P

ERMISSIONOndergetekende verklaart dat de inhoud van deze masterproef mag geraadpleegd worden en/of gereproduceerd worden, mits bronvermelding.

P

REFACEBefore you lies the dissertation “Bottleneck strategy in ecosystems: A multiple case-study of the agricultural lighting industry”, the basis of which is a case case-study of ten firms active in the agricultural lighting industry between 2011 and 2020. It has been written to fulfill the graduation requirements of the Master in Business Engineering at the University of Ghent (UGent). I was engaged in researching and writing this dissertation from January 2019 to August 2020.

My research question was formulated together with my supervisor, Bart

Clarysse. The research was difficult, but conducting extensive investigation has allowed me to answer the question that we identified. Fortunately, both Mr. Clarisse and his colleagues from the Chair of Entrepreneurship at ETHZ were always available and willing to answer my questions.

I would like to express my gratitude to my supervisor, Bart Clarysse, who guided me throughout this project and who provided me with the opportunity to explore this topic. Many thanks to the people from the Chair of Entrepreneurship at ETHZ who provided me with multiple insights and weekly feedback. I would also like to thank my partner Amber, for putting up with me being away in Switzerland, and for providing guidance and a sounding board when required. Finally, many thanks to my friends and family who supported me during the writing of this research. My parents deserve a particular note of thanks: your support and guidance allowed me to find my way and make me the man I am today.

I hope you enjoy your reading.

Tim Huyghe

TABLE OF CONTENTS

1. INTRODUCTION ... 6

2. LITERATURE STUDY ... 9

3. METHODS AND DATA ... 14

3.1. DATA ANALYSIS ... 16

4. THE CONTEXT ... 17

4.1. THE AGRICULTURAL LIGHTING INDUSTRY ... 17

4.1. ECOSYSTEM ... 19

4.1. BOTTLENECKS ... 21

4.1.1. The lighting component ... 21

4.1.2. The software component ... 22

4.1.3. The data component ... 23

4.1.4. The finance component ... 23

4.1.5. The sales component ... 24

5. FINDINGS ... 26

5.1. 2011-2015:BUILDING THE LIGHTING PORTFOLIO ... 26

5.1.1. The lighting component ... 28

5.1.2. Activity in other components ... 31

5.1.3. Exceptions during this period ... 34

5.1.4. Summary ... 35

5.2. 2016-2018:EXPLORING THE ECOSYSTEM ... 36

5.2.1. The digitisation of agricultural lighting ... 40

5.2.2. Focus on services ... 42

5.2.3. Exceptions during the second period in strategy ... 44

5.2.4. Summary ... 46

5.3. 2019-2020:CHOOSING THE ECOSYSTEM STRATEGY ... 47

5.3.1. Focussing on one component ... 50

5.3.2. The road to a system strategy... 52

5.3.3. Exceptions to the period ... 54

5.3.4. Summary ... 54

6. DISCUSSION ... 56

6.1. ECOSYSTEM STRATEGY ... 56

6.2. BOTTLENECKS ... 57

6.3. DIFFERENT ENTRANTS ... 58

6.4. FUTURE RESEARCH AND LIMITATIONS ... 59

7. CONCLUSION ... 61 8. BIBLIOGRAPHY ... VI 9. TABLE OF USED QUOTES ...XI

LIST OF TABLES AND FIGURES

1. Figures

Figure 1: Agricultural lighting ecosystem components in 2020 ... 18

Figure 2: Product value system of LED grow lights ... 20

2. Tables

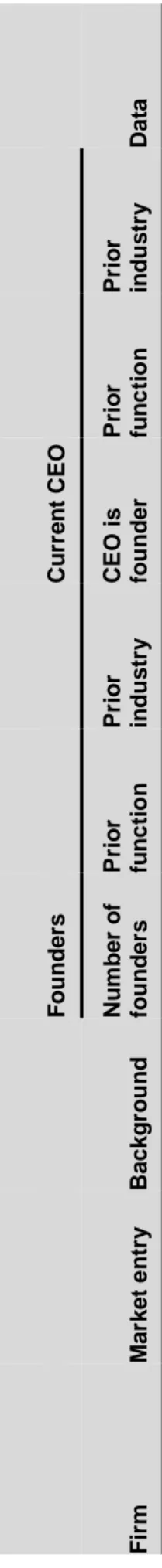

Table 1: Sample firms ... 15

Table 2: Component activity between 2011 and 2015 ... 29

Table 3: Component activity between 2016 and 2018 ... 39

1.

I

NTRODUCTIONSince the introduction of the term ecosystem by Moore (1993), classic firm-supplier relationships and value chains have been replaced by ecosystems where relationships between firms are intertwined and interdependent. Technological innovations from the last decades facilitated this transformation. For example, the introduction of electric car batteries requires cooperation between car manufacturers, charging infrastructure, governments and electricity providers (Kapoor, 2018).This change has been studied in multiple industries over the years, such as the semiconductor industry (Adner & Kapoor, 2010), the personal computer industry (Mäkinen & Dedehayir, 2013) and, more recently, the mobile software industry (Kapoor & Agarwal, 2017). To be successful in an emerging ecosystem, a firm needs to cooperate and compete with other firms in the ecosystem to create and capture value (Adner & Kapoor, 2010; Kapoor & Lee, 2013; Teece, 2007). Moreover, Kapoor (2018) suggests that a firm’s strategy requires a bottleneck component of the nascent ecosystem. However, despite the recent introduction of the concept of ecosystems and interest in ecosystem strategies (Davidson et al., 2015; Kapoor, 2018; Overholm, 2015), not much is known about the various strategies used by different entrants in emerging ecosystems. Hence, the research questions I investigate in this paper is are: What are the strategies used by different entrants in an emerging ecosystem and why did they choose these strategies?

The shift from a linear value chain to an interconnected value system requires a firm to depend on interactions with other firms to be successful. Adner and Kapoor (2010) explain that a firm in an ecosystem needs to collaborate with other firms to create value and capture returns. In addition, a firm still needs to compete with other firms in an ecosystem to capture and protect the created value, which can be direct, indirect or a combination of both (Davidson et al., 2015). As a result, a firm needs to have a broad understanding of the dynamics in the ecosystem to find a strategy that balances value creation and value capture (Ozcan & Eisenhardt, 2009). For example, Apple had to cooperate with Universal Music to provide a platform to sell music online and to create value in the music distribution industry. Moreover,

Apple also had to compete with Universal Music and other firms to capture a part of the created value.

