m

Nanosys 2001 USA Photovoltaics, life sciences, displays, sensors electronics

$ 189m

Innolume

(NL Nanosemiconductor)

2001 Germany Laser $ 20,8m

Cyrium Technologies 2002 Canada Photovoltaics $ 26m

QD Vision 2004 USA Displays, LEDs $ 134m

Ocean NanoTech 2004 USA Life sciences, laser, displays $ 19m

InVisage Technologies 2006 USA Camera $ 130m

NanoGap 2006 Spain Life sciences, energy, electronics $ 18m

Siva Power (Solexant) 2006 USA Photovoltaics $ 145m

Amastan Technologies 2007 USA Batteries, coating (plasma technology) $ 29m

Avantama 2008 Switzerland Photovoltaics, displays, electronics $ 2,6m

Qlight Nanotech 2009 Israel Displays -

Nanophotonica 2009 USA Displays, photovoltaics $ 8,8m

Nexdot 2010 France Displays (quantum plates) $ 7,9m

Valoya 2012* Finland Specific product: LED growth lights (e.g. L-Series)

-

Nano-Lit Technologies 2013 Canada Specific product: Circadian Rhythm Lighting

$ 0,4m

UbiQD 2014 USA Photovoltaics, security, energy $ 5m

QD Solar 2014 Canada Photovoltaics $ 13m

Polar Light Technologies 2014 Sweden Displays, security, lighting -

Zitong Nanotechnology 2015 China Displays, life sciences, lighting -

Inno QD 2015 South-Korea Displays $ 2,6m

XTPL 2015 Poland Displays, security, semiconductors biosensors

$ 11,6m

QNA Technology 2016 Poland Displays, security -

Sherpa Space 2016 South-Korea Specific product: smart farming lights (Sherpa Eye & Sherpa Light)

$ 2,1m

QLEDCures 2017 USA Specific product: LEDs for light-based medical treatments (mouth sores)

$ 0,2m

QustomDot 2020 Belgium Displays, lighting $ 3,6m

* Valoya Oy was founded in 2009, but the first patents indicating QD research are only listed in December 2012

However, in order to come up with a representative sample, we did try to distribute the ventures – more specifically, their founding dates – evenly over the whole period of our case study. Our research includes eleven ventures founded between 1998 and 2004, ten in the period 2006-2013, and an additional ten from 2014 till now. This split allows us to identify general patterns in the sector that differ among the

three different periods. For all 31 ventures, we collected in-depth longitudinal data concerning founders, application focus, patent filing, funding rounds, lead investors and their background, acquisitions, and other vital events. Our original data source was the press releases gathered from Dow Jones’ Factiva database. Additionally, we scanned the internet for complementary data. Especially from sites like CrunchBase and CBInsights, we were able to extract sufficient information in order to fully complete most ventures’ funding history.

Our research is based primarily on secondary data, but it also includes primary sources like assigned patents (Espacenet and Google Patents), received grants (SBIR.gov), or quotes from interviews with founders or executives (de Montereau, 2013). Combining and comparing this wide variety of sources and data allows for a thorough foundation to perform our qualitative analysis (Newman & Ridenour, 1998).

Method & data analysis

Firstly, we ordered all ventures chronologically according to their founding year (see table 1). Subsequently, we tried to construct a “life story” for each individual case so far, which includes all critical events that happened throughout the life course of the venture. An example can be found in Appendix 1. It concerns the company Nanosys, one of the first QD ventures established and a leading example within the industry.

In order to understand the actions taken in the commercialization process, we make use of so-called process research (Langley, 1999). In this approach, examining directly what happened and who did what when, plays an essential part in understanding how and why events play out over time (Mintzberg, 1979). Therefore, our second step consists in identifying general patterns. In this regard, we pay special attention to the changing investment landscape observed in the QD sector (private versus public versus corporate funding) and the ventures’ evolving strategic focus (IP – specific application – specific product). Determining these trends brings us to the third step of our process research, namely understanding how things evolve and why they evolve in this way (Van de Ven & Huber, 1990). Whereas in the second step – the pattern identification step – we purely identified events and trends, we now concentrate on the agency and guiding principles of the entrepreneurs behind these actions and how

the institutional climate influences this agency (Phillips & Tracey, 2007). We look further than the events and actions themselves and try to explain why the actions took place. As Langley (1999) describes it: “Despite the primary focus on events, process data tend to be eclectic, drawing in phenomena such as changing relationships, thoughts, feelings, and interpretations.” In order to form a good understanding of both the entrepreneurs’ and investors’ motives, we try to support our theory with excerpts from interviews with founders, executives, limited partners, etc.

In short, we start our analysis by identifying patterns visible in the QD sector. As our eventual goal is to analyze the impact of the interplay between technology entrepreneurs and investors on QDs’ commercialization, we look for visible trends both in the investment landscape and among the QD ventures. In other words, we first take a closer look at both sides individually, after which we make use of an institutional perspective to understand the interaction between the funding partners and the entrepreneurs. In what follows, we identify patterns in the business strategy of QD startups, after which we do the same for the investment landscape.

