A

THEORETICAL

ANALYSIS

OF

BLOCKCHAIN

SOLUTIONS

IN

CORPORATE FINANCE

Aantal woorden / Word count: 16,851Stamnummer / student number : 01510102

Promotor / supervisor: Prof. Dr. Klaas Mulier

Masterproef voorgedragen tot het bekomen van de graad van:

Master’s Dissertation submitted to obtain the degree of:

Master in Business Economics: Corporate Finance

CONFIDENTIALITY AGREEMENT

PERMISSIONI declare that the content of this Master’s Dissertation may be consulted and/or reproduced, provided that the source is referenced.

I

Preface

Prior to writing this master dissertation I had close to no knowledge when it comes to blockchain technology. Hence, the choice of this master’s dissertation initially came from a personal drive to take the time to learn all about blockchain technology and its future impact on our economy. For years I was stuck on unanswered questions; what is blockchain? ; what efficiencies can/will it bring? ; how disruptive is it really? And many more. Therefore, I realized it was the perfect opportunity to take blockchain solutions in corporate finance as my master thesis’ subject and fully master the concept of blockchain and its consequence in my field of study.

As I am writing this preface we are facing a world-wide pandemic: COVID-19. The economy and day-to-day life have taken massive hits. Teleworking is now the standard and people are expected to stay at home as much as possible. As a consequence, the University of Ghent requires all master students to discuss how COVID-19 influences their respective master theses. Luckily for me, next to the interruption of my social life, the only change of course I encountered is the obligation to conduct my interviews with blockchain professionals through online platforms.

Despite this, I would like to dedicate this paragraph to everybody that supported me during the writing of this thesis. First of all, I would like to thank my friends and family for supporting me with love and understanding. Secondly, I want to express my appreciation to the blockchain professionals that took the time to answer my questions. Lastly, I want to thank my supervisors, Klaas Mulier and Frederik Verplancke, for guiding me through this project. Without this support-group my thesis would not have been possible.

II

Table of contents

PREFACE ... I TABLE OF CONTENTS ... II LIST OF ABBREVIATIONS ... IV LIST OF FIGURES ... V 1. INTRODUCTION ... 12. WHAT IS BLOCKCHAIN TECHNOLOGY AND WHAT IS ITS POSITION COMPARED TO BITCOIN AND DISTRIBUTED LEDGER TECHNOLOGY? ... 3

A) DISTRIBUTED LEDGER TECHNOLOGY ... 3

B) BLOCKCHAIN TECHNOLOGY ... 5

C) BITCOIN ... 6

3. HOW DOES BLOCKCHAIN WORK ... 7

A) CONSENSUS MECHANISMS ... 7

Proof of Work: ... 8

Proof of Stake: ... 9

B) PERMISSIONLESS AND PERMISSIONED PLATFORMS, PRIVATE AND PUBLIC BLOCKCHAINS ... 9

Permissionless blockchain ... 10

Permissioned blockchain ... 10

Private blockchain & Public blockchain ... 11

C) TWO CONFLICTS WITHIN BLOCKCHAIN TECHNOLOGY ... 11

4. SMART CONTRACTS ... 12

5. LIMITATIONS BLOCKCHAIN ... 14

A) TECHNICAL LIMITATIONS ... 14

B) NONTECHNICAL LIMITATIONS ... 15

6. BLOCKCHAIN SOLUTIONS IN FINANCE ... 17

A) KNOW-YOUR-CUSTOMER/ ID FRAUD PREVENTION ... 19

B) RISK ASSESSMENT ... 20

C) CROSS-BORDER PAYMENTS ... 21

7. BLOCKCHAIN IN CAPITAL MARKETS ... 25

A) HOW IS BLOCKCHAIN TECHNOLOGY ADDING EFFICIENCY IN CAPITAL MARKETS? ... 26

B) TRADE SETTLEMENT PROCESS ... 27

8. CAPITAL MARKET UTOPIA... 30

A) HOW WILL CAPITAL MARKET PARTICIPANTS BE AFFECTED IN THIS UTOPIA? ... 32

B) WHERE CAN BLOCKCHAIN REDUCE COSTS IN THE CAPITAL MARKET UTOPIA? ... 33

C) WHAT BARRIERS OF ADOPTION WILL THE CAPITAL MARKET PARTICIPANTS ENCOUNTER? ... 34

9. ICOS AS A FUNDRAISING METHOD FOR CORPORATIONS. ... 36

A) ISSUES REGARDING ICOS ... 37

B) SHARES VS CRYPTO-ASSETS ... 37

C) WHO IS INVESTING IN ICOS? ... 39

D) CAN ICOS BECOME A MAINSTREAM METHOD OF FUNDRAISING? ... 40

III

11. IN-DEPTH INTERVIEWS ... 42 12. CONCLUSION ... 45 13. REFERENCES ... VI 14. APPENDIX ...

IV

List of Abbreviations

AML: Anit-Money laundering BTC: Bitcoin cryptocurrency CCP: Central Counter Party CSD: Central Security Depository DLT: distributed ledger technology DVP: Delivery Versus Payment ETH: Ethereum cryptocurrency

GDPR: General Data Protection Regulation HFT: High Frequency Trader

ICO: Initial Coin Offering IEO: Initial Exchange Offering KYC: Know-your-Customer

OECD: Organization for Economic Cooperation and Development PoS: Proof of Stake

PoW: Proof of Work

SEC: U.S. Securities and Exchange Commission XRP: Ripple cryptocurrency

V

List of figures

Figure 1: The difference between centralized ledgers & distributed ledger technology (Belin O., n.d) Figure 2: Different type of ledgers (Edureka, 2019)

Figure 3: From DLT to Bitcoin

Figure 4: From initiating the transaction to completing the transaction (Edureka, 2019)

Figure 5: 100 000 Visa Transactions compared to 1 BTC transaction (Bach, Mihaljevic, & Zagar,

2018).

Figure 6: The four versions of Blockchain (Drescher, 2017).

Figure 7: Stuck in the pioneering stage (Higginson, Nadeau & Rajgopal, 2019). Figure 8: From innovation to benefits (Oliver Wyman & Euroclear , 2016)

Figure 9: Capital Market Utopia through blockchain and smart contracts (Oliver Wyman & Euroclear,

2016)

1

1. Introduction

With the launch of Bitcoin on January 3rd, 2009 a new payment method was set in motion accompanied

by a new technology. The technology supporting Bitcoin, called blockchain technology, has the power to change the financing sector both drastically and permanently. Numerous financial players are trying to create and launch blockchain solutions that potentially will be a game-changer for the industry as a whole.