Kapoor (2018) suggests that a successful strategy in a nascent ecosystem would focus on the bottleneck in an ecosystem. A bottleneck is the component that most constrains an industry’s value creation. This implies that the focal firm must identify the bottleneck component, focus its activities and resources on this bottleneck to create value and compete with other firms in that component to capture the created value. Alternatively, the firm could also cooperate with other firms that are also focussed on the bottleneck component to create value through a partnership. For example, Apple worked together with multiple music providers to create value in the music distribution component. The dynamic nature of ecosystems means that this bottleneck can shift between components, which requires firms to adjust their ecosystem strategies over time. In other words, the restraint of the bottleneck component on the value will lower over time and another bottleneck will emerge. This requires firms to periodically analyse the ecosystem and adopt a dynamic strategy.

In recent years, different ecosystem strategies have been studied. The findings of some studies suggest vertical integration as a viable ecosystem strategy, such as owning or controlling firms in other ecosystem components to manage interdependence (Adner & Kapoor, 2010; Hannah & Eisenhardt, 2018). Other studies have demonstrated that an open innovation can lead to a competitive advantage in the ecosystem (Masucci et al., 2020; Rohrbeck et al., 2009). Additional strategies have also been proposed for entrants with different pre-entry capabilities (Kapoor & Furr, 2015) or between start-ups and incumbents (Adner & Kapoor, 2016b). The most effective strategy for identifying and entering a bottleneck in an emerging ecosystem remains unclear.

To answer these two research questions, I studied the agricultural lighting industry and analysed it using a multiple-case study, similar to the methodology of Hannah and Eisenhardt (2018). This industry has experienced a transformation since the commercialisation of the first LED grow light and is projected to reach a market size of $20 billion in 2030. The introduction of LED technology has allowed for the development of new products and services in various

components of the nascent ecosystem, which has enabled different firms with diverse backgrounds to enter the industry. I gathered data on 10 firms active in the industry between 2011 and 2020 that entered with different backgrounds, such as incumbents, new entrants and diversifying entrants. I analysed each firm’s activity in the ecosystem and compared their ecosystem strategies.

This study contributes to research that has explored the intersection of nascent ecosystems, ecosystem strategies and bottlenecks. This study also offers information on the identification of bottlenecks and how value creation and capture is perceived during the emergence of an ecosystem. This study provides insight into the ecosystem strategies used during

the emergence of an ecosystem that developed because of the introduction

of a new technology. First, a firm focuses its efforts on the component where the new technology has the most impact. Second, a firm enters multiple components that it perceives as bottlenecks and explores the ecosystem to establish a complete view. Finally, after a firm reduces uncertainty, it chooses to either follow a component strategy or enter the next bottleneck, which eventually results in the firm adopting a system strategy.2. L

ITERATURE STUDYSince Moore introduced the term ecosystem (1993), there has been a slow shift from linear value chains to intertwined networks between firms. This change is apparent in industries and the literature. Instead of focussing on cost leadership or differentiation, firms concentrate on the interaction within and outside their industries and their contribution to the total focal offer’s value proposition (Gomes et al., 2018; Kapoor, 2018; Scaringella & Radziwon, 2018). In other words, the firms in an ecosystem cooperate to create value for the end user. Zhang and Liang (2011) demonstrate that mobile network operators in China developed partnerships to match demand and supply. These firms were able to build the 3G data network only through cooperation with other firms from inside and outside the industry. Moreover, the ecosystem enabled them to develop new technology and innovate in the mobile network industry.

According to Kapoor and Lee (2013), for the implementation and commercialisation of a new technology, the focal firm depends on other actors in the ecosystem to make investments and change their activities. In other words, the value created and captured from this technology depends on the different interactions of the firms in the ecosystem. The value creation and capture can be linked to two streams in ecosystem literature (Gomes et al., 2018).

The first stream links value creation to innovation ecosystems, where the interaction in the ecosystem is seen from a cooperative point-of-view. The innovation ecosystem can be defined as a collaborative network through which firms enable the flow of knowledge, support technology development and innovate products and services (Jackson, 2012; Jacobides et al., 2018). The firms in an innovation ecosystem need to work together and combine their individual offers to deliver a value proposition to the customer that is more substantial than they would be able offer separately. Apple innovated in the music distribution industry by forming partnerships with music corporations such as Universal Music and developing the music distribution platform known as iTunes. Without the collaboration of music corporations, Apple would not been have been able to create value in the music distribution ecosystem.

The second stream concentrates on present value creation by the firm and how this value is captured. This stream relates to business ecosystems, where the perspective is more focussed on competition than cooperation between the firms in the ecosystem. A business ecosystem is a network of firms concentrated on a focal product that creates value by combining resources and captures value by competing against each other (Valkokari, 2015). Apart from the difference in their relation to the value proposition, the business ecosystem has a more demand side approach to the ecosystem, while the innovation ecosystem has a focus on supply and innovation (Scaringella & Radziwon, 2018). After creating value through innovation in the music distribution industry, Apple had to compete with other distributing firms to protect the present value creation and capture this value. Despite having a collaborative partnership with Universal Music and other music corporations, Apple competed with them because they had their own distribution platforms.

The firms in an ecosystem are active in one or multiple segments of an industry, called components. Some components of an ecosystem will constrain value creation and value capture. Poor performance, high cost or scarcity of certain activities and resources in a particular component inhibit returns from a firm’s activities. The component that inhibits the most value is called the bottleneck of the ecosystem (Kapoor, 2018). For example, the energy capacity of electrical car batteries limits the growth of the electrical car industry. In addition to limiting value creation and capture, the bottleneck also inhibits the ecosystem’s growth and performance (Jacobides et al., 2018). The bottleneck of an ecosystem is dynamic and can shift between components in the ecosystem over time. Hannah and Eisenhardt observed that between 2007 and 2014 the residential solar industry had three periods with different bottlenecks. The first bottleneck occurred in the finance component, the next one happened in the sales component and the final one took place in the installation component. The observed firms acknowledged the same bottleneck for each period, which prevented them from creating and capturing value. For example, in the second period, the sales costs were too high and limited solar industry firms from capturing value.

The interconnectivity or interdependence between components indicates that the bottleneck component will also constrain the created and captured value in other components of the ecosystem. Adner and Kapoor (2016a) demonstrate that the performance of a new technology will be held back by other components when they do not innovate. Furthermore, changes in the bottleneck component can positively and negatively affect limits imposed by the other components in the ecosystem. As the electric car industry has demonstrated, battery improvements can lower the constraints laid on the industry by the charging infrastructure. In contrast, an improved charging infrastructure in the electric car industry will negatively impact the electricity grid, which indicates the next bottleneck location (Kapoor, 2018).

To successfully lower the constraints of the bottleneck component, Ozcan and Eisenhardt (2009) explain that a firm must have a complete view of the ecosystem and gain insights into the relationships between components and actors in the industry. More precisely, these insights will allow the firm to adopt a successful ecosystem strategy. For example, Cisco was able to become a platform leader in the networking services industry because of its understanding of the dynamics of the business ecosystem (Gawer & Cusumano, 2002; Li, 2009). The firm adopted a mergers and acquisition strategy that lowered the constraints in the technology component and enabled them to achieve technological excellence. Another example is the dominance of Microsoft, Intel and Google in their respective industries (Jacobides & Tae, 2015). Their understanding of how value is created in the ecosystem allowed them to pinpoint bottleneck components, such as software, and control the market from this bottleneck. In both examples, the firms understood the dynamics of the ecosystem, which enabled them to adopt a successful ecosystem strategy.