5. THE COMMERCIALIZATION PATH: THREE WAVES

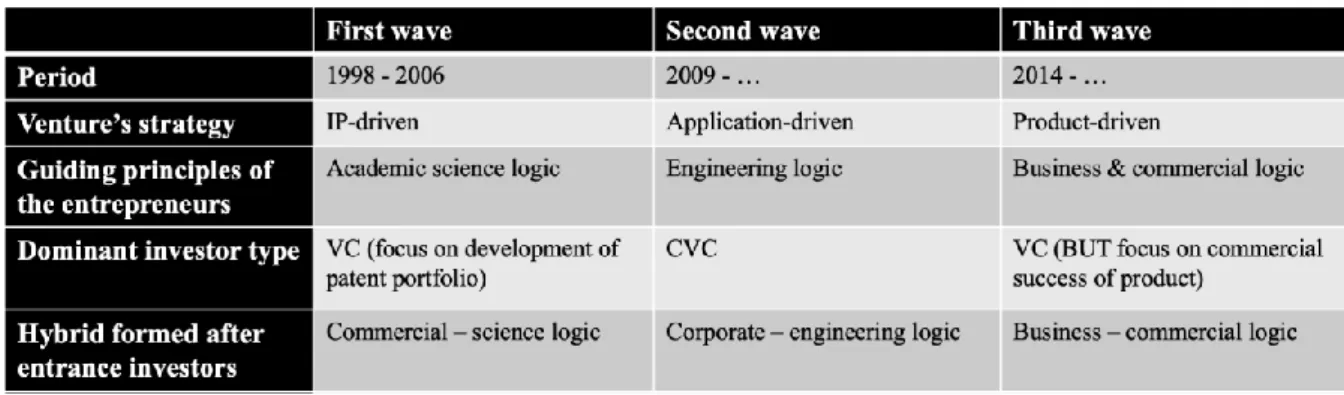

We analyze the incubation period of the QD industry through an institutional lens. Based on the insights of Clarysse and Thiel (2020), we briefly sketch the phased evolution observable in the QD sector and identify three distinct periods.

First wave (1998 - 2006): “techie tech” ventures with no application focus

The first entrepreneurial wave starts back in 1998, with the foundation of the very first startup fully dedicated to the quantum dots technology: Quantum Dot Corporation. (Co-)founded by pioneering scientists and academics, these first wave ventures merely focused on the “R” in R&D with as primary driver scientific publications. Academic science logics were deeply embedded in the early entrepreneur’s agency, with the publication of scientific findings as the primary goal. This logic attends to the pursuit of knowledge for knowledge’s sake (Murray, 2010). Therefore, the ventures’ operations

were based on expanding further research in the hope of getting a better understanding of these nanocrystals and, more specifically, how and if they could be integrated into various applications. None of the QD ventures could provide an actual full-fledged business model; the mission was to monetize patents through licensing deals or patent sales. The rush in patent applications can be attributed to the commercial and professional logics brought into the venture by outside investors. As they wanted to see a return on their investment, ventures had to turn their knowledge into private property and economic rewards (Murray, 2010). Nonetheless, with no prospect of commercialization in the coming years, it may come as a surprise that all these ventures were funded to a significant extent by venture capitalists. This contradicts extensive literature stating VCs target promising industrial applications that could return a 10-fold multiple over a 3-6-year time horizon (Zider, 1998; Robinson, 1987).

In 2004, the withdrawn IPO of Nanosys, a pioneering firm in the QD sector, marked the beginning of the end for this unsustainable situation. The prevailing naivety of getting additional investments without any near-term prospects of return started to melt like snow in the sun. Ventures realized they had to shift their strategic focus and start generating revenue soon, which led to the end of excessive research with no clear vision, hence the end of the first stylized period. What followed was a tough period for the sector: partners no longer wanted to contribute a significant part in new investment rounds, let alone be the lead investor. At the same time, new VCs who wanted to invest large amounts were hard to find. This trend was enforced by the current state of the global economy. The outbreak of the financial crisis initiated a very silent period in the QD sector between 2007 and 2009. For the first wave ventures, this was the time to rethink and reform their strategy and vision.

Second wave (2009 - …): focus on specific applications

This period of stealth eventually led to a new wave in which the entrepreneurs started to pay more attention to engineering rather than a sole focus on the science behind the nanocrystals. As most founders lacked the necessary experience, they relied on the business expertise of newly attracted executives to redefine their venture identity. This resulted in a more specific focus on one or a few applications, those closest to potential commercialization. In this regard, we see that many of the ventures started to concentrate their research on improving mainstream products, especially in the sectors of displays,

lasers, and photovoltaics. If we look back, the missed IPO of Nanosys in 2004 initiated a phase of institutional disruption, after which engineering and corporate logic started to dominate the organizational field. This is also prompted by the fact that many ventures closed collaboration agreements with downstream partners in the corresponding segment, hoping to integrate their business into the value chain of an existing market. The changed institutional setting, dominated by engineering and corporate logic, eventually resulted in the first successful commercial market application. The introduction in 2014 of Samsung’s QLED TV, developed in collaboration with Nanosys, is characteristic for this second stylized period.