The number of daily end-users and transactions on the bitcoin blockchain has risen drastically since its release in 2009, ranging from around 250 in 2010 to more than 300.000 in 2019. Furthermore, the conversion with our traditional currencies, for example EUR, USD and JPY, has sparked the interest of the general public and corporations. Additionally, blockchain technology tout court has sparked the interests of institutional investors. For example, venture-capital funding in blockchain related companies has reached $1 billion in 2017 (Higginson, Nadeau & Rajgopal, 2019). This technology has furnished finance related companies with ideas to implement blockchain solutions within their organizations. Many researchers have suggested looking at blockchain as a technology of the magnitude as big as the internet; an information technology with all kinds of applications ranging from any form of asset registry, inventory management, communication, data exchange, etc… However, Swan (2015) suggests blockchain technology is even more: “blockchain is a new organizing paradigm for the discovery, valuation, and transfer of all quanta of anything, and potentially for the coordination of all human activity at a much bigger scale than has been possible before.” (Swan, 2015)

Swan (2015) indicated that there are three different types of blockchain activity areas: Blockchain 1.0, Blockchain 2.0 and Blockchain 3.0. First, Blockchain 1.0 is related to currency, currency transfer, remittances, international payments and the deployment of cryptocurrencies in peer-to-peer payment systems. Second, Blockchain 2.0 is related to all economic, capital market, banking and financial applications beyond simple cash transactions. Stocks, bonds, futures, swaps, options, mortgages, smart contracts and property all are classified under Blockchain 2.0. Last, Blockchain 3.0 applications are applications beyond currency, capital markets and finance. Blockchain applications providing solutions for governments, healthcare, culture, art and science can be categorized under Blockchain 3.0. In this dissertation I’ll mainly focus on Blockchain 2.0 solutions. Some Blockchain 1.0 solutions will also be discussed to add perspective and to make the blockchain solutions in finance more comprehensible.

First, the reader will be oriented in the world of blockchain by positioning it to both Bitcoin and Distributed Ledger Technology. These three are often confused and for people that are unfamiliar with the subject these are all considered equal. In short, Distributed Ledger Technology (DLT) is a covering term for a databasing technique, blockchain technology is a subgroup of DLT and Bitcoin is an interpretation of blockchain technology. Second, the reader will be oriented into how blockchain technology operates and the different types of blockchain. This is done to assure that readers with close to no knowledge about blockchain technology are able to understand the concepts behind this thesis.

2 Blockchain technology cannot be reduced to technology behind the Bitcoin network. Essentially, blockchain technology is a data structuring technique that cryptographically records, stores and shares information, such as financial transactions, in a decentralized network. However, providing a universal definition is difficult as blockchain technology definitions differ greatly. Next, smart contracts are discussed. This is software that is coded on the blockchain that defines and executes contracts automatically.

However, to date blockchain solutions have technical and non-technical limitations that have prevented blockchain to become the next big thing. Hence, an overview of the technical and non-technical limitations will be provided. Nonetheless, blockchain professionals agree that these technical limitations are only of a temporary nature.

Subsequently, an analysis of the key blockchain solutions in corporate finance are discussed. There are many interesting possibilities with blockchain technology. Hence, the discussed solutions have topics such as risk assessment, cross-border payments, know-your-customer solutions, capital market solutions and fundraising.Major financial players are trying to implement blockchain technology within their respective sectors to create efficiencies. Banking services could be affected massively by this technology and annual costs might be reduced with $15-20 billion by 2022 (Belinky, Rennick, & Veitch, 2015). Additionally, capital market players are experimenting with blockchain technology to create added-value and efficiency by reducing the amount of intermediaries, minimizing data reconciliation and preventing data manipulation. Lastly, blockchain solutions have the potential to revolutionize corporate fundraising through Initial Coin Offerings by allowing cheap public fundraising with close to no intermediaries.

To summarize, blockchain technology has been a hot-topic in the financial sector for years. Almost every large financial player is looking to create efficiencies and get ahead by implementing blockchain solutions in their business. However, to date there has not been any ground breaking application that is up and running. This dissertation tries to provide key insights about blockchain technology in corporate finance to readers with close to no knowledge about blockchain. These insights will help the reader understand the scope of this technology’s potential to become a game-changer.

3

2. What is blockchain technology and what is its position

compared to Bitcoin and Distributed Ledger Technology?

Most people associate blockchain technology with its most well-known interpretation: Bitcoin. However, Bitcoin is only one of the blockchain applications that exist today. Blockchain technology cannot be reduced to the technology that supports crypto-currencies such as Bitcoin. Essentially, blockchain technology is a data structuring technique that cryptographically records, stores and shares information, such as financial transactions, in a decentralized network. The first important thing to understand is the difference between blockchain technology and distributed ledger technology. Some confusion is caused by the fact that blockchain technology is a kind of distributed ledger technology. Distributed ledger technology (DLT) is a covering term for technologies such as blockchain technology. Below DLT is discussed briefly after which it will be positioned to blockchain technology. Next blockchain technology will be positioned to Bitcoin to clear confusion between all these terms.a) Distributed ledger technology

A distributed ledger is a consensus of replicated, shared and synchronized digital data, geographically spread across multiple sites, countries or institutions (Walport, 2016). This concept existed way before blockchain technology. Lamport & Fischer (1982) theorized ‘The Byzantine Generals Problem’. They refer to a situation where parties get conflicting information in a hostile environment. Distributed ledger technology is a catch-all term for multi-party systems that have no central operator or authority, despite parties who may be unreliable or malicious (Raughs, Glidden, Gordon,…& Zhang, 2018). In these systems all individual nodes of the network can witness all the transactions and have access to the recordings shared across the network and can possess their identical copy of it. A couple of benefits of this type of technology are listed below.

First, the fact that the ledger is distributed across the whole network, and all nodes have access to the recordings of transactions, eliminates the need of a central authority that checks and controls for manipulation. All the singular nodes are expected to look at the transactions and check for fraud or manipulation.

Second, centralized ledgers are known to be targeted by cyber-attacks. In the case of DLT, attackers will have a hard time to manipulate the data. This is because they will have to succeed in attacking all copies of the distributed ledger simultaneously in order to successfully manipulate the ledger (Raughs, Glidden, Gordon,…& Zhang, 2018). For example, if they succeed in attacking one of the ledgers all other ledgers will still have the untampered, correct information. The attacked ledgers are destroyed by the nodes and the original data within the ledger will still be intact.

4 Last, DLT systems are not necessarily immutable and in fact can be reversed depending on the system’s design. This means that a transaction may be reversed after it’s confirmation and execution (Raughs, Glidden, Gordon,…& Zhang, 2018). Nevertheless, it is important to note this is different for transactions on a blockchain, immutability is one of the key characteristics of blockchain technology.

Some people argue banking is the business of storing information about money and storing money itself. This implies that distributed ledger technology is the anti-thesis of banking because banking’s very existence depends on a centralized authority (Dumlao, 2018).

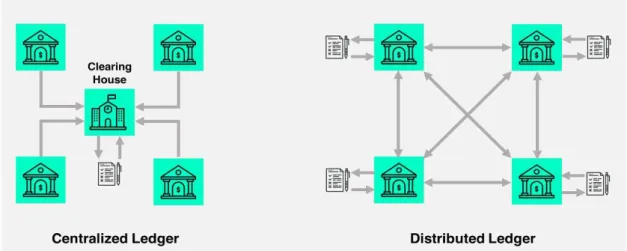

Figure 1 and Figure 2 visualize the difference between a centralized ledger, decentralized ledger and a distributed ledger. The main difference between a decentralized and a distributed ledger is that in the first a couple of users store the ledger and in the latter every node stores the ledger.

Figure 1: The difference between centralized ledgers & distributed ledger technology (Belin O. , n.d)

5

b) Blockchain technology

Blockchain technology is a specific distributed ledger technology invented by Satoshi Nakamoto. It is commonly believed that Satashi Nakamoto is a pseudonymous for the person or persons writing the white paper of bitcoin: ”Bitcoin: A Peer-to-Peer Electronic Cash System” on 31st October 2008. However, the concept of a blockchain can be traced back to Haber & Stornetta (1991) and Bayer, Haber & Stornetta (1992). When referring to a blockchain people are referring to the chain that is formed by connecting all blocks that contain data. On the other hand, blockchain technology signifies all applications, programmes, technologies and services that are operating through a blockchain.