In contrast to an already existing ecosystem, an ecosystem strategy is difficult to define in an emerging or nascent ecosystem because of uncertainty (Dattee et al., 2018). This uncertainty prevents the firm from gathering a complete view of the ecosystem and prohibits coordination in the industry (Ozcan & Eisenhardt, 2009). Furthermore, the firm will not able to form a clear view of the future ecosystem, which limits the creation of a successful ecosystem strategy.

There are many ecosystem strategies that a firm can follow to be successful in a nascent ecosystem. Hannah and Eisenhardt (2018) identify three strategies that firms in a nascent ecosystem can use to help them balance between value creation and value capture and achieve success: a component strategy, a system strategy and a bottleneck strategy. A component strategy focusses on the activities of one component in the nascent ecosystem. The firm captures value in this single component and relies on cooperation with various firms in the other components to create value. In contrast to the component strategy, a firm following a system strategy will be present in multiple components of the nascent ecosystem and will strive for value capture through competition. Finally, a bottleneck strategy is a dynamic method that balances the extremes of competition and cooperation. The firm identifies the bottleneck, enters this component and switches to future bottlenecks as they emerge.

Kapoor and Furr (2015) suggest different strategies between new entrants and diversifying entrants in a nascent ecosystem based on complementary assets and pre-entry capabilities. New entrants focus their resources on a superior technology and depend on other firms in the nascent ecosystem to provide products and assets that are complementary to this technology. In contrast, diversifying entrants will leverage their pre-entry capabilities to gain presence in multiple components and achieve faster commercialisation of a full portfolio of products and services. These pre-entry capabilities are more advantageous if they are related to what is needed in the nascent ecosystem.

A different ecosystem strategy is suggested for start-ups and incumbents linked to the emergence of a new technology (Adner & Kapoor, 2016b). Based on possible challenges for the new technology and improvement opportunities for the old technology, Adner and Kapoor suggest a framework for the speed of technology substitution with four different scenarios. For each scenario, the incumbent and start-up must follow a different strategy to be successful. For example, when there are many challenges for the new technology and few opportunities to improve the old technology, the start-up should focus its activities on the bottleneck of the ecosystem, rather than on the new technology. In contrast, the incumbent should protect itself against overconfidence and only invest in incremental changes to the old technology.

Despite the existing literature on strategies and bottlenecks in a nascent ecosystem, there are still some questions that remain unanswered. First, there are multiple strategies possible in a nascent ecosystem and this ecosystem has many entrants with different backgrounds, such as incumbents, start-up entrants and diversifying entrants. However, do these different backgrounds affect the chosen ecosystem strategy of the firm? Second, a nascent ecosystem is filled with uncertainty and not all firms will have advanced insights on the dynamics of an ecosystem. This incomplete view of the ecosystem could lead some firms to perceive value creation, value capture and bottlenecks differently from other firms in the ecosystem. Therefore, in this study, I analyse the emerging ecosystem in the agricultural lighting system to address which strategies are used in a nascent ecosystem and explain the differences in strategy choice.

The remainder of this research is organised as follows. Section 3 describes the methods used for this analysis. Section 4 provides an overview of the selected data and the nascent ecosystem context of the agriculture lighting industry. Section 5 describes the analysis of the industry between 2011 and 2020 and presents the three periods and their characteristics. Section 6 concludes and considers implications for future research.

3. M

ETHODS AND DATATo expand the knowledge of a firm’s strategy in an emerging ecosystem and gain insight on the reasons underlying this choice, I use the theory-building, multiple-case study method, which was presented by Eisenhardt and Graebner (2007) and applied in the ecosystem literature by Hannah and Eisenhardt (2018). The case study method treats each case as an experiment to test and compare theories and develop causal explanations.

The research sample consists of 10 firms active in the agricultural lighting industry between 2014 and 2020 (Table 1). The choice of firms is based on market reports indicating the important players within the agricultural lighting industry for the upcoming years and on the amount of available data and press coverage. The resulting sample consists of two major players already active in the agricultural lighting industry (Philips Lighting, Osram), six new entrants (Valoya, Lumigrow, Transcend Lighting, Fluence Bioengineering, Heliospectra, Illumitex) and two technology ventures that entered the market to commercialise their technology (UbiQD, Nanoco). This mix of different firms enables a general conclusion about the dynamics within the ecosystem, the perceived bottlenecks and the applied ecosystem strategies. Which will give insights in the adopted strategies in a nascent ecosystem.

For each company, I collected data concerning general events and component-specific activities. I used a variety of data from primary, secondary and tertiary sources. The primary data include 18 internal documents, including financial reports and statements and 110 screen shots of the web sites of the different companies. The secondary data include: 336 contemporary press articles, 7 interviews and informative videos from agricultural lighting magazines. Finally, I used LinkedIn profiles and internet archives, such as the wayback machine, as tertiary sources of information to enrich the data.

Table 1: Sample firms D a ta 3 0 a rticl e s 3 8 o th e r 4 4 a rticl e s 7 o th e r 4 6 a rticl e s 1 1 o th e r 1 4 a rticl e s 3 4 o th e r 4 6 a rticl e s 3 8 o th e r 67 a rticl e s 7 o th e r 3 2 a rticl e s 3 o th e r 1 9 a rticl e s 3 o th e r 2 6 a rticl e s 1 2 a rticl e s 4 o th e r P rio r in d u s tr y E le ct ro n ic s T e ch n o lo g y L ig h tin g L ig h tin g F o o d p ro ce ssi n g L ig h tin g F in a n ce P rio r fu n c tio n M a n a g e m e n t M a n a g e m e n t V P S a le s C E O V P S a le s C E O C o n su lta n t C u rr e n t CE O C E O i s fo u n d e r No No Ye s No No No No Ye s Y e s No P rio r in d u s tr y / / Air pu rifi ca tio n ? Co n su lta n cy A ca d e m ia F in a n ce L ig h tin g L ig h tin g A ca d e m ia A ca d e m ia P rio r fu n c tio n / / VP B u si n e ss d e ve lo p m e n t ? Ma n a g e m e n t R e se a rch e r C E O M a n a g e m e n t T e ch n o lo g y d ir e ct o r S e n io r re se a rc h e r P ro fe sso r F o u n d e rs N u m b e r o f fo u n d e rs / / 1 2 3 1 2 1 1 1 B a c k g ro u n d In cu m b e n t In cu m b e n t N e w e n tr a n t N e w e n tr a n t N e w e n tr a n t N e w e n tr a n t N e w e n tr a n t N e w e n tr a n t D iv e rsi fy in g e n tr a n t D iv e rsi fy in g e n tr a n t M a rk e t e n tr y 2011 2014 2010 2009 2011 ? 2013 2010 2014 2015 F ir m S ig n ify O sr a m V a lo ya L u m ig ro w Ill u m ite x H e lio sp e ct ra F lu e n ce B io e n g in e e ri n g T h riv e A g rit e ch U b iQD N a n o co