Third wave (2014 - …): specific products and end-user needs

In more recent years, we see the rise of companies who try to commercialize their proprietary QD technology in the form of their own end-product. Whereas in the previous wave, entrepreneurs worked closely together with mainstream players to monetize their technology, new QD ventures are founded with the sole objective of bringing their proprietary product to market in the next few years. These companies – although limited in prevalence – personalize a new phase in the commercial development of the QD technology. We can characterize third-wave-entrepreneurs as distinct business model innovators. Their decision making is prompted by an institutional setting dominated by business and commercial logic. Principles associated with a business-like logic are cost-effectiveness and customer satisfaction (Reay & Hinings, 2009), an explicit market orientation, commercial success, and growth (Eikhof & Haunschild, 2007). For those entrepreneurs surrounded by commercial logic, their basis of legitimacy lies in finding a successful new product building on their research (Thornton, 2002). Ventures distinguish themselves from previous startups by having a clear strategic plan on how to build a viable product business around the QD technology. Another aspect in which the third wave differs from the previous two is the vision and mission of the entrepreneurs. They establish their ventures with the purpose of using the quantum dots to satisfy the specific needs of their end customers. Examples in our case study are QLEDCures (treatment of cold sores), Nano-Lit Technologies (natural light to enhance your sleep and optimize your performance), Sherpa Space and Valoya (both focusing on efficient growth lights).

Important to notice here, is that these three different waves we have identified, represent in no way strict separations, meaning that far from all companies founded after 2014 focus on their own marketable product (e.g. QustomDot, a Ghent-based QD startup). On the contrary, since 2014, the ventures with specific product focus represent the minority, but it is essential to acknowledge this new trend in the sector. The one where QD ventures engineer, develop, and produce their own device that generates revenue instead of depending on licensing fees or patent sales.

6. QD FUNDING: CHANGING INVESTMENT LANDSCAPE

Having identified distinct differences between the three entrepreneurial waves and, more specifically, their corresponding institutional setting, we now shift our focus to the funding of these ventures. In this regard, a distinction between the different types of investors is fundamental. In line with Pahnke et al. (2015), we distinguish three types of funding based on their difference in institutional logics: venture capitalists guided by professional logic, corporate venture capitalists dominated by corporate logic and lastly, funding by government agencies whose actions are determined by state logic.

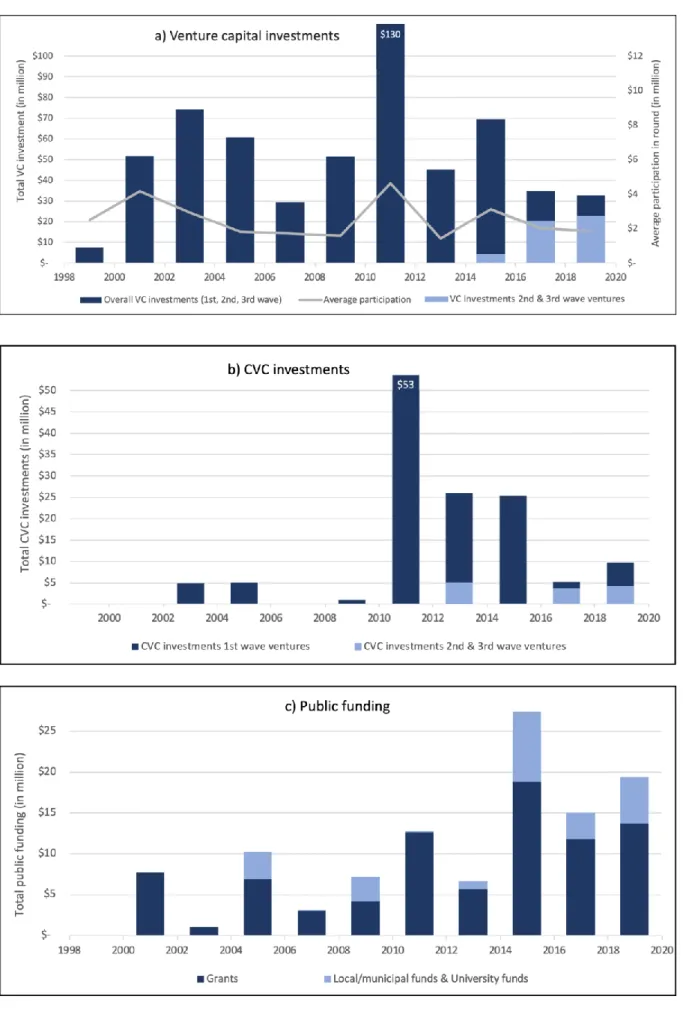

For each investment type, the evolution of invested capital in the QD sector is represented by figures 1a, 1b, and 1c. Because of the possible volatility in the data, we take the invested amounts of two consecutive years together in order to be able to identify general trends. Also, notice the difference between the scales used for all three graphs. To make it easier to compare the prevailing investment proportions within the QD industry, we divided the graph ranges in half going from VC to CVC, and from CVC to public funding. At first glance, one can see that the following three graphs exhibit some parallels with the entrepreneurial waves discussed above. Therefore, we make a first attempt in explaining the observed investment patterns based on the three distinct stages that characterize the QD industry incubation period.