Initially, blockchain technology was the decentralized managing technique of Bitcoin, designed for issuing and transferring money for the users of the bitcoin currency (Yli-Huumo, Ko & Choi, 2016). Blockchain technology supports the public ledger of all transactions that have ever been made in bitcoin and all this without any control of a trusted third party. Thanks to the immutable characteristic of the technology, executed transactions that are accepted by all nodes (network participants) cannot be modified or deleted. However, blockchain technology is also applied to other types of uses. It can for example create an environment for digital contracts and peer-to-peer data sharing in a cloud service (Swan, 2015). The strong point of blockchain technique, data integrity, is the reason why its use extends also to other services and applications (Yli-Huumo, Ko & Choi, 2016). Blockchain technology’s characteristics and how it functions will be further discussed in the next chapters.

6

c) Bitcoin

Lastly, bitcoin is based on a specific type of distributed ledger technology: blockchain technology. Bitcoin is the first working application of blockchain technology and was also invented by Satoshi Nakamoto. The writer(s) believed in a peer-to-peer network to facilitate the online transaction from one party to another with no need of any intermediaries. ‘What is needed is an electronic payment system based on

cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party. Transactions that are computationally impractical to reverse would protect sellers from fraud, and routine escrow mechanisms could easily be implemented to protect buyers.’ (Nakamoto, 2008) Figure 3 visualizes the relation between DLT, Blockchain and Bitcoin.

7

3. How does blockchain work

In the previous chapter I explained what blockchain technology is and how it is associated with both DLT and Bitcoin. In this chapter I will go deeper into the functionality of blockchain and it’s different types. Judmayer, Stifter, Schindler and Weippl (2018) wrote a clear story about a pre-hestoric village called Nakamotopia. The pre-historic village’s name refers to the inventor of blockchain and bitcoin, Satoshi Nakamoto. This story is added in the Appendix as it clearly explains the basic blockchain technology concepts. I suggest readers with little to no blockchain expertise take the time to read the metaphorical story as it will help them better understand the next chapters. In this chapter I will start with discussing consensus mechanisms followed by the different types of blockchains.

a) Consensus Mechanisms

First, I will discuss what consensus mechanisms are and which types exist. Consensus mechanisms allow secure updating of a distributed shared state (Baliga, 2017). In other words, this means these are mechanisms that assure nodes are synchronized and agree upon a consistent state of the blockchain. This is crucial since these consensus mechanisms ensure that every user consults the same blockchain and conflicts are minimized. Attaining consensus within the network is not trouble-free. The consensus mechanisms must be resilient to malicious nodes, message delays, partitioning of the network, corrupted messages and messages reaching out-of-order (Baliga, 2017). Dr Arati Baliga defined three characteristics to test the applicability and efficacy of the consensus protocols: Safety, Liveness and Fault Tolerance. Baliga (2017) defined these as follows:

1) Safety: A consensus protocol is determined to be safe if all nodes produce the same output and the outputs produced by the nodes are valid according to the rules of the protocol. This is also referred to as consistency of the shared state.

2) Liveness: A consensus protocol guarantees liveness if all non-faulty nodes participating in a consensus eventually produce a value.

3) Fault Tolerance: A consensus protocol provides fault tolerance if it can recover from failure of a node participating in consensus.

Two most used consensus mechanisms I will discuss are Proof of Work (PoW) and Proof of Stake (PoS). Next to Proof of Work and Proof of Stake there are many other consensus mechanisms. The most viable ones next to PoW and PoS are the Ripple Protocol Consensus Algorithm (RPCA), Stellar Consensus Protocol, Delegated Proof of Stake, Proof of Importance, Practical Byzantine Fault Tolerance (PBFT), Proof of elapsed time ,Proof of Luck and Proof of eXercise. Most of these are discussed and explained by Bach, Muhaljevic & Zagar (2018). However, these will not be discussed in this master’s dissertation since it is not relevant to my research but are mentioned to show there are

8 many different types of consensus mechanisms. Figure 4 shows when and where the consensus mechanism is initiated in the transaction process.

Figure 4: From initiating the transaction to completing the transaction (Edureka, 2019)

Proof of Work:

The Proof of Work (PoW) consensus mechanism will be explained based on the Bitcoin Proof of Work consensus mechanism. It is important to realize that other types of Proof of Work exist, for example, Ethereum’s Proof of Work consensus mechanism but these only differ slightly. The Bitcoin PoW is the most known consensus protocol but far from the best. The main concept behind Proof of Work is that nodes must find a hash value. Hash values are used in computer science to map arbitrary large data to bit strings of a fixed length (Baier & Breitinger, 2011). These hash values are large numbers that ensure data integrity. In Bitcoin, nodes must find values lower than a certain number set by the Bitcoin protocol. The process of finding the correct hash value, adding a new block to the blockchain and claiming the reward is referred to as mining (Baliga, 2017). The reward for mining a block is currently 12,5 bitcoin and will be reduced to 6,25 in May 2020. The reason why the system is designed to halve the mining reward every 210.000 blocks is not explicitly explained by Satoshi Nakamoto. However, one theory is that the system was designed to distribute more coins at the beginning of the network to incentivize people to join the network. Nonetheless, 12,5 bitcoin has a lot of value. Based on the current conversion rates, the mining reward is approximately worth € 91 250 (calculated on 29/04/2020).

Due to the distributed nature of blockchain networks, sometimes multiple miners are able to find a winning hash value at the same time. Every winning miner will add their winning block to the blockchain and shares this of the peer-to-peer network. Now there is a temporary ‘fork’ in the blockchain network. This means there are multiple ‘correct’ blockchains where some miners are adding blocks to one branch, and others are adding blocks to another branch of the blockchain, based on which winning miner is positioned closest to them in the network. However, as time flows and blocks are added to these forks, the Bitcoin protocol will ensure that the branch with the longest chain will get included and other chains

9 will be deleted. Eventually this generates consistency among all network participants regarding the state of the blockchain (Baliga, 2017).