3.1. Data analysis

I began my analysis by constructing a short case history for each firm with a descriptive timeline (See Appendix 1). This is a table of chronological events with supplementary information for each event. The major activities of each firm and important industry events were highlighted. This within-case analysis provided insight about the players in the industry and how they operate. I also used this analysis to define the agricultural lighting industry as an ecosystem and identify its components through the study of the relationship between firms and products. For each component, an analysis was created to explore the different applied strategies and the possibility that a particular component could be perceived as a bottleneck within the ecosystem.

After completing the within-case analysis, I conducted a cross-case analysis to compare the activities and strategies of each firm across the components of the ecosystem. For this, I constructed a timeline (See Appendix 2) illustrating the major activities in every component of the ecosystem for each firm. This allowed me to structure the description of events in periods using temporal bracketing (Langley, 1999).

Given my research questions, I focussed my attention on each firm’s ecosystem strategy. According to Hannah and Eisenhardt (2018), a firm’s ecosystem strategy focusses on the interactions a firm makes with the components and other firms in the ecosystem. Likewise, I define a firm’s ecosystem strategy as the components it decides to enter, other firms it partners with and how value is created and captured. The strategy of the firm was compartmentalised into the five components of the ecosystem. For each firm and component, a strategy was found through the within-case analysis and then compared to the existing literature to provide the appropriate constructs.

4. T

HE CONTEXT4.1. The agricultural lighting industry

The research context of this analysis is the agriculture lighting industry, with a focus on LED lighting for greenhouse applications. Recently, farmers have started using LED technology as grow lights instead of High Pressured Sodium (HPS) lighting, which is a technology that has been in use since the fifties. LED grow lights emit less heat than HPS technology, which can lead to energy savings up to 70% and produce bigger yields. For example, a 600-watt HPS grow light can yield up to 300 grams for the space its light covers, which translates into half a gram for each watt. In comparison, an LED grow light yields up to 1.5 grams per watt and uses less electricity to produce the same output. Moreover, LED lights do not contain toxic metals and can be six times more durable than the most recent HPS-based grow lights. Most importantly, LED technology allows for a wide range of new applications in the agricultural lighting industry, such as dynamic lighting and harvest prediction models.

The context of agricultural lighting is appropriate for several reasons. First, the agricultural lighting industry has experienced rapid changes since the introduction of LED and is shrouded in uncertainty. In the past, LED lighting was primarily used to conduct research on the growth of plants in controlled environments (Morrow, 2008). However, LED lighting has gained traction within the agricultural lighting industry over the last decade because the new LED developments are more productive than the older HPS grow lights, farming space is becoming scarce and demand is rising for locally produced goods and improved energy efficiency (Pattison, 2018; Brenda B. Lin, 2015). LED lights have a forecasted market size of $20 billion in 2030. In addition, their small size, durability, cool surfaces and variable wavelength benefits (Gioia D. Massa, 2008) indicate that this technology will have a significant impact on the agricultural lighting industry.

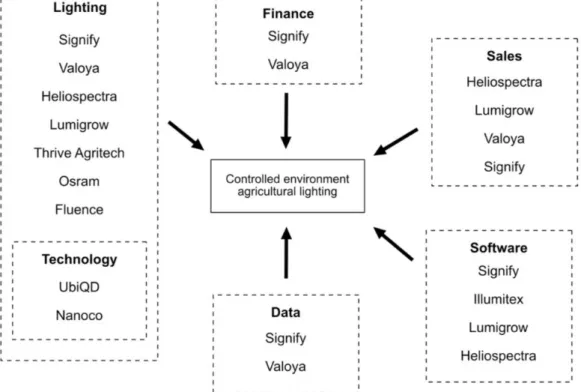

Second, I have defined the CLA industry as an ecosystem comprising five distinct components: 1) Lighting, 2) Software, 3) Data, 4) Finance and 5) Sales (see Figure 1). The

flexibility, automation and energy efficiency of the application of LED in grow lights have changed the industry. It has transitioned from a classic buyer-seller relationship between the lighting producer and the farmer that focussed on value capture to a service-focussed relationship that emphasises value creation between partnering firms. These factors, combined with the wide range of new applications that LED grow lights provide, have led to the emergence of the ecosystem and the value of the product offer consisting of products and services from multiple components.

Figure 1: Agricultural lighting ecosystem components in 2020

Third, although the agricultural lighting industry has existed for a significant amount of time with an established technology, there is currently no specific market leader. Before the introduction of LED lighting, the agricultural lighting industry could have been described as an oligopoly consisting of large, long-established firms (e.g., Philips, GE lighting, Osram) with knowledge of standard HPS technology. The shift to LED technology caused these incumbents to lose their market dominance. As a result, many new entrants with different backgrounds entered the industry. It is possible that this fall in market power was caused by

incumbent inflexibility, as defined by Hill and Rothaermel (2003). This inflexibility could result from fear of cannibalisation, restraint against investments in uncertain technologies or rigid routines, such as the production of HPS lights. The absence of a market leader in this industry provides smaller firms with an opportunity to shape the industry and the technology it will use in the future.

Finally, the promise of high revenues, the benefits and multiple applications of the new LED technology in the agricultural industry and the absence of a clear market leader have led to the market entry of multiple firms from different backgrounds. Apart from incumbents that have switched from older HPS technology to LED technology, many start-up and diversifying entrants have entered the agricultural lighting industry. The founders of start-up entrants often have backgrounds in areas such as academia or software development, while diversifying entrants have joined the market from the perspective of various technologies or component capabilities, such as software or architectural lighting industry.

While the future of the agricultural lighting industry is uncertain, market research forecasts high revenues. Moreover, this industry’s emerging ecosystem, its shift in market power and the proliferation of new entrants with diverse backgrounds make it an interesting context for studying different ecosystem strategies over time.