First wave (1998 - 2006): VC dominance

When we look at the gathered data for the first wave (1998-2006), we can conclude that the research performed by the very first QD ventures was funded predominantly by venture capital. These investors were typically big investment firms with large funds and specialized in healthcare and biotechnology and – to a lesser extent – information technologies. Typical examples like Venrock, Institutional Venture Partners, Polaris and Morgenthaler Ventures have respectively $2.5, $7, $1.1 and $2.8 billion in committed capital. Consequently, the investment of a couple of millions meant a mere “drop in the bucket” for these investors. It is intriguing to notice the downward trend in total VC investments from 2004 on, until the beginning of the second wave in 2009. We can spot a similar trend when we have a closer look at the average participation of these firms in the investment rounds of early QD startups. Whereas venture capitalist in the very early years seemingly did not bother to invest an additional million, we see their participation in the following funding rounds steadily go down until 2010, the start of the second entrepreneurial wave. Ventures compensated the decreased interest of their initial funding partners by attracting – most of the time – smaller VC firms to participate in their following rounds (Nanosys’ series D included not less than 16 investors, 12 more than their initial four partners). While venture capital represented the dominant source of funding in the early years of industry incubation, public funding was relatively low while the corporate investments before 2010 can be considered as negligible.

Second wave (2009 - 2015): boom in CVC investments, VC partners follow

Around the turn of the decade, we see an explosion in VC investments. Not only the total invested amount by VCs skyrockets, the sudden boom in corporate investments is even way more pronounced. Of course, increased VC investments may seem logically after years of financial distress, but the explosive emergence of CVCs out of nowhere, can be interpreted as a sign of industry reformation and strategic reinvention of QD ventures. They attracted the attention of corporates such as Samsung and Intel who – through their venture capital arms – formed a new institutional realm financing QD ventures (Clarysse & Thiel, 2020). Important to notice, because of the weakening interest of VCs in nanotech companies and the financial downturn the past years, company valuation was at an all-time low within

the QD sector. Therefore, big incumbents were able to enter the ventures under alluring deal terms. These favorable conditions translate into large invested amounts by – in the majority of cases – big electronics manufacturers. Examples within our case study are numerous: a $10 million investment by Tokyo Electron in Nanoco between 2010 and 2012, 3 million USD invested in QD Vision by DTE Energy Ventures, a $20 million investment in Invisage Technologies by Intel or a 15 million USD participation by Samsung in a 2010-investment round by Nanosys. The fact that this round was complemented by a $16 million investment from previous investors is representative for the rest of the QD companies. Therefore, the attempt of existing investors – those high-profile VC firms who invested in the first rounds – to limit their share dilution proves to be a more logic explanation for the skyrocketing VC investments between 2010 and to 2012 (Figure 1a). In order to “keep up” with the substantial investments made by the Samsung’s and Intel’s, venture capitalists who initially funded the ventures had to (reluctantly) allocate additional millions to new financing rounds. This is demonstrated by the spike in average participation in Figure 1a. Furthermore, during the second wave, traditional VC firms seemed to be no longer attracted to the QD technology and therefore, no longer entered the sector. This phenomenon is illustrated by the – and more specifically the absence of – light-blue bar charts in Figure 1a. These represent the total invested amount by VC firms in the companies founded after the financial crisis of 2008 that are included in our case study. This allows us to conclude that, between 2009 and 2015, newly-founded QD startups could not count on venture capitalists to finance their first operations.

Figure 1b shows the same for corporate investments: apart from the Merck investment of a few millions USD in Qlight Nanotech, we perceive no other CVC investment in second-wave startups. In their search for funding, the new ventures relied on the much smaller funds of incubators and accelerators, local not-for-profit VCs or university funds financed by public institutions.

Third wave (2014 - …): public funding and new type of VC

The increased importance of local programs funded by the government strongly continued its rise in the past few years as we can see in Figure 1c. An essential remark in this regard is the fact that financial details concerning the collaboration with national inter-university funds, accelerators, etc. often remain

undisclosed. Therefore, we expect the light-blue pillars in this figure to be significantly higher as we identified many deals between recent startups and local public funds of which the deal terms remain undisclosed. Despite our data being incomplete, it is clear that non-dilutive sources of funding like government-backed funds and grants play an increasingly important role in the financing of young QD ventures. Overall, taking also grants into account, government funding soars to great heights during this third entrepreneurial wave. Not only recent QD startups, but also older ventures benefit to a great extent from new government funding programs. As an example, both NanoGap and Avantama, respectively funded in 2006 and 2008, received many millions between 2015 and 2019 from the Horizon 2020 program set-up by the European Commission.

As for CVC investments, we see that those corporates that previously entered the ventures during the second financing wave, continue to enlarge their equity stake round after round. After Samsung contributed a significant share to the 2012 F-round of Nanosys, the venture received an additional $ 5 million in funding from the tech giant in 2015. In the same year BASF’s venture capital arm participated in QD Vision’s new funding round, joining existing CVCs DTE Energy and Novus Energy who – with the two of them – had invested 10s of millions over five years. Just like back in 2010, initial VC partners tried to minimize dilution by co-investing with the corporates that entered the QD venture. This explains the relatively high average participation in 2015 as seen in Figure 1a.

As for investments in new companies, we see an interesting trend occurring in recent years. From 2004 on, VC interest in QDs sharply declined which resulted in almost no venture capital investments in new QD ventures till 2014. Since then, we see a gradual growth in VC financing of startups (light-blue columns in figure 1a). However, these venture capitalists can in no way be compared to the high-profile VC firms who invested during the first years of the QD industry incubation period, with billions of assets in mostly life sciences, biotechnology and IT. On the contrary, many of these new investors are so-called micro-VCs who invest limited amounts in seed-stage startups. Additionally, they provide non-financial support (e.g. mentorship) to accelerate growth (Sonne, 2012), much in line with the service offered by accelerators or incubators. These small-scale VC firms have a minimal number of other investments. Investors like Kilauea Investments and KLP Ventures who respectively have a stake in Nano-Lit Technologies and Amastan Technologies, even recorded only one other investment deal. On

top of this micro-financing, we also notice a revival in the interest of larger VC firms with significantly more assets under their management. For example, Nexdot raised $ 5 million in 2016 from CapDecisif Managament and Emertec Gestion, two of the more prominent French investment firms with a combined asset portfolio of $ 350 million, and KB Investment, one of Korea’s leading VC firms with over $ 1.4 billion of assets led the A round of Sherpa Space in 2019. The QD ventures that succeeded in attracting big venture capitalists, are firms with a well-elaborated business plan, a defining characteristic of the third phase in the QD market development as seen in previous section.