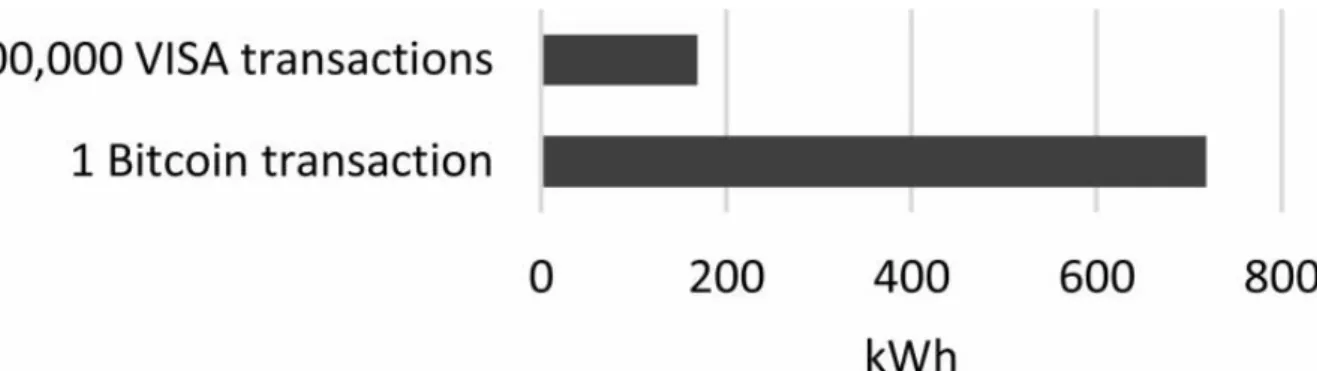

The major drawback of this mechanism is that it is compute-intensive and energy demanding. Miners invest in expensive hardware and delocalize to countries with lower electricity cost in order to stay competitive. The estimates of the total energy consumption regarding bitcoin mining vary considerably, ranging from the electricity generated by a small power plant up to the consumption of small to medium-sized countries such as Denmark, Ireland or Bangladesh (Vranken, 2017). As further comparison, the Bitcoin network consumes as much energy as one US household does in a year, every four seconds on average (Bach, Mihaljevic, & Zagar, 2018). Additionally, Figure 5 shows a comparison in energy consumption between 100 000 visa transactions and 1 bitcoin transaction (Bach, Mihaljevic, & Zagar, 2018).

Figure 5: 100 000 Visa Transactions compared to 1 BTC transaction (Bach, Mihaljevic, & Zagar, 2018).

Proof of Stake:

Since the drawbacks of PoW are major, researchers and developers have tried to find alternative consensus mechanisms to reduce the energy consumption of the consensus mechanism. Proof of Stake is the eco-friendlier version of PoW. Instead of spending $2000 buying mining equipment to engage in the PoW mechanisms, miners buy $2000 worth of cryptocurrency and stake it to buy proportionate block creation chances to earn a mining reward. This mechanism is a randomized process used to choose the next block producer. The more currency a miner stakes the higher the probability he can validate the next block and receive the reward (Baliga, 2017).

This has a couple of consequences. First, in Proof of Work miners tend to directly trade their coins for real world money which pushes the value downward. This in contrary with Proof of Stake where miners are incentivized to hoard the coins, which is also not optimal since coins are created to spend. Second, the Proof of Stake consensus mechanism is much more energy efficient. The well-established Ethereum blockchain is working on launching a Proof of Stake implementation called Casper.

b) Permissionless and Permissioned platforms, Private and Public Blockchains

In this section the different types of blockchain are discussed based on their characteristics. Blockchain developers will have to decide on whom is allowed to make transactions and whom is participating in

10 the consensus mechanism. Permissioned or permissionless platforms refer to the ability to write blocks and participate in the consensus mechanism. Private and public blockchains refer to readability and ability to make transactions on the blockchain.

Permissionless blockchain

The number of network participants is vast within permissionless blockchains. These participants, also referred to as nodes, are all untrusted since anyone can join and participate in the consensus mechanism (Baliga, 2017). Since many untrusted nodes participate in the network, the consensus mechanisms for such blockchains should account for maliciousness. One of the major problems a consensus mechanism should account for in such environments are Sybil attacks (Baliga, 2017). Sybil attacks occur on blockchains when a single person can create multiple identities and influence the consensus process. Additionally, these attacks may occur when multiple people work together and create multiple identities. Within the proof of work consensus mechanism nodes must prove they have spent lots of computational power towards solving the cryptographic puzzle (Baliga, 2017). If Bitcoin’s mining process wouldn’t be as energy consuming, Sybil attacks could influence the blockchain state. Bitcoin and Ethereum are the most known and widely-used permissionless blockchains.

Permissioned blockchain

The number of network participants within permissioned blockchains is limited. These nodes are semi trusted, known, verified, and pre-selected (Baliga, 2017). These types of blockchains are used within private, one-single entity or organization but also within a consortium of big banks. In the first case the organization makes use of blockchain technology to conduct their database management, auditing or financing. Therefore, public writing access might not be feasible (Baliga, 2017). In the second case the banks form a consortium and use the same blockchain for some applications. Here it can be the case that 15 out of 20 banks have to agree on the newly written block for it to be added to the blockchain. Public writing access might also not be feasible in this context (Baliga, 2017). Usually these networks are smaller and therefore operate with other consensus mechanisms. Ripple is an example of a permissioned blockchain, they determine the roles of the nodes participating in the validation process of their transaction network. Other examples are Eris and Hyperledger.

Singh (2019) described the main benefits and drawbacks of permissioned blockchains. The main benefit is the efficient performance in permissioned blockchains thanks to the limited number of nodes. Second, permissioned blockchains have a better governance structure compared to permissionless blockchains. This means they are organized, and nodes work together. Lastly, permissioned blockchains are more cost effective compared to permissionless blockchains. However, the security of the network depends on the integrity of the nodes. Nodes can work together and maliciously modify the data within the blockchain (Singh, 2019).

11

Private blockchain & Public blockchain

Private blockchains grant access to read the blockchain only to a certain preselected group of users. These preselected nodes are also able to make transactions. On the other hand public blockchains exist. These are open to all users or nodes to read and create transactions. Depending on what the blockchain solution is developed for the developers will decide whether the blockchain should be public or private.

c) Two conflicts within blockchain technology

Blockchain faces 2 major conflicting goals. First, there is the trade-off between transparency of the blockchain and the privacy of network participants. Second, there is a consideration to be made between the security of the network and the speed at which it operates (Drescher, 2017).

The concept of an open public blockchain allows everyone to consult the ledger and see which transactions have been made and which parties are involved. However, this concept is stringent to the privacy of the users of the blockchain. Hence the conflict between the transparency needed to prevent-double spending and privacy of users (Drescher, 2017).

Secondly, blockchains are characterized by data protection and integrity. Transactions that were conducted in the past ,and therefore already added to the blockchain, are protected of manipulation and alterations. This security measures comes at a cost : lower transaction speed. This is a problem for many applications where speed and scalability are necessary (Drescher, 2017).

These conflicts can be traced back to the roots of blockchain technology : reading and writing blocks to the blockchain. The conflict between transparency and privacy can be traced back to the reading of transaction data (Drescher, 2017). Furthermore, the conflict between security and speed can be traced back to the writing and the adding of blocks to the chain. When considering to go for transparency or privacy, blockchain creators actually consider to choose a public blockchain or a private blockchain. When deciding whether a faster blockchain is more feasible or extra security is required, developers are trying to decide between a permissionless blockchain or a permissioned blockchain. This creates 4 versions of blockchain which are shown in figure 6.

12

4. Smart contracts

Multiple researchers have attempted to define the concept of a smart contract. A smart contract is a concept that was first proposed by Nick Szabo in 1996. According to Szabo (1996) the basic idea of a smart contract goes as follows : ‘many kinds of contractual clauses (such as liens, bonding, delineation

of property rights, etc.) can be embedded in the hardware and software we deal with, in such a way as to make breach of contract expensive (if desired, sometimes prohibitively so) for the breacher.’ (Szabo,

1996). However, this is a very broad idea and more recent researchers have attempted to define smart contracts more adequately. Ethereum’s founder Vtalik Buterin defined smart contracts as systems which automatically move digital assets according to arbitrary pre-specified rules. Next, Jaccard (2017) defined smart contracts as : ‘A smart contract is a software, which computer code binds two, or a multitude, of

parties in view of the execution of predefined effects, and that is stored on a distributed ledger’ (Jaccard,

2017).