4.1. Ecosystem

The presence of an ecosystem in the market is an absolute requirement for the analysis of ecosystem strategies; therefore, we need to verify the presence of a nascent ecosystem in the agricultural lighting industry. Kapoor (2018) has indicated that an important characteristic of an ecosystem is the presence of a complementary and interdependent relationship between firms and across components. A complementary relationship implies that these firms have to create or increase the value of the focal product. An interdependent relationship describes their offers as connected, which means a change in the offer from one firm will affect the value creation of another offer. These two relationships verify the presence of an ecosystem in the

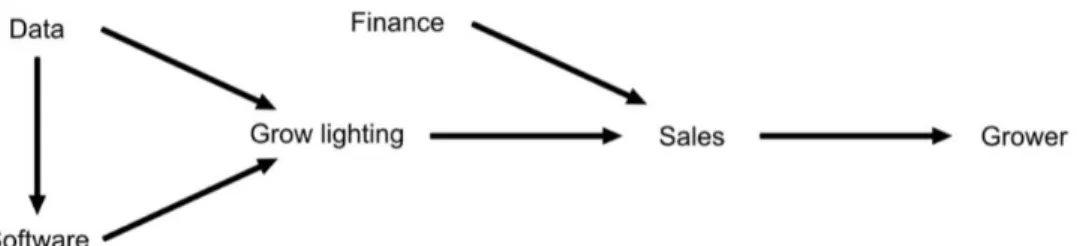

agricultural lighting industry as complementary and interdependence are two distinct characteristics of an ecosystem. I constructed a value system of the industry around the focal product (Jacobides et al., 2018), which enables these relationships to be perceived from a product point-of-view.

The value system from a product point-of-view is the perspective where LED lighting in the agricultural lighting industry is seen as the focal product of the ecosystem. The end user value of LED lighting can be final if it is sold independently from other offers; however, it is more valuable if enhanced by the complements present in the ecosystem. During my research, four components were found to have a positive impact on the user value, as illustrated in Figure 2. These components are data, software, finance and sales and services. All four of these components have a complementary and interdependent relationship with the focal product. For example, the software is designed to manage the LED lighting and enhances the value of the focal offer by providing centralised control over the greenhouse environment. In addition, a change in design or possible wave lengths of a LED grow light will require an update in software. This relationship of value co-creation and dependence in the value system confirms the emergence of a nascent ecosystem in the agricultural lighting industry with LED lighting as focal product.

Another important characteristic of an ecosystem is technological modularity (Jacobides et al., 2018). This modularity indicates that the complementary and interdependent offers of an ecosystem can be produced by different firms with almost no coordination required. The existence of technological modularity between the products and services in the agricultural lighting industry is another argument for the presence of an ecosystem in the research context of this paper.

4.1. Bottlenecks

In the following paragraphs, I offer a brief overview of the products and services provided in each component and the possible actions a firm can take to be active in that specific component. Furthermore, I describe the impact of products and services in each component on the total value created in the ecosystem and investigate the possibility that a component can be perceived as a bottleneck by one of the firms active in the industry.

4.1.1. The lighting component

The first component is the lighting component. This component includes the development of LED lighting technology and the production of various grow lights that use it. Before LED technology changed the market, this component was an industry of its own, dominated by incumbents and an almost fully developed HPS technology. The lighting component contains a subcomponent called technology, which includes the firms that research and develop improvements for the existing LED technology. For example, quantum dot technology is comprised of very small semiconductors with optical and electrical characteristics. This technology would allow for more precise wavelength management and a significant reduction in size compared to the current LED products.

The change from HPS grow lights to LED grow lights in the agricultural lighting industry occurred rapidly for two reasons. First, LED technology significantly affected the efficiency and versatility of agricultural lighting. LED grow lights produce less heat and use less energy than HPS lighting, which lowers operational costs. Moreover, in contrast to the continuous

wavelength of HPS grow lights, LED technology allows changes in wavelengths and colour without the installation of different light bulbs. Second, while LED technology was developed in the sixties, commercialisation in the agricultural lighting industry was not yet possible at that time because of technology restrictions. LED grow lights could not match the same output of HPS grow lights and were too costly to produce. It was only in the late nineties that scientists were able to develop LED lights that could emit bright white and blue lights. The technology was being researched for a couple of decades, so the positive characteristics were known, but the implementation was lacking.

The introduction of more efficient and durable LED lights in the agricultural lighting industry and the value increase of product offers from emerging components means that the lighting component can no longer be considered in isolation. The production and development for these lights has existed for a significant period of time, so the marginal value creation is low. However, it may be perceived as a bottleneck because grow lights are central to the agricultural lighting industry and the introduction of a new technology requires the development of new LED grow lights.

4.1.2. The software component

The development and utilisation of software for greenhouse applications occurred after the introduction of LED technology to the industry and was enabled by broad data gathering and research on different plants. At first, LED lighting products were only suited for general plant types or growth cycles, which led to a demand from farmers to make the lighting products more versatile. With the software, a farmer can collect real-time information about crops, control and manage wavelengths for various lights and forecast the quantity and quality of future harvests. Three possibilities for acquiring the software emerged: developing the software in-house, outsourcing the software development to a partnering company or acquiring the software licence from another firm.

The software component has a significant impact on the efficiency and profitability of farmers. First, software allows farmers to precisely manage plant growth with real-time

information. Second, the agricultural industry offers small profit margins for farmers and the acquisition of grow lights requires a substantial upfront investment. Software that predicts the best harvesting period would increase plant quality and farmers’ profitability. Likewise, the software is also important for the collection and analysis of data for further plant research. This indicates that the software is a core component of the agricultural lighting industry and could be perceived as a bottleneck in the ecosystem.

4.1.3. The data component

The third component comprises data gathering and analysis. LED grow lights and software are not yet optimal for each plant and growth cycle, so data must be gathered from the different end users (e.g., farmers, universities, research centres) and analysed to develop better growth recipes. Data collection and research has always been a part of the agricultural lighting industry. However, the high accessibility and transferability of data from LED grow lights has made data and research a component of the ecosystem. While the gathering of data is considered a standard element of the relationship between the firm and the end user because it is a source of potential value creation for both parties, it is not a mandatory element. The data is usually gathered and researched at a firm’s central research lab.

Outsourcing this component to another firm in the ecosystem through partnership is difficult because the data collected from each firm is different. Moreover, outsourcing would make the partner dependent on the lighting firm. The significant impact of the data research, the considerable resources and effort needed to create a data gathering network and the confidential aspect of the data means that this component is likely to be perceived as a bottleneck within the ecosystem.

4.1.4. The finance component

The acquisition of LED lights or modernising an old lighting system to a new LED-based lighting system is a substantial investment for greenhouse farmers because the initial cost of an LED light bulb is much higher than that of an equivalent HPS light. Although the benefits

of LED lighting, such as energy efficiency, longer lifetimes and shorter growth periods, outweigh the needed capital, farmers are hesitant to invest. Despite the fact that LED technology has been in development for several years, many farmers are either unaware of the benefits of LED lighting or cannot set up a savings plan.