Looking at the other side of the story, the fact that the majority of VC financing deals nowadays concern investments in newly established ventures (light-blue columns in figure 1a), indicates that new rounds of investments in older (first-wave) QD ventures are becoming less frequent.

7. EVOLVING INSTITUTIONAL CONTEXT: STEP-BY-STEP APPROACH

Having identified the general trends of the QD industry’s development, we analyze the market movements more in depth in this section. We make an effort to place the strategic actions, taken by the ventures, within the continuous evolving institutional context in which technology entrepreneurs operate. We approach this interaction from two different perspectives. On the one hand, we show how entrepreneurial agency is limited by conflicting prescriptions from different institutional logics and how this institutional complexity impacts their decisions (Dalpiaz et al., 2016; Binder, 2007). On the other hand, we prove the agency that entrepreneurs have in reshaping the organizational field through institutional work (Clarysse & Thiel, 2020; Philips and Jarvis, 2011). Vital events (Pontikes & Barnett, 2017) play an essential role in both relations as they may act as triggers for the behavioral reformation of institutional actors. In what follows, we chronologically link critical events in the QD sector to new institutional settings at that given moment. In turn, we use the shift in dominant logics to explain the evolution in goals, strategy, legitimation and principles that guide the actions of an entrepreneur. As indicators of strategic change, we look at application focus, closed partnerships, patent applications and, more specifically, the variation of these variables over the years. We often reflect to the narrative of Nanosys as the company can be seen as the poster child for many sweeping changes the QD industry has known since its inception in 1998.

7.1.1 Early years: research labs disguised as companies

The sudden emergence of the QD-based ventures around the turn of the century can actually be traced back to a select few of very successful serial entrepreneurs. Having earned a small fortune in the biotech-industry, these consummate Silicon Valley insiders were looking for the “next big thing“ to invest their money in (Rotman, 2000). Being partners of investment funds, both Joel Martin, founder of Quantum Dot Corporation, and Larry Bock, founder of Nanosys, stumbled upon nanotechnology while scanning the market for new opportunities. Steve Empedocles, co-founder of Nanosys and academic with a PhD in Chemistry, explains the origin of the company:

One day, he (Larry Bock) was sitting there and reading Science and he noticed that somehow there were more articles about this thing called nanotechnology than there were about biotech

which he was really surprised about, you know, what is this thing that I never heard of? So, he called me up one day and said “Hey, I am Larry Bock, I think I want to start a nanotech company and I’d like to talk to you about it.” (interview with Steve Empedocles, 14 September 2017)

Similarly, Paul Alivisatos, a well-renowned chemist, got a phone call from Joel Martin who was wandering around Silicon Valley looking for a new investment opportunity. To compensate their lack of (nano-)scientific background Martin and Bock signed leading nanodot researchers, resulting in the foundation of respectively Quantum Dot Corporation (1998) and Nanosys (2001). Whereas Martin’s background made QDC pursue healthcare applications, Nanosys acquired exclusive licenses to IP from all over the world with no focus on a specific application.

It is meaningful to understand the setting in which these pioneering ventures were established. Whereas in normal circumstances, entrepreneurs go to investors in the hope to convince them of their business, in the QD case, it was the investors who went to academics in the hope they could offer them the investment opportunity they were looking for.

This poses questions concerning the technology readiness at that time and whether investors – driven by the desire to participate in this promising tech – understood how early-stage the QD research still was. Stan Williams, director of nanoscience at HP Labs, provides an answer by saying:

“Those investors who excel at popularizing the field are not necessarily those who understand it. Venture capitalists often do not understand its physical limits or what’s physically possible.” (Braunschweig, 2003)

Despite a general reluctance to invest in early stage companies, QDC and Nanosys were able to close funding rounds worth 10s of millions. How? As Martin and Bock both launched several biotech and medical companies in the nineties, they were ideally positioned to find capital for their new QD ventures, because they had already raised millions and millions from prominent biotech and pharmaceutical VC firms. The extensive contacts they had built up over the years, allowed them to convince high-profile investors to finance a technology they did not understood. For example, if we look at the investors of Argonaut Technologies, a biotech company previously founded by Bock and Martin together, we see some of these VC firms like Institutional Venture Partners and Schroder Ventures return as prime investors of QDC. The same holds for Nanosys (e.g. ARCH Venture Partners and CW Group previously invested in Illumina, another biotech startup found by Larry Bock).