Smart contracts are particularly interesting since it allows to encode the rules of a contract in computer code, which is executed and replicated over nodes in the blockchain. This type of contract can be self-enforcing, but also triggered by external inputs from trusted sources such as a financial exchange to set the contract in motion (Caytas, 2016). For example a smart contract could be depending on a certain condition such as time. For instance, a smart contract could be set in motion, automatically, at a certain time in the future, if a certain plane has landed, when the temperature in a certain city rises over a certain amount. Basically everything can be computationally coded. Furthermore, smart contracts can be coded to re-occur and have internal state, meaning that much more is possible. Additionally, they stay permanently on the blockchain unless they are coded to self-destroy after execution (Peters & Panayi, 2016).

Some researchers argue that the term ‘smart contract’ is not correct since these are neither smart nor contracts. They are not smart since they are not capable of translating complex legal agreements into software. Furthermore, they are not contracts since they have no underlying legal or contractual provision (European Comission, 2019). However, most researchers disagree with the statement mentioned above and believe the term smart contract is feasible. Firstly, they are ‘smarter’ than regular contracts since they are automatically enforced by computer code, the probability of a future dispute is reduced, they are less prone to human errors and they require less intermediaries. Secondly, they can be considered contracts since they alter the rights and obligations of the involved parties.

What makes this type of contract special? What makes it disruptive? The characteristic that they allow high customisability to transactions is what makes them appealing to many researchers. Furthermore, they are completely digitally encoded within a blockchain which is not the case with traditional contracts. Essentially, they reflect real-world contractual agreements in cyber-code (Macrinici, Cartofeanu, & Gao, 2018). Instead of a thrusted legal entity/organisation the contract is enforced by computer code which enables two or more parties to transact without the need for intermediaries.

13 An interesting use of smart contracts is to set up a Decentralized Autonomous Organization (DAO). A DAO can be seen as an organization that is run through rules encoded as smart contracts on a blockchain (Chohan, 2017). Essentially, these virtual organizations run by smart contracts on a blockchain network mitigate moral hazard problems that might occur in traditional organizational environments. Moral hazard occurs when an agent/entrepreneur does not behave or perform as agreed upon in the contract. Additionally, DAOs completely minimize the need of human input through smart contracts and reduce friction between stakeholders (Kaal, 2019). However, this type of organization has encountered security problems in the past and some of the DOAs have been hacked. The most well-known failure was Ethereum’s ‘The DAO’. ‘The DAO‘ was programmed through smart-contracts to be a crowd-funding platform which had raised $150 million prior to the attack. ‘The DAO’ was attacked on June 18th, 2016 and $50 million worth of crowdfunded Ethereum was stolen (Atzei, Bartoletti, & Cimoli,

14

5. Limitations blockchain

Since blockchain technology is quite new it still faces some obstacles. In this chapter I try to provide an overview of the limitations blockchain will have to overcome to attain it’s true potential. First the technical limitations blockchain technology faces are listed. Next, the non-technical limitations will be discussed.

a) Technical Limitations

Multiple researchers have discussed technical limitations of blockchain technology (Drescher, 2017 ; Ibba, Pinna, Baralla, & Marchesi, 2018). The main technical limitations are enumerated below.

1. Lack of privacy 2. Lack of flexibility 3. Limited scalability 4. High costs

5. The security model 6. Integrity of nodes

The first blockchain limitation I would like to discuss is the potential lack of privacy within a blockchain network. Since a blockchain is a peer-to-peer distributed ledger, every participant in the network has access to a complete version of the transaction data. They can freely consult the ledger and see which transactions were made, the amount transferred, the involved accounts and the time of transaction. The level of transparency is necessary to prevent double-spending attacks and other security measures. This is often regarded to as a limiting factor for applications that might need a certain level of privacy (Drescher, 2017).

Secondly, I would like to point out the lack of flexibility within a blockchain environment. Since blockchain are characterized by immutability this prevents the network from altering certain past transactions. Furthermore, a blockchain is constructed based on protocols and mathematical rules that are fine-tuned to each other to work as an eco-system. Upgrading or changing major components of a running blockchain is something that is not easy to execute. This implies that the protocols, algorithms, crypto-graphic procedures have to be valid for the full lifetime of the blockchain (Drescher, 2017).

Next, at the moment blockchains are characterized by a limited scalability. Due to consensus mechanisms such as PoW, the distributed nature of the blockchain and other security measures it can sometimes take a long time before the new blocks are processed. This problem is especially found in public blockchains which allows an unlimited amount of network participants. For applications which require high processing speed, high scalability and high throughput this can be a major problem (Drescher, 2017).

15 Additionally, some blockchain technologies such as Bitcoin are marked by high costs. This problem is also related to the limited scalability. For some security measures, such as the consensus mechanisms, high computation power and energy consumption is needed to support the blockchain network. Often, these costs can be measured in different scales such as computation cycles, physical time, energy consumption or money (Drescher, 2017).

Further, the security model of the blockchain is based on two cryptographic keys per account. There is a private key and a public key. The private key serves as a key to access the account of the owner. The public key serves as an address where transactions are sent to or from. If a user happens to lose the private key to an account they lose access to that account. Furthermore, if someone happens to steal/find the private key the security is breached. There are no additional security models that protect the contents of the account which is often regarded to as a limitation. However, this security measure is very solid and only causes problems if users accidently lose or leak the key (Drescher, 2017).

Lastly, blockchain relies on the integrity of the nodes. Only when the majority of the nodes are honest and don’t have malicious intentions, the ledger and the transaction data is trustworthy. If a malicious node controls 51% of the power to influence the consensus mechanism and is able to add corrupted blocks to the chain of blocks there is a major problem. This is particularly relevant for cryptocurrencies with a low market capitalization that are run on blockchain. However, there are many consensus mechanisms that prevent this type of attack. Theoretically this type of attack is possible on a blockchain that is run by PoW such as Bitcoin (Drescher, 2017).

b) Nontechnical Limitations

Researchers such as Drescher, Guo and Liang C argue that true decentralization and disintermediation is not achievable. For certain applications, such as bitcoin, true decentralization and disintermediation is perfectly achievable in theory. In reality, even the bitcoin blockchain is prone to some kind of centralization since the consensus protocol is mostly run by a couple of professional miners. However, for many finance related applications, it might be feasible to have some kind of centralization to safeguard the network. Furthermore, achieving true disintermediation is technically very difficult, especially in a scalable manner. Hence researchers suggest more centralized consortium blockchains and private blockchains might be more interesting to support finance-related application (Guo & Liang, 2016).

Further non-technical limitations lie in the lack of regulatory support and the lack of public acceptance. These two go together in a certain way. Users are not eager to use blockchain applications because they doubt the legal consequences of transactions made on blockchains. Questions arise regarding safety, security and legal implications. As mentioned before, people see similarities between blockchain technology nowadays and internet commerce in the 1990s. The same applied to internet in the 90’s, there was a lack of legal acceptance (Drescher, 2017). According to Guo and Liang, the regulations in

16 the USA are limited to ensure sufficient freedom for innovation. Furthermore, they suggest that the decentralized and self-governance nature of blockchains debases the need for regulation. However, a technology with potentially disruptive consequences bears a lot of risk, hence it needs regulation.