In the past, firms that were active in lighting components countered farmers’ financial constraints by informing them about government grants, subsidies and programs and facilitating their access to these resources. In more recent years, Lighting as a Service (LaaS) has been adopted by firms in the ecosystem to provide additional financial aid to farmers. LaaS is a service contract that was developed for industrial and public lighting to connect customers to the firm for a longer period. This contract requires farmers to make monthly payments; the fee is determined by the monthly cost savings on energy due to the installation of LED lighting. In exchange, the lighting firm provides the farmer with installation, maintenance, repairs and expert services about the lighting.

This component places a large financial constraint on the value creation and growth of the ecosystem; therefore, it is likely that the finance component would be perceived as a bottleneck in the agricultural lighting industry.

4.1.5. The sales component

The final component is the sales component. This component comprises all the services provided before, during and after sales of LED grow lights. The services before sales are workshops and courses to share expertise and on site analyses on optimising greenhouse usage. During sales, the firms active in this component will provide a platform for the actual sale to happen, together with the distribution and installation of the lights. After sales, services focus on repair, maintenance, product and software updates and data analysis for the optimisation of the greenhouse farm. Several possibilities to provide sales services emerged: a self-developed sales platform with or without before and after sales services, the use of a network of sellers and distributors with the addition of sales services or the sole use of this network of sellers and distributors without additional services.

The new entrants to this industry need to establish their own sales platform or network of distribution partners and develop services related to sales, so it is possible that this component would be perceived as a bottleneck. Incumbents who were previously active in the industry will already have an established network and may not perceive this component as a bottleneck.

5. F

INDINGSThe analysis of the timelines of the firms and their activity across the components of the ecosystem led to the conclusion that there were three periods during the emergence of the ecosystem. Excluding a period of research and development before 2011, the first period ranged from 2011 to 2015. This period was characterised by an intensive investment of resources by firms in one component. From 2015 to 2018, firms in the ecosystem perceived different bottlenecks and also explored the ecosystem by entering multiple components at once. During the period between 2019 and 2020, which is still ongoing, there are two possible scenarios. Firms can continue a dynamic strategy and enter the next bottleneck, with respect to their activities in other components. Firms could also focus on one component in the ecosystem and abandon their activities in all other components. This last period can be perceived as a crossroads for firms, where they decide to follow either a system strategy or a component strategy. Below, I analyse these periods separately and focus on firms’ ecosystem strategies and activities in the various components.

5.1. 2011 - 2015: Building the lighting portfolio

Although LED technology has been around since the sixties, it took until 2011 for the first LED grow light to be released on the market. The years before 2011 many new firms were founded and entered the market of LED technology for grow lights. The impact LED technology on other industries and benefits it has over older grow light technologies can explain the surge in interest for LED technology in the agricultural lighting industry. For example, Jeff Bisberg, CEO of Illumitex, illustrates the potential of LED in grow lights:

“LED lighting has been revolutionizing a number of markets and although it's new to the horticultural market what we've seen is time and time again once LED enters a market it takes over. It started with flashlights, went to traffic lights, we've all seen him in automobiles.”

In addition, Josh Gerovac, horticulture1 specialist at Fluence bioengineering, stated in 2012:

“LED chip manufacturers have improved the efficacy of components available to horticultural lighting manufacturers over the last several years, which has enabled them to significantly improve photon efficacies that now surpass HPS fixtures, and they continue to improve every year.”

The first period starts in 2011 with the arrival of the first LED-based grow lights on the market. LED products released before 2011 were only suitable to replace HPS light bulbs and lightbars in the original grow light. After 2011, the first stand-alone LED grow lights were commercialised with better specifics than HPS grow lights. These LED products were generic and could be used for multiple purposes to meet the versatile demands of the farmers and plant researchers. Or as stated by Lars Aikala, CEO of Valoya: “Due to the locations in difficult places and buildings, at the moment everybody wants different solutions, affecting the light suppliers to create a single product in high volume and for a lower price.”

Form the observed component activity in the industry (see Table 2), we can conclude that between 2011 and 2015 all firms were active in the lighting component. While some firms also developed products and services in other components during this period, there was a general tendency to first focus on the development of new lighting products with the new LED technology. Technical and economical limitations of the LED technology, such as the low efficiency and high costs, are the reason for the focus on the lighting component. Therefore, LED technology and grow light development were viewed as the primary constraint on the industry growth, as stated by Nick Klasse, CEO of Fluence Bioengineering: “The indoor agricultural market is on the forefront of food and floricultural innovation, yet has been stifled due to the efficiency, performance and economic limitations of lighting.” On why it took so long to develop these LED grow lights Jeff bisberg, CEO of Illumitex stated: “The reason

1 Horticulture can be defined as the art and practice of plant farming and management. In the past this term was mostly associated with gardening and flower farming but since the introduction of LED lighting this term has also been adopted for the management of environments in greenhouses and vertical farms.

horticultural was sort of the last market is because it's one of the brightest light fixtures out there, I mean basically we're trying to replace the Sun.” This motivation suggest that the lighting component was possibly perceived as a bottleneck during the first period.

5.1.1. The lighting component

The first firm to release a LED-based grow light was Lumigrow. This firm was founded in 2007 in California by software developers and was able to release its first commercial products in 2009. These products were developed to replace older and less efficient HPS light bulbs or lightbars in grow lights. It was only in 2011 that the firm released its first stand-alone LED grow light. This product was a LED lightbar with multiple but fixed colour and light spectrums. Later during the period, Lumigrow released two other products with a broader but adjustable light spectrum. Both products were developed for applications in either greenhouse farming or plant research.

The second firm to enter the market with a commercial LED product was Illumitex. This firm was founded in 2005 by two plant growth researchers and a former consultant. The firm focussed its activities on LED lighting research and product development in three different industries: architectural lighting, general lighting and horticulture lighting. In 2011, Illumitex released two generic LED grow light products for the horticulture lighting industry, but also enlarged its product portfolio for other industries at that time. The firm abandoned the other industries in 2015 and focussed its activities only on the agricultural lighting industry. As a result, two new grow lights that were developed in collaboration with multiple research centres and universities. These grow lights could output multiple wave lengths and colours, but did not have a specific targeted audience.