The fact that serial entrepreneurs were the drivers behind the creation of the very first QD companies expresses itself in another – more remarkable – phenomenon. More specifically, we can witness investments in ventures, of which the founder is actually a partner of the investing entity. In this, Nanosys serves as a poster boy. Over the first investment rounds, the company received funding from CW Group and Lux Capital, both VC firms in which Larry Bock served as managing/limited partner. If we quickly run ahead in time, we can see that after Bock was replaced as CEO in 2008, both investment firms no longer participated in future rounds. We presume that one of their partners, Larry Bock himself, was the only reason these VC funds invested in the venture.

7.1.2 Herding behavior exhibited by both academics and investors

Incentivized by the interest in QDs portrayed by successful entrepreneurs with a track record of successful startups, many academics active in the field follow their example and establish their own startup in the following years. For instance, Evident Technologies (2000), Zia Laser (2000), Nanoco (2001), Cyrium Technologies (2002), QD Vision (2004) Ocean NanoTech (2004) and many others, are all founded by scientists with PhD’s in Physics, Electrical Engineering or Chemistry. Academic research groups were placed in startups financed by excited Silicon Valley VCs who thought that with nanotech, they could repeat the strategy of the first-wave innovation in semiconductors and the second-wave innovation in biotechnology (Tremaine et al., 2010). Especially after the collapse of the Internet Bubble, investors were hypnotized by nanotechnology and – as the Venture Capital Journal declared – the “buzz was getting louder and louder” (Braunschweig, 2003). Once again, a critical remark to make is that it was the investors who contacted scientific groups with the offer to invest in their research. Stanley Williams, head of Hewlett-Packard’s quantum science research labs, notes:

“I have many cold calls from venture capitalists displaced by the dot-com era and looking for the next big thing. A lot are focusing on nanotech as the next big payday.” (Rotman, 2002)

There are many reasons why especially biotech/healthcare blue-chip firms were ubiquitous in the early years of the QD industry incubation. Not in the least because these funds supervised billions of assets and the relatively small amounts invested in the early QD ventures meant peanuts to them. Additionally, there is the fact that pioneering entrepreneurs like Larry Bock and Joel Martin lured investors – who

funded their previous biotech and healthcare companies – into the nano-field. In turn, other VCs followed their competitors in the hot market, exhibiting herding behavior (Pontikes & al, 2017). In line with Guler (2007), the early QD investors’ limited technological knowledge seems to ratify their decision to follow technology fads. What also drove the investment wave was big pharma’s ticking time bomb: many of the fund’s top drugs were coming off patent by 2008. Therefore, many of the major pharmaceutical companies were looking at nanotech as a potential new source of IP protection (Risinger, Boris, Li, & Calone, 2003). The overwhelming interest in QDC indicated the attractiveness of the QDs for the healthcare industry. Hingge Hsu, Partner of Schroder Ventures, stated publicly in 2000 that more than 100 companies had approached Quantum Dot Corporation in the hope to collaborate.

In sum, the overwhelming prospects that nanotech could revolutionize whole industries, convinced the most prominent VC firms to invest a few million guaranteeing – if the technology indeed managed to deliver up to the expectations – their future piece of the pie. Steve Jurvetson, a renowned VC, illustrates the dominant thinking – characterized by inflated expectations – at the time:

“We believe that nanotech is the next great technology wave, the scientific innovation that revolutionizes most industries and indirectly affects the fabric of society. Historians will look back on the upcoming era with no less portent than the Industrial Revolution.” (Jurvetson, 2004)

7.1.3 New research goals for academic teams

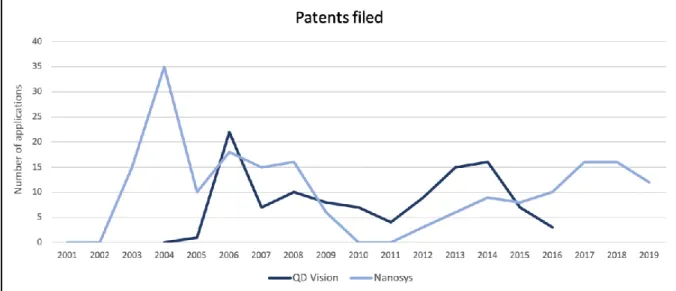

The academics – on their side of the story – continued their research, albeit now in companies acting as research labs funded by high-profile investors. However, the entrance of VCs in this scientific setting inevitably also meant the introduction of new institutional backgrounds into the academic teams. The resulting blend in different field level logics was translated into a more commercial approach towards academic research, finding the balance between the investors’ commercial logic and the science logic exhibited by academics’ decision making. In concrete terms, this meant the research was more focused towards developing an extensive patent portfolio with claims in a wide range of applications (Clarysse & Thiel, 2020). The number and variety of ventures’ patent applications in their first years confirm this. Figure 2 shows the number of patents applied for by Nanosys and QD Vision (we have chosen these two representative ventures because they also exhibit a trend we will discuss later on). The early spikes we can observe for both ventures demonstrate the high-rate development of IP portfolios.

Figure 2: Patent applications

As the technology stood still in its infancy, licensing deals were the most apparent source of near-term value capturing, besides selling small batches of proprietary QDs to other research labs. Showing technological leadership through new partnerships and patents formed the most important basis of legitimation. Additionally, by providing QD material to other labs, ventures were able to attract additional interest from a diverse set of organizations and recruit new talent. Closing partnerships with best-in class universities and companies formed a paramount benchmark for investors to measure progress. The bigger the names, the better, as demonstrated by for example the Nanosys’ development agreement with Intel or IBM’s agreement with Evident Technologies to license their IP (both closed in 2003).