17

6. Blockchain solutions in Finance

Currently, the banking system is characterized by rigidness and latency in transactions. This is partly due to the use of centralized databases which hold all sensitive information and require several days of processing for international or inter-bank transactions. This causes an economic slowdown as this might cause liquidity problems for some companies (Jaoude & Saade, 2019).

Most financial transactions could be reinvented on the blockchain, including stock, private equity, crowdfunding instruments, bonds, mutual funds, annuities, pensions, and all manner of derivatives (futures, options, swaps, forwards, etc.). However, it is important to consider to only add financial processes, or part of processes, that would gain efficiency from implementing blockchain technology. The in-depth interviews allowed me to realize that many developers try to add way too much processes on blockchain. Although, this is often not efficient and adds complexity to developing the blockchain solutions.

As mentioned in the introduction, blockchain technologies have sparked interests in the Venture Capital industry raising $1 billion of funding in 2017. Furthermore, investment banks are eager to add blockchain applications to allow instantaneous execution, post-trade services, and settlement. This could significantly reduce the amount of middle-and back-office processes (Higginson, Nadeau & Rajgopal, 2019). According to Santander’s Fintech 2.0 paper distributed ledger technology such as blockchains could reduce banking costs with $15-20 billion per year by 2022 (Belinky, Rennick, & Veitch, 2015). These cost reductions are found in cross-border payments, securities trading and regulatory compliances (Belinky, Rennick, & Veitch, 2015).

Furthermore, since 2015 numerous major international financial institutions such as UBS, J.P. Morgan, Goldman Sachs have invested in R&D in the blockchain industry. The latter of these giants even has a patent on clearing and settlement of securities based on blockchains. Furthermore, stock exchanges have also shown wide interest in blockchain applications to support their platforms (Guo & Liang, 2016). In 2015 Nasdaq launched a platform called Linq, allowing securities to be transacted through blockchain technology.

Additionally, multiple financial institutions have joined forces in banking consortia to research and promote blockchain technology. The most known blockchain banking consortium is R3. R3 was founded in 2015 by leading banks such as Barclays, J.P. Morgan, UBS, etc… Nowadays R3 is an enterprise software firm that offers the largest blockchain ecosystem in the world bringing together more than 300 organizations across multiple sectors. They developed the open-source blockchain platform Corda that allows individuals to develop their own blockchain applications and Corda Enterprise, the commercial version of Corda for enterprise usage.

Nonetheless, caution is still needed since none of the financial industry’s initiatives have been tested on a larger scale. This has raised questions about the scalability of blockchain technology and the tough regulatory barriers in banking. These concerns have been exacerbated by short-term expenses, cultural

18 resistance since blockchains may threaten jobs and concerns regarding revenue streams (Higginson, Nadeau & Rajgopal, 2019).

Furthermore, Higginson, Nadeau and Rajgopal (2019) allege that most blockchain related projects get stuck in the first cycle in the product lifecycle journey. They believe that, in late 2018, blockchain’s practical value lies mainly in 3 areas ; niche applications, modernization value and reputational value (Higginson, Nadeau & Rajgopal, 2019).

In the last area, reputational value, companies are conducting research and developing applications supported by blockchain technology with the sole purpose to impress competitors and shareholders. By doing this they want to show they are innovative and competitive (Higginson, Nadeau & Rajgopal, 2019). Higginson, Nadeau and Rajgopal (2019) argue blockchains focused on customer loyalty, IoT networking and voting falls under this category.

In the niche applications area companies are developing applications and technologies enabled by blockchains for very specific and well-suited situations. Under this category they put data integration for tracking asset ownership and asset status. They understand that these applications are found in insurances, supply chains and capital markets. In these fields blockchains can tackle inefficiency, process opacity and fraud (Higginson, Nadeau & Rajgopal, 2019).

Lastly, companies that create blockchain solutions in the category of modernization value are focused on modernizing the industry they are active in. They want to add digitization, process simplification and collaboration to their industries. In this area they categorize global shipping contracts, trade finance and payments applications. However, blockchain is often only small part of the innovation (Higginson, Nadeau & Rajgopal, 2019).

Figure 7 shows a graph that most blockchain applications get stuck in the pioneering stage and are not getting tested on a large scale level.

19

Figure 7: Stuck in the pioneering stage (Higginson, Nadeau & Rajgopal, 2019).

Higginson, Hilal & Yugac (2019) stated that currently there are three major cases where blockchain’s strengths; data handling, disintermediation and trust are adding value. These points of discussion are provided below and are Know-Your-Customer/ID fraud, cross-border payments and risk assessment. Further, blockchain in capital markets, a blockchain trade settlement process and funding through Initial Coin Offerings will be discussed.

a) Know-your-customer/ ID fraud prevention

According to Higginson, Hilal and Yugac banks lose $15-20 billion every year due to identity fraud. Since customer privacy and data is highly protected by regulations such as the EU’s General Data Protection Regulation (GDPR) banks and financial institutions are investing a lot to ensure they are in compliance with all these regulations. They have invested in automation, fraud prevention, anti-money laundering (AML), standardization, real-time information sharing and predictive models. Through these investments they have increased efficiency but latency and manual efforts are higher (Higginson, Hilal & Yugac, 2019).

Such as in many other areas blockchain technology might provide interesting benefits in KYC and ID fraud prevention. According to Higginson, Hilal and Yugac (2019) banks can use a digital fingerprint as a unique identifier in account opening and client onboarding. This identifier is stored on a DLT such as

20 a blockchain and is referenced by any bank in the network. The decentralized nature of blockchain allows banks to share authenticating information and thus remove overlapping KYC and AML compliance checks. This lightens the information burden and incentivizes banks to disseminate their data as it is uploaded.

Higginson, Hilal and Yugac (2019) expect blockchain solutions to cut costs by $1 billion in customer onboarding, $2 to $3 billion in regulatory fines and $7 to $9 billion in losses from identity theft. There has been many research in regards of ID fraud detection. For example Norbloc, a Swedish start-up offers KYC compliance products based on blockchain technology. They have worked together with Belgium-based Isabel group, Belgium’s largest fintech company. Together they built a platform to simplify identity management. Furthermore, Mastercard has patented a system that uses a private blockchain to protect and verify identity data (PYMNTS, 2018). Additionally, Cambridge Blockchain has created a protocol that enables financial institutions to meet the new data privacy rules and identity compliance check. Last, many other companies such as Metadium, Thekey and Trusti are working on identity/KYC compliance checks through blockchain technology (Higginson, Hilal & Yugac, 2019).

Additionally, individuals will be more in charge of their own data through these kinds of blockchain mechanism. They are the owner of their own private identity and decide whether or not to share it without any intermediary help. This is often referred to as self-sovereignty of personal data (Higginson, Hilal & Yugac, 2019).