Table 2: Component activity between 2011 and 2015 A c tiv e p a rt n e rs 4 1 2 0 4 0 0 0 1 1 L ig h tin g P ro d u c ts / S e rv ic e s 2 0 4 3 4 3 4 3 0 0 F ir m S ig n ify O sr a m V a lo ya L u m ig ro w Ill u m ite x H e lio sp e ct ra F lu e n ce B io e n g in e e ri n g T h riv e A g rit e ch U b iQD N a n o co A c tiv e p a rt n e rs 50+ 2 2 0 0 0 S a le s P ro d u c ts / S e rv ic e s 0 No t a ct iv e 0 No t a ct iv e 0 2 1 1 No t a ct iv e N o t a ct iv e A c tiv e p a rt n e rs 0 F in a n c e P ro d u c ts / S e rv ic e s 3 No t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e A c tiv e p a rt n e rs 10 3 D a ta P ro d u c ts / S e rv ic e s 1 No t a ct iv e 0 No t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e A c tiv e p a rt n e rs 0 S o ft w a re P ro d u c ts / S e rv ic e s N o t a ct iv e N o t a ct iv e N o t a ct iv e 1 No t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e N o t a ct iv e

Valoya was the next frim to enter the market. The firm was founded in 2009 in Finland by Lars Aikala, an entrepreneur interested in how farmers are able to grow plants during the winter when there is almost no sunlight. With this in mind he gathered a team of scientists to develop agricultural lighting based on LED technology. In 2011, Valoya released three product lines at the same time with each a different focus. These products were respectively focussed on high-powered large-scale installations, greenhouse farming and growth chambers. In 2015 the firm followed up with another product line that contained the first dimmable and passively cooled LED grow light.

In line with the other firms during this period, Signify, Philips Lighting before 2016, focussed its efforts on the development of lighting products using the new LED technology. The firm had been active in the agricultural lighting industry since the sixties and even though the LED technology was available to Signify in the beginning of the century, the firm only released their first product in 2011. There could be multiple reasons for this late adaptation to LED products, but the biggest possibility is incumbent inflexibility suggested by Hill and Rothaermel (2003). The firm’s first product focussed on greenhouse farming with ease of installation as a selling point. In 2014, another product line designed for large scale indoor farms was added to the portfolio.

The next firm to release a product was Heliospectra. The firm was founded in 2006 in Sweden by plant researchers with the goal to provide system solutions to greenhouse farmers. After three years in an incubator program and three additional years of LED and plant research, the frim launched its first commercial product in 2012. This product had generic wave lengths and could be used for plant research, greenhouse farming and vertical farms. In 2015, this product with two newer and cheaper models. These two products were respectively focussed on plant research and greenhouse farming.

One of the last firms to release a LED product was Fluence Bioengineering. In contrast to the above firms, this firm followed a different trajectory than the gradual release of products (except Valoya). Fluence Bioengineering was founded 2013, during the first period, and is thus a later entrant to the industry than the others. The founders of Fluence Bioengineering

had experience in the lighting industry and received sufficient funding, but did not follow the same release schedule like the other firms in the industry. Instead, the firm released a portfolio of multiple products at the same time where each product was designed to answer the specific needs for each type of customer. This portfolio consisted out of four products: one general product and three others with a focus on on growth chambers, vertical farming or greenhouses. The motivation for this release strategy can be found in multiple possible reasons. First, the founders of the Fluence Bioengineering had industry experience. The first year the firm also focussed its activities on research on plant growth and only started development of products in 2014, as stated on their website. This suggest that the firm had a better knowledge of the grower’s needs, while other earlier entrants had to collect this knowledge through feedback after the release of their first product. Second, their late entry to the industry could have allowed the firm to identify these grower’s needs faster than the other entrants, as the characteristics of the industry were better known. Finally, the firm wanted to deliver multiple options to potential customers as stated by Nick Klasse, CEO of Fluence Bioengineering: “Do you want it to grow tall, small, wide? To flower? We’ve got it.”

The last firm to bring a LED grow light on the market was Thrive Agritech. This firm was founded in 2010 by a former Product Manager and Director at Signify. Even though the experience in the lighting industry, the firm only released their first commercial product in late 2014. This product was a generic grow light who could be used to grow different plants. In 2015, Thrive Agritech added two new grow lights with more versatility to its product portfolio. Similar to Fluence Bioengineering, Thrive Agritech released their first product later than the other firms and can also be seen as a late entrant to the industry.

5.1.2. Activity in other components

During the first period some firms entered or were already active in other components than the lighting components. These firms were either active in the other components than lighting by entering and providing products and services themselves or they formed partnerships and cooperated with other firms who are active in that component.

An example of a firm that was active in multiple components and provided its own products and services is Signify. The firm had been present in the agricultural lighting industry since the 1960’s and remained active in it after the introduction of the LED technology. Signify had built up a network of customers, sellers and partners over the past decades and used these relationships in the emerging ecosystem. In addition to being active in the lighting component, Signify entered three new ones. In the sales component, Signify used its already existing network of certified partners to sell, distribute and install their products. The firm was also already active in the finance component with the Philips Lighting Capital support. This support consists out of three services: asset-based financing, large projects finance and the self-developed Lighting as a Service contract. This last service is a contract that requires monthly payment by the end user, where the fee is determined by the monthly cost savings on energy. In exchange, Signify provides the grower with installation, maintenance, repair and expertise services. During the first period, Signify entered the emerging Data component. The firm opened a research centre with the purpose to collect and analyse data to speed up development of their lighting products. This data was also used for the development of products and services in other components. At the opening of the research centre Gus van der Felts, executive at Signify, stated: “This new GrowWise research center aims to take farming to the next level, with Philips scientists leading research into LED light recipes … Our aim is to develop technologies that makes it possible to grow tasty, healthy and sustainable food virtually anywhere.”

Another firm that entered the emerging data component was Valoya. The founding team of Valoya had little experience in the lighting industry and had to look for a way to bridge this knowledge gap. They did this by actively cooperating with universities and research centres to gather data and communicated with farmers to receive feedback. In the beginning, CEO Lars Aikala stated: “We recognised the opportunities in the market, but of course weren’t able to start trials in our office. We cooperated with European universities, government, research institutes to understand what the optimal parameters are for achieving optimal plant growth.” The data collection and analysis done in this period allowed the firm to research and develop

grow lights faster than other firms in the industry. Moreover, the firm gained an advantage in later periods by having a faster product development and more growth recipes (periods of different wave lengths adjusted to the growth stage of each specific plant). To illustrate, in the second period the firm was able to update its products more frequently compared to the other firms and was also able to develop multiple highly-praised growth recipes.

Another component that emerged during this period was the software component. In the beginning of 2015, Lumigrow was the first in the ecosystem to enter this component alongside the lighting component. The firm developed its own software which allows its users to have remote control access, receive real-time feedback for maintenance and create separate light zones and schedules. The possible reason why Lumigrow was able to develop sooner than other firms was the software experience of its founders. These software capabilities possibly gave the firm important insights and the ability to develop the lighting software faster. The firm soon identified that software could be a potential bottleneck in the ecosystem as stated by Kevin Wells, CEO of Lumigrow “We know our customers need every advantage they can get to maximise yield without increasing the size or expense of their operation. Ease of installation, the convenience of remote monitoring and control, and shared-savings payment plans all make advanced spectrum control a ‘must have’ for growers.”