The broadcasting of their technology, together with the mission to develop an extensive patent portfolio, provide the main reasons why many companies – and the investors behind them – wanted to keep all applications on the table and hence had no clear sector focus. Examples within the field of QDs are abundant: UltraDots, Nanoco, Ocean NanoTech, Crystalplex, Nanosys... Dr. Robert Metcalfe, partner of Polaris Venture Partners, one of the main investors in Nanosys, illustrates the lack of focus:

“Nanosys is at a very early stage, with exciting possibilities on many fronts. The team now sorting through early applications of nano-dots, rods, and wires is first rate… This is no time for hardening of the categories.” (Robert Metcalfe, 2002)

Although VCs were responsible for the first steps in valorizing and monetizing quantum dots, technology entrepreneurs could only consult the otherwise broad skillset of venture capitalists to a limited extent. Whereas VCs typically excel in solving product problems and helping technical founders with sales and marketing (Wasserman & Flynn, 2007), their limited scientific knowledge confines their technological contribution. As most of these young QD ventures did not have any products but instead faced challenging technological issues concerning the stability of QDs for example, VCs found themselves in an unusual situation in which their contribution – despite their valuable business expertise – was somewhat limited. We ascertain a deviation from the conventional beliefs that VC ties are not about exploration, as the time frames required for technical innovation are often longer and the discovery process more open-ended (Davis and Eisenhardt, 2011; Pahnke et al., 2015). In this regard, we can quote Ruben Serrato, managing editor of the journal Nanotechnology Law & Business, stating in 2004 that:

“Not only will venture capital alter nanotech, but nanotech will alter venture capital.”

Usually searching for investments which they can monetize within several years (Zider, 1998), VC firms who invested in QD companies faced divergent prospects: it seems as they would have to display more patience, but a unicorn-like payoff would compensate this. Serrato adds:

“VCs now active in nanotech will possess distinct competitive advantage in the future. The patents, standards and research priorities being established today will be the foundation for many of tomorrow’s industries.”

7.2.1 Signs of dampening expectations

One of the conclusions we drew when looking at Figure 1a, was that from 2004, VC investments steadily decreased. Additionally, the average participation of VC firms took a severe drop over the years compared to the early round investments of high-profile investors. Their willingness to make significant contributions to new funding rounds diminished as commercialization prospects were prolonged rather than shortened. Whereas investors previously already had doubts concerning the prematurity of investing in QDs, some vital events confirmed their suspicion that the technology was not yet ready for VC investment. In 2004, this was painfully demonstrated by the lack of interest in the IPO of Nanosys. The resulting withdrawal of the offer meant a first punch in the face for investors’ sentiment concerning

QDs. As Tom Taulli, manager of the Oceanus Value Fund and Forbes-editor specialized in VC, describes:

“It’s not a good sign. If this company couldn’t make it, no one else can.” (Regalado & Hennessey, 2004)

Following the dotcom bubble, the Sarbanes-Oxley Act – with its increased regulations and costs of listing (Graffagnini, 2009) – had turned public offerings into something only reserved for the most promising companies. The fact that even the brightest star in the QD field could not make the leap towards a listing on the NASDAQ closed the IPO window for nanotech companies. The withdrawn listing completely deprived venture capitalists from their exit prospects in the short term and was a sign for VCs to migrate away from nanotech.

In the following years, we see the acquisition of early QD ventures for amounts far below the amount of funding they received over the years. Examples in our study are Quantum Dot Corporation and Zia Laser. With a total of $ 46 million in in equity investments received over the years, the $ 26 million that Invitrogen eventually paid for the patent portfolio of QDC, indicates the disillusionment after years of inflated expectations. This meant that ventures which already received previous rounds of funding, had to attract additional investors for new rounds, to compensate for the lower amounts their existing partners were willing to contribute. This led to an enormous fragmentation of investment rounds. For example, not less than 16 investors took part in Nanosys’ D round in 2005.

7.2.2 Entrepreneurs look for alternative forms of funding

New QD startups had to turn to alternative sources of funding; VC investments in young startups were exceptional. Both NanoGap and Amastan Technologies, respectively founded in 2006 and 2007, waited six or more years to issue their series A financing: they took place respectively in 2012 and 2016. Startups appealed to local funds like the Spanish I2C firm which solely invests in the region Galicia (NanoGap) or micro-VCs like Launch Capital that provided seed-stage financing to Amastan Technologies. The same holds for Crystalplex (founded in 2004): they waited until 2009 to announce their series A round and attracted the local incubator Pittsburgh Life Sciences Greenhouse to financially bridge this five-year gap.

Also play a preeminent role in this regard, are grants and public funding outgoing from the government. Around the turn of the century, governments had launched initiatives like the NNI and European Union Framework for Nanotechnology which brought about a new wave of government funding. To give an idea of the rise in subsidies: in 2001, the US Congress appropriated about $ 460 million to nanotech programs, three years later, in 2004, they budgeted $ 850 million (Paull, Wolfe, Hébert, & Sinkula, 2003). Referring back to Figure 1c, we can observe a significant increase in government funding between 2004 and 2006. For example, Nanosys received not less than eleven SBIR grants in this 2-year period for projects with varying application purposes (from transistors to photovoltaics). These Small Business Innovation & Research grants were very popular among QD ventures because they fitted perfectly with the mission that most of these startups had: publish and patent new discoveries in a wide range of applications. The SBIR program included numerous agencies (e.g. National Science Foundation) and most of them allowed nanotechnology proposals in any area that was broadly related to the agency’s mission (Kalil, 2005). Because of this, QD ventures could continue their research in a wide variety of applications and expand their patent portfolios at the expense of the government. An additional benefit of grants is that public bodies have way less time to monitor investments as compared to VC firms, and consequently, are less demanding that the firm demonstrates results (Crawley, 2007). Therefore, ventures do not have to fear much interference as public institutions are rather passive partners.

In this respect, Pahnke et al. (2015) show that government funding appears to be the most limiting type of financing for long-term innovation success. Ocean NanoTech, a US-based QD venture founded in 2004 and – more importantly – with nothing but public funding, confirms. Alike many other first-wave ventures, the company solicited for the funding of research projects in diverse application fields ranging from army goggles (2005), to QD LEDs (2007) or food pathogens (2008). With no guidance provided by VCs or other investors, the venture turned out to be a smallish commercial research laboratory which makes not even $ 1 million in annual sales.

7.2.3 Investment partners intervene

Because of the flexible character of the SBIR program, some companies even used awarded grants for projects in other domains, to finance research on the main application on which they had started to focus. Indeed, whereas companies before the financial crisis tended to research the potential use of QDs in a various range of fields, the tough financial times forced investors to take action which resulted in a strategic refocus on specific applications. As many years had gone by since their initial investments and researching multiple domains had not brought the companies much closer to a commercial product, investors in the board decided to bring in managers who previously had proven they are capable of bringing advanced technologies to market. Examples within our study are numerous. Both Cyrium Technologies (2005-2009) and QD Vision (2006-2010) introduced three new CEO’s over a time span of four years. Furthermore, Nanosys’ approach serves as a representative example for other QD ventures. With a Venrock partner as chairman in 2008, the board recruited Jason Hartlove, a Silicon Valley engineer who piloted many different technologies out of HP labs into products on the marketplace (Tomczyk, 2014). Hartlove himself explains how he encountered a drifting company struggling to find its identity:

“The company had great science and technology behind it, a strong team of deeply talented people, but no sense of where the commercial markets were or what their needs were. The modus operandi of the company had become to stay alive by pursuing funded research programs, whether or not there was any practical or commercial market or business case for doing so did not matter.” (Tomczyk, 2014)

These problems were rooted in the academic logics which had been guiding the actions of entrepreneurs for years. The licensing and sales of small quantities could not provide a steady revenue and compensate for all the money that went into research projects. By mainly focusing on developing impressive patent portfolios, ventures slowly ran out of funds. Hartloves’ nickname – “the MacGyver of Silicon Valley” – nicely illustrates the reason why these new CEO’s were recruited: bring together knowledge gathered over the years and make a product out of it, one that could be commercialized and generate revenue in the near term. It may come as no surprise that many of these newly introduced managers (e.g. Dan Button who took over the steering wheel of QD Vision in 2008 or Steve Eglash who was recruited as the new CEO of Cyrium Technologies in 2007) had backgrounds in engineering. The managers brought values and beliefs from an engineering point of view into the companies which

lead to a shift in how it profiled itself: from being a science company to an engineering one (Clarysse & Thiel, 2020). Additionally, together with the engineering logics, they added leadership experience in bringing products to market. Hereby recognizing the importance of closing alliances with incumbents in the largest markets. Hartlove illustrates:

“When I joined, I began to work with the product division of major technology companies, to look for how our technology could solve relevant problems that they had today or that they would have in the near future. From this dialogue, I was able to identify a few opportunities which were high-growth, which were real and happening now, and for which we had a compelling value proposition with a material that we could actually manufacture.” (Tomzcyk, 2014)

From this excerpt, we can get much information considering the new mission of QD ventures. The newly installed management identified those applications that already were at a relatively advanced research stage and had the potential to improve existing products with a large established market (e.g. displays). Closing agreements with prominent leaders in those specific “billion-dollar”-markets became the ventures’ most important goal. Therefore, companies paid much attention to convincing the market incumbents of their superior technology (Clarysse & Thiel, 2020). The competition among QD ventures to close partnerships with the most prominent corporates is displayed – pun intended – by the lawsuit between Nanoco and Nanosys in 2008. By means of a patent infringement claim, Nanosys tried to emphasize their reliability and quality as compared to their big competitor in the provision of QDs to display manufacturers, being Nanoco. Nanosys’ CEO reveals the true intention of the lawsuit by making following statement in 2009:

Nanosys is committed to serving visionary manufacturers by creating process-ready components for industries including electronics, energy efficiency, and medical devices. By enforcing ownership of our intellectual property, the manufacturers remain the real winners in having access to proven, trusted advanced material architecture, including quantum dot applications.

(Ganguli, & Jabade, 2012)

The statement also indicates another key realization QD manufacturers had to make: engineering ready-to-use components that manufacturers could build easily into their products (Tomzcyk, 2014).

Once again, this shows the ventures’ new intention to close agreements with market leaders in one specific sector with a massive end market and try to improve their products. In this respect, entrepreneurs identified specifically the display and solar market as sectors with a tremendous market opportunity in the near term. An important note here is that around the end of the decade, the QD potential to make solar panels more efficient received much attention as the solar market started to explode. Technology