Nonetheless, there are some challenges regarding blockchain-based KYC and AML solutions. The initial capital investments to implement the blockchain applications are very high. Next, there has to be a major change in how banks conduct their business and how they make profit. Furthermore, if these banks work together and share customer data, which bank is responsible for errors or frauds? Additionally, there are a lot of practical problems such as the fact that customers have to agree to upload finger prints. Merchants will be obliged to update their identifying systems and adjust processes. Banks have to be in a large banking network before acquiring economies of scale (Higginson, Hilal & Yugac, 2019). One of the main problems is the so-called Occam problem (Higginson, Hilal & Yugac, 2019). Why would a bank take a lead and invest in technology systems that offer no competitive advantage at this point in time?

b) Risk Assessment

It is known to researchers that banks tend to be conservative when making credit decisions. This is because financial institutions have to make their assessments based on limited data from different sources. Sometimes the data doesn’t even exist for the non-banked (those that are not accessing banks or online banking), under-banked or micro-SME’s. Blockchain could potentially offer a solution by pooling large amounts of data. This pooling is anonymized and protected by the blockchain’s protocols. Banks could view this data, on the blockchain, that has been uploaded by any bank in the network. This

21 could be accessed without explicit consent at the time of consultation since customers can consent through pre-programed smart contracts (Higginson, Hilal & Yugac, 2019).

As a result financial institutions should allow faster decision-making, more efficient processes and a potentially more informed credit allocation process. However, some problems can occur. The first problem Higginson, Hilal and Yugac (2019) discuss is the processing power needed to run the models that use distributed data across millions of sources. In addition some customers might prefer not to share their data and constraint institutions from full access. The financial institutions will have to work hard to convince the customers to share their data, potentially breaching their privacy and security (Higginson, Hilal & Yugac, 2019).

There are multiple firms operating in credit scoring through blockchain technology. For example, Spring Labs have raised $15 million through an initial coin offering (ICO) in 2018. They launched a blockchain network for credit assessment (Higginson, Hilal & Yugac, 2019). The way ICO’s function will be discussed later in this dissertation. Also Bloom and Colendi are firms using blockchain technology to conduct credit scoring.

c) Cross-border payments

Fees for cross-border payments range from 2 to 3 percent and can even be as high as 10 percent. The cross-border payment market totals at around $600 billion and still grows annually at around 3 percent a year(Higginson, Hilal & Yugac, 2019). Cross-border payments are known to be inefficient, complicated, opaque and highly mediated. The industry for cross-border payments is growing significantly and competition is rising which is increasing efficiency (Higginson, Hilal & Yugac, 2019). However, blockchain can still add value and solve some inefficiencies. For example, through blockchain based crypto-currencies, payments could be made and settled in minutes in contrast to a couple of days through more conventional techniques. Additionally, through blockchain technology there would be more transparency and costs could be reduced by $4 billion annually (Higginson, Hilal & Yugac, 2019).

For example, Ripple Net is an initiative that could drastically change these cross-border payment problems. Ripple Net is a system developed by Ripple Labs and is currently the third largest cryptocurrency after Ethereum and Bitcoin. The current market capitalization of Ripple (XRP) is $10,288,977,263 (03/03/2020) which is approximately 6 % of Bitcoin (BTC) and 57% of Ethereum (ETH). Ripple Net connects banks and payment providers through the network and allows them to make payments with fiat currency or Ripple Labs’ own XRP (Higginson, Hilal & Yugac, 2019). The network is based on a private blockchain, relying on a limited ecosystem of correspondent banks.

Additionally, there also have been initiatives from financial institutions. The Interbank Information Network is a cross-border payment service launched by J.P. Morgan, Royal bank of Canada and Australia and New Zealand Banking Group. They use blockchain technology to reduce the number of

22 intermediaries (Higginson, Hilal & Yugac, 2019). The network is powered by Quorom, a permissioned blockchain variant of the Ethereum blockchain. Nowadays 365 banks are in the network and is still growing.

To summarize, cross-border payments could benefit drastically by blockchain technology. Processing time and costs can be reduced thanks to a smaller network of intermediaries and less back-office processes (Higginson, Hilal & Yugac, 2019).

However, there are still some major working points regarding cross-border payments that are supported by blockchain technology. Firstly, due to the nature of blockchain technology there are some limitations to the anonymity in some scenarios. Therefore some companies are doing research regarding tokenization, which would allow to disguise sensitive data (Higginson, Hilal & Yugac, 2019). Secondly, there still is friction when converting crypto-assets into fiat currencies. This tampers with the real-time settlement (Higginson, Hilal & Yugac, 2019).

Nowadays there are quite a lot of international payment companies that focus on remittances for individuals. These companies try to ensure fast and affordable cross-border transactions. Companies such as TransferWise and Xoom are known for this kind of service. Usually, banks also have services to send money abroad. For this service they usually ask a fee to conduct the international payments. To put this all in perspective, I wanted to compare how much it would cost me to send €100 to a hypothetical friend in Kenya through PayPal’s Xoom, KBC and eventually two existing blockchain solutions.

First, I tested how this would work through Xoom which is an initiative by Paypal. I easily found that it would cost me an additional €2,99 to send €100 to my hypothetical contact in Kenya. Conveniently I could even choose my transfer to be prepared as a cash pickup in a corresponding Kenyan bank for my friend. Xoom ensured that this transfer would be ready only a couple minutes after making the transaction. This transaction cost is fixed independently of the amount of the transaction.

Second, I contacted my local banker to help me find out how much it would cost me to transfer €100 to my hypothetical Kenyan friend. KBC has three options in regards of the processing fees. The first option is for me to carry the costs, the second option is to share the costs and the last option is for the beneficiary to carry the processing costs. I decided to pay the processing costs for my Kenyan friend. Through the telephone the KBC help desk let me know that the payment to Kenia would cost me €20 + 21% V.A.T. Additionally, there could be some underlying costs that the receiver’s bank charges. The helpdesk could tell me that if my Kenyan friend had access to both an IBAN number and a BIC number the transaction would take approximately five working days. Essentially, this means that the transaction trough traditional banking services such as KBC would cost me €24,20 and would arrive five days later. However, this is expensive and takes a lot of time. Nonetheless, this is also a fixed cost and if I would want to send much more the cost would remain the same.

23 Third, I tried to find out how much it would cost me to transfer the €100 through the blockchain payment network provided by RippleLabs. RippleLabs is a blockchain company that connects banks and payment providers on their blockchain network. To complete this transaction to my hypothetical Kenyan friend I used Xendpay, a payment service provider that operates on the Ripple Net. Before I was allowed to transact through Xendpay I had to verify my account by uploading a picture of my Passport which takes up to 3 days to confirm. Next, I could easily create my hypothetical transaction to the bank account of my Kenyan friend. Xendpay has a ‘Pay What You Want’ policy. This allows me to send up to £2000 every year free of charge. However, Xendpay recommends users to a minimum transfer fee of £3,5 which is not compulsory. Additionally, businesses that use Xendpay to pay internationally are allowed to send up to £4000 every year free of charge. However, the transaction would take 2-3 working days to be on the bank account of the recipient which does not make it much faster compared to a regular bank transfer. As Xendpay uses a ‘Pay What you Want’ policy the fee is depending on the person making the transaction. However, after sending £2000 free of charge in a year, a minimal fee of £3,5 will be required every transaction and this transaction cost can be considered as a fixed fee.

Last, as I was not convinced by the efficiency of the transaction through Xendpay I continued looking for another method to transfer my money to my Kenyan friend through blockchain solutions. I decided to try to send my money through a cryptocurrency wallet provider. A cryptocurrency wallet can be seen as a program that allows users to store their public and private keys. Essentially, it allows users to track, receive or send cryptocurrencies. For this method I chose the well-known platform Binance.