Many firms during this period were also active in the sales component. The majority of firms in the industry made use of sales and distribution networks and certified partners. For instance, Valoya entered a partnership with Conviron to exclusively distribute their products in Europe and become their preferred partner for integration in future products. Another example are all the partnerships between Signify and its distributors. Over the years the firm developed a global network of certified partners called ‘Philips LED Horti Partners’. These partners need to follow certain courses and prove to possess the required knowledge and expertise to install Signify grow lights. The use of certified partners has three advantages. First, it overcomes the problem of a diverse and spread-out customer base. The distribution network of the certified partner aggregates all customers in one place and allows the firm to tap in that network with little effort. As stated by Lars Aikala, CEO of Valoya: “This agreement

with Conviron enables us to serve seed companies and the biotech and agritech markets with greater reach, better support and unprecedented solutions.’” Second, by securing a partnership with a local distributor the firm limits the ability of rivals to be active in the same region. Third, the firm can limit the spending of its resources to aid the user with installation and providing expertise. Shami Patel, CEO of Lumigrow at that time, commented:

“We have identified GrowGeneration as a company not only with wide and deep distribution capabilities, but they also possess the staff that has the background and knowledge to present our LED technology to the market place. Gaining the benefits of smart LED technology does require some education, so knowledgeable support for our growers is to the highest importance to us.”

In contrast to using a network of distributors, some firms made use of an online store to sell their products. Both Fluence Bioengineering and Thrive Agritech sold their product independently during this period. Heliospectra even went further and developed their own before, during and after sales services. As stated on the website the firm has “the goal to provide lighting system solutions to its customers.” In addition to LED grow lights and an online webstore, these solutions contained guides for the installation and optimal use of the grow lights, on- and off-site assistance and expertise regarding the construction of the greenhouse.

5.1.3. Exceptions during this period

One exception during this first period is the trajectory of the diversifying entrants. These entrants, UbiQD and Nanoco, entered the agricultural lighting industry to commercialise their quantum dot technology. Quantum dots are very small semiconductors with optical and electrical characteristics that can enhance LED lighting. This technology would allow for a more precise wave length management and a significant reduction in size compared to the LED products at that time. A report by Frost & Sullivan stated that quantum dot technology could have a big impact on the agricultural lighting industry: “Quantum dots are ideal for optimising the light spectrum for plant growth systems … This advancement represents a huge disruption to the traditional grow lighting solutions, such as LED fixtures.” Because this

technology is only applicable in grow lights, both entrants focussed on the lighting component. They set up a research division for the development of lighting products, however did not exceed in the development of a product during the first period.

The possible reason for the absence of a commercial product is for both firms different. UbiQD focused on the commercialisation across different applications of their technology (solar, agriculture, ink) and divided its resources over the development of many different products. This led to the company not releasing any products in any of the industries during the first period. Nanoco also focused its efforts across different applications and saw the agricultural lighting industry only as a niche market, as stated by CEO Michael Edelman: “Now that horticultural lighting, we think is worth over $1 billion. So, it’s niche, but significant.” The main possible reason of no commercialisation is the failed partnership with OSRAM. These firms signed a co-development agreement in 2011 with the goal to incorporate Nanoco’s quantum dot technology in OSRAM’s LED products. Even though the agreement was renewed for four consecutive years, no products were released and the partnership was ended in 2016 by Nanoco. The reason for the termination were the poor results as stated by Michael Edelman, CEO of Nanoco “They (Osram) haven’t moved forward with any of our ideas or technologies into a product.”

Despite having access to a more efficient technology and sufficient resources, both diversifying entrants failed to compete or collaborate within the lighting component. They were not able to create or capture value effectively and fell behind to the other firms in the industry in terms of product portfolio.

5.1.4. Summary

When the ecosystem emerges, the incumbents and the different entrants will focus their attention on the component that holds back the most value, the bottleneck. In the agricultural lighting industry, the introduction of LED technology made firms focus on the development of products and services in the lighting component This suggests that in an industry that already

existed and where the emerging of the ecosystem is triggered by a new technology, the first bottleneck will be the component where the new technology has the biggest impact.

The focus on the bottleneck component does not suggest inactivity in the other components. The firm can still enter and be active in multiple components to enlarge the value proposition to the end user. This activity alongside the bottleneck component could either be done through cooperation or competition. To illustrate, Valoya entered the sales component in this period through partnerships with distributors and installers. Because of cooperation with these firms, Valoya was able to create additional value in the form of providing before, during and after sales services. Collaboration with partners in components different than the bottleneck has a focus on value creation and suggest that the firm uses either a component strategy or a bottleneck strategy, dependent on in how many components the firm is active.

In contrast, competition in components different than the bottleneck has a focus on value capture. To illustrate, Signify was mostly active in the bottleneck component but used also in other components. The firm used its Lighting as a Service contract to capture the value created in the lighting component and competed with other firms in the data component for partnerships with research centres and universities. This suggest that incumbents like Signify will adopt a system strategy in the nascent ecosystem, where the focus is more on competition than cooperation.

5.2. 2016 - 2018: Exploring the ecosystem

The focus of on the lighting component in the first period resulted in a lower constraint on the value creation and growth in the agricultural lighting industry. After 2015, there were less products developed and commercialised than in the first period. The firms focus their resources more on updating already released products. Furthermore, it is also observed that after the first period firms shifted their focus away from the lighting component. More firms entered other components than the lighting component and developed new products, services and partnerships in these components (see Table 3). A reason for this shift from the lighting

component to other components in the industry can be that development of grow lights no longer constrain the most value in the ecosystem. As a result, firms had to broaden their view of the ecosystem and explore multiple components to identify a new bottleneck. Another reason for the shift away from the lighting component is the management changes that happened during this period. Executives with more experience in sales or the lighting industry replaced CEO’s who had a background in academia or research. To illustrate, Ali Ahmadian, former executive in the food industry, replaced founder Staffan Hillberg as CEO of Heliospectra in the beginning of 2017. The board stated that “Heliospectra is entering a new phase” and that Ahmadian is chosen for his “strong international commercial intuition.” Another example is the change in management at Illumitex. The founding team, with experience in research and academia, was replaced by new CEO Jeff Bisberg, former sales executive at GE Lighting.

A key difference to the first period is that firms in the industry did not focus on one specific component as the bottleneck. During the second period, firms in the industry perceived multiple components as the bottleneck. These components can be devised in to two streams. The first stream of perceived bottlenecks are components that held back the growth because of the lack of digitisation in the agricultural lighting industry, which are the software and data component. Multiple firms focussed their resources on the development of software and adopted the term ‘Digital Horticulture’. To illustrate, Thrive Agritech changed their name in the beginning of 2017 from Transcend Lighting to the current name to be more associated to the digital side of agricultural lighting. As stated by the CEO Brian Bennett:

“When launching Transcend Lighting our mission was simple, to make controlled environment agriculture more efficient and sustainable through advanced LED technology … Moving forward we will be offering a basket of new products and technologies that will be even more impactful to our customers. Technologies that include software, controls, data analytics and more.”