Binance is a cryptocurrency wallet and platform where you can buy and sell all kinds of cryptocurrencies. Binance allows users to fund their account with fiat currencies and cryptocurrencies free of charge. I could buy € 100 worth of BTC and send it to my Kenyan friend through the Bitcoin network. However, I can also choose to buy other cryptocurrencies and send those to my Kenyan friend. It is important to realise that the conversion to real-world currencies might change between the moment I buy the cryptocurrency and between the moment my Kenyan friend sells the cryptocurrency. Additionally, there is a variable fee of 0.1% on this transaction. Depending on what cryptocurrency I choose to buy the transaction time will vary. For a BTC transaction it takes approximately 1hour. However, a transaction through Binance’s own BNB cryptocurrency only takes 1 second. After making the transaction my Kenyan friend can sell the cryptocurrency back for fiat currency free of charge. However, since Binance does not offer the possibility to trade in Kenyan Shilling, my Kenyan friend will have to withdraw in more conventional fiat currencies such as Euro. At this point my Kenyan friend has to convert the withdrawn money back to Kenyan Shilling which also bears conversion risks and costs. I can conclude that this method is cheaper and faster compared to more conventional methods. However, this might not be the most user-friendly and risk-free method.

24 To conclude, blockchain technology could drastically influence how international payments will be conducted. For professional use cases blockchain technology has already shown to allow efficient payment networks to be created. Additionally, the two blockchain payment services are both cheaper and faster than traditional banking transactions for individuals too. However, when conducting an international payment through a cryptocurrency wallet provider users might face currency risks. To conclude, as an individual, to date it is still more user-friendly to use other online payment services such as Xoom that is not relying on blockchain technology.

25

7. Blockchain in capital markets

According to a study by Buehler et al. (2015) the adoption of blockchain technology in capital markets will happen in four stages of development. First, blockchain applications will be developed and launched within single enterprises across legal entities. Second, a small sub-set of banks will implement blockchain applications within their organizations to enhance manual processes. Third, blockchain technology will be used to upgrade inter-dealer settlements. Last, blockchain applications will be used everywhere in the public market to enhance processes between buyers and sellers (Buehler et al., 2015).

• Single-enterprise blockchain implementations across legal entities: This is the development stage where enterprises implement blockchain technologies within their own business groups. This requires redevelopment of current platforms and processes. This allows capital market players to acquire confidence in the new techniques. Furthermore, possible issues and limitations the concerned parties encounter can be handled internally allowing efficient and further blockchain adoption in the future (Buehler et al., 2015).

• Smaller banking consortia to enhance manual processes: Within this stage Buehler et al. (2015) puts forward assets that are traded infrequently or usually over the counter to provide a testing ground for blockchain technology. Market participants could agree upon standards and protocols to test the technology with relatively small investments and in that way find potential improvements to current applications (Buehler et al., 2015).

• Change of inter- dealer settlements: By standardizing the inter-dealer settlements within the blockchain applications the use of the technology will become endorsed. This will give positive signals of the technology to the larger public(Buehler et al., 2015).

• Public adoption of blockchain technology in capital markets : This stage is heavily dependent on the large-scale conversion of current capital markets to blockchain technology induced capital markets (Buehler et al., 2015).

Buehler et al. (2015) suggest participants prepare for this evolution of blockchain adoption in capital markets by considering four immediate actions. First, they recommend businesses to assess their business plan and impact for the long-term. Furthermore, they suggest capital market participants work heavily together in consortia together with regulators. Next, businesses that are active within capital markets should experiment with DLT internally and understand it’s opportunities. Last, capital market participants need to look for blockchain opportunities in post-trade and manual processes.

26 • How does blockchain technology affect our business in the long run?: Buehler et al. (2015) advise companies to invest in expertise to learn what aspects of their business is vulnerable to blockchain technology. Planning can help mitigate this disruptive impact.

• Working together in consortia with capital market participants and regulators: Blockchain technology implementation is in early stages and it is of great importance to create consensus and governance on the technology. This cooperation will result in faster development cycles and industry utilities compared to competition (Buehler et al., 2015).

• Experimenting with DLT: Currently capital market participants encounter challenges regarding internal ledger synchronization, which is also referred to as data reconciliation. Furthermore, regulators are putting pressure to consolidate these ledgers. This allows participants to tackle two problems at once by getting to know the technology and working towards consolidated ledgers (Buehler et al., 2015).

• Look for blockchain opportunities in post-trade and manual processes: Within these processes blockchain technology would be less disruptive for the business models and therefore educational to experiment with (Buehler et al., 2015).

a) How is blockchain technology adding efficiency in capital markets?

It is important to note that in the near-future it is more likely that technology budgets and management priorities will be affected by highly-focused blockchain implementation than the business models themselves (Buehler et al., 2015). The aspects that are discussed below mainly hold if the public and all participants adopt blockchain technology.

In general, it is possible to achieve some of the benefits that are accompanied by blockchain technology within the current market infrastructure without the need for actual blockchain technology. This could be achieved by aligning industry standards for the processes, data terms, contractual documentation etc (Oliver Wyman & Euroclear, 2016). Through this standardization, settlement times and costs could be reduced. For example, using one single database that records all asset transactions and is used as a universal source of truth by all participants could be an expansion of the current role taken by the Central Securities Depository (CSD) (Oliver Wyman & Euroclear, 2016). Furthermore, auto-execution of coded logic within basic non-blockchain ‘smart contracts’ could be implemented in the current market infrastructure also (Oliver Wyman & Euroclear, 2016). Lastly, near real-time settlement of asset transactions already exist in some cases today in European markets. Nonetheless, it is a market choice that a cash settlement takes at least 2 days and the industry operates at the speed of the slowest trades (Oliver Wyman & Euroclear, 2016).

27 However, some of the blockchain benefits such as the distributed nature of blockchain technology are very promising. This distributed nature allows participants to work from their own local version of the ledger and reduces duplication of the system (which can be costly and prone to errors) (Oliver Wyman & Euroclear, 2016). Additionally, this distributed nature averts the risk of overloading a central authority. The concerned participants can interchange information bilaterally without intervention of the central authority (Oliver Wyman & Euroclear, 2016). Since there is no central authority there is no central point of failure that is vulnerable to attacks. Next, with the difficulty to change the data confined within the block after it being added to the blockchain there is a reduced risk of manipulation (Oliver Wyman ; Euroclear, 2016).

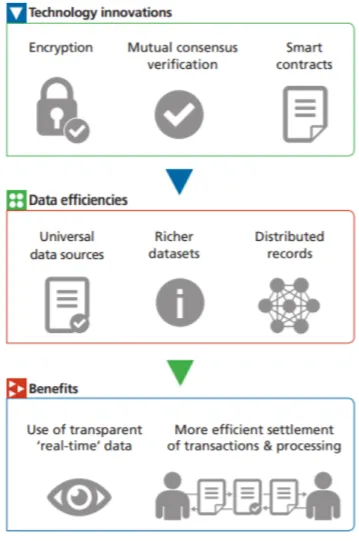

Figure 8 visualizes in what way the blockchain innovations create benefits in capital markets.

Figure 8: From innovation to benefits (Oliver Wyman & Euroclear , 2016)

b) Trade Settlement Process

The trade Settlement Process has been marked by inefficiencies due to a traditional processing time ranging from 3 days in the US, Canada and Japan to 2 days in the EU, Hong Kong and South Korea (Peters & Panayi, 2016). The main advantage of near-real time clearing and settlement is the elimination of counterparty risk. Counterparty risk in clearing and settlement is defined as the risk that one